Aug 2, 2021

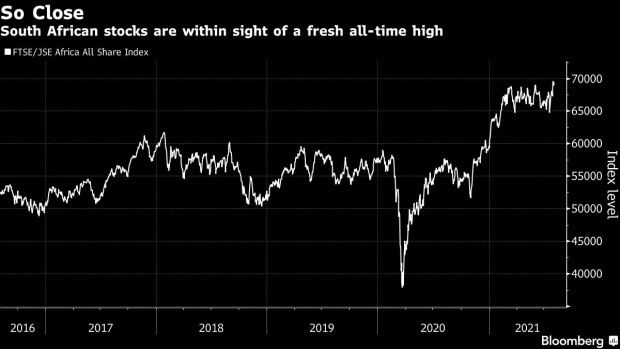

South Africa Stocks Near a Record as Rand Boosts Banks

, Bloomberg News

(Bloomberg) -- NOTE: The South African stock market opener will be discontinued from Aug. 9. For more coverage of this market, see the daily Inside South Africa column. Click here to manage your subscriptions.

South African stocks kicked off August on a positive note, rising to trade near their all-time high and joining global peers in rallying as some of the concerns over China’s regulatory crackdown eased and progress on a U.S. infrastructure spending plan aided sentiment.

The FTSE/JSE Africa All Share Index advanced as much as 0.9%, before paring its gains to 0.5% by 9:56 a.m. in Johannesburg, with the index’s biggest companies -- Naspers Ltd., Anglo American Plc, BHP Group Plc and Richemont -- among those leading the advance. MTN Group Ltd. gained after its Nigerian unit reported increased profit.

Equity benchmarks in Asia climbed Monday, with Hong Kong and China stocks paring some of last week’s rout sparked by Beijing’s clampdown on everything from technology to private education and property. The nation also faces a Covid-19 spike and signs of slowing economic growth, spurring bets on monetary easing and a rally in sovereign debt.

Chinese Stocks Jump as Beijing Signals More Economic Support

“Asian markets are largely positive across the board, despite weaker-than-expected China PMI data for July, citing rising costs, released over the weekend and the largest resurgence of Covid-19 cases in China as the delta variant spreads to 18 provinces,” said Rella Suskin, head of research at Benguela Global Fund Managers in Johannesburg.

- Naspers, with a 14% weighting on the index, advances 1% to provide the biggest boost to the market, as the risk-on sentiment countered weakness in partly owned online giant Tencent Holdings Ltd. in Hong Kong trading. Naspers subsidiary Prosus NV, which holds the company’s 29% stake in Tencent, rises 1.2%

- Industrial miners climb 0.9% as iron ore prices advance

- NOTE: Iron Ore Treads Water as Top Steel Industry Braces for More Cuts

- Kumba Iron Ore Ltd. +0.8%, African Rainbow Minerals Ltd. +1.6%, Anglo American Plc +1.5%, Glencore Plc +1.1%

- Luxury retailer Richemont gains as much as 1.1%

- NOTE: Real Deal NY: Richemont will take over Guess store on Rodeo Drive

- Bank stocks rise 0.9% as the rand strengthens

- NOTE: History Points to Rand Losses This Month: Inside South Africa

- FirstRand Ltd. +1.1% Capitec Bank Holdings Ltd. +1.2%, Standard Bank Group Ltd. +1%, Absa Group Ltd. +0.8%, Investec Plc +0.1%

- MTN rises 2.3% after results from its unit in Nigeria, the company’s largest market

- NOTE: MTN Nigeria to Limit Dollar Spending to Cut Currency Risk

- Foreign investors were net sellers of South African stocks Friday, disposing of 128 million rand ($8.78 million) of equities, according to data from exchange operator JSE Ltd.

©2021 Bloomberg L.P.