Jun 15, 2022

Stocks jump as Powell soothes Wall Street's nerves

, Bloomberg News

This was a classic sell the rumor buy the news situation with the Fed: Belski

Stocks rallied, halting a five-day rout that took 10 per cent off the S&P 500, after Federal Reserve Chair Jerome Powell said outsize rate hikes will be rare as officials intensify their battle against sky-high inflation. Treasury yields tumbled alongside the dollar.

Equities pushed higher amid wild swings as the central bank raised rates by 75 basis points -- the biggest increase since 1994 -- and Powell said officials could move by that much in July or make a smaller half-point hike. While “it will take some time” to get inflation back down, the Fed chief is confident that “we will do that.” His remarks sent two-year Treasury yields sinking as much as 24 basis points.

“The Fed nailed it,” said Ronald Temple, co-head of multi-asset and head of US equity at Lazard Asset Management. “The Fed demonstrated its resolve to tame inflation without undermining its employment mandate. While some spectators argued for an even steeper hike, the Fed understood that the combination of rate hikes and QT already takes the US into uncharted territory with significant risks to growth,” he said, referring to quantitative tightening.

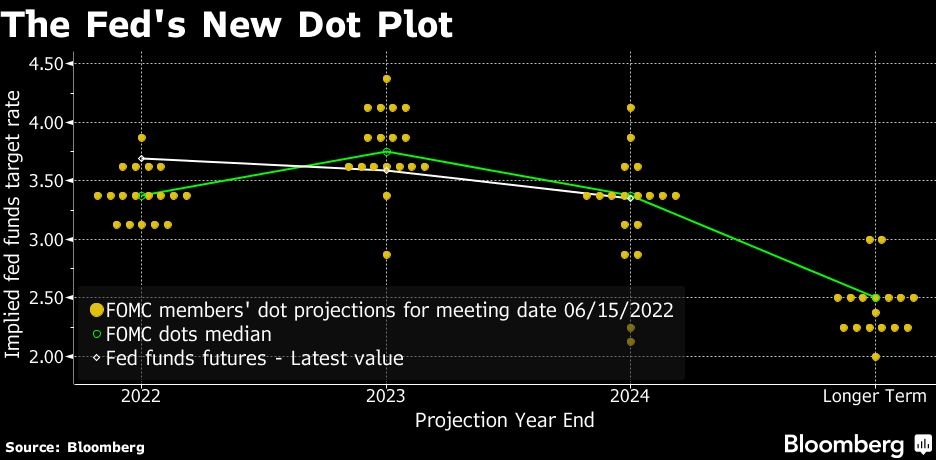

Powell and his colleagues on Wednesday intensified their effort to cool prices by lifting the target range for the federal funds rate to 1.5 per cent to 1.75 per cent. Officials projected raising it to 3.4 per cent by year-end, implying another 175 basis points of tightening this year. The Fed also reiterated it will shrink its massive balance sheet by US$47.5 billion a month -- a move that took effect June 1 -- stepping up to US$95 billion in September.

Barclays Plc, which was among the first major banks to shift its Fed prediction for June to a 75-basis-point hike, said it anticipates the central bank will return to hiking at a 50-basis-point pace in July. Meantime, T. Rowe Price Group Inc., manager of US$1.4 trillion in assets, said investors should buy bonds now because it’s the “most attractive point” in years.

More comments:

- “This indicates some confidence in what the Fed is doing,” said Kathy Jones, chief fixed-income strategist at the Schwab Center for Financial Research. “The Fed should see a flatter yield curve when it raises rates, unless there’s fear that they’re not going to get inflation under control or they haven’t reached a critical point where they can do that.”

- “With inflation not letting up, it’s become pretty clear that the Fed needs to take a more aggressive approach,” said Mike Loewengart at E*Trade from Morgan Stanley. “Keep in mind that as we go through a changing monetary policy landscape, we’ll likely continue to see volatility as the market digests the new norm. Sticking to your investment strategy during waves of volatility is a solid course of action — aka don’t panic.”

- “The Fed needed to prove once again it was serious about fighting inflation,” said Barry Gilbert, asset allocation strategist for LPL Financial. “The more aggressive stance can still be consistent with a softish landing for the economy, but the path is getting narrower.”

The Fed’s so-called dot plot, which the US central bank uses to signal its outlook for the path of interest rates, shows the median year-end projection for the federal funds rate moved up to 3.4 per cent. The estimate for the end of 2023 was boosted to near 3.8 per cent.

Key events this week:

- Bank of England rate decision, Thursday.

- US housing starts, initial jobless claims, Thursday.

- Bank of Japan policy decision, Friday.

- Eurozone CPI, Friday.

- US Conference Board leading index, industrial production, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.5 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 2.5 per cent

- The Dow Jones Industrial Average rose 1 per cent

- The MSCI World index rose 1.3 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.9 per cent

- The euro rose 0.4 per cent to US$1.0458

- The British pound rose 1.6 per cent to US$1.2189

- The Japanese yen rose 1.3 per cent to 133.73 per dollar

Bonds

- The yield on 10-year Treasuries declined 17 basis points to 3.31 per cent

- Germany’s 10-year yield declined 11 basis points to 1.64 per cent

- Britain’s 10-year yield declined 12 basis points to 2.47 per cent

Commodities

- West Texas Intermediate crude fell 2.6 per cent to US$115.78 a barrel

- Gold futures rose 1.2 per cent to US$1,835.30 an ounce