Mar 28, 2023

Short Sellers Losing Battle With Day Traders in Korea’s EV Rally

, Bloomberg News

(Bloomberg) -- Short sellers betting against electric-vehicle battery stocks in South Korea have fought a losing battle with day traders.

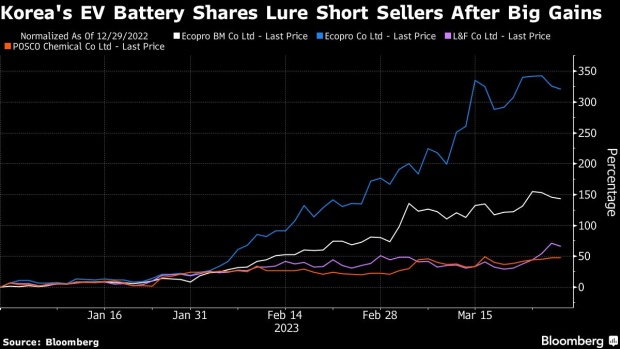

Shares of cathode-active materials supplier Ecopro BM Co. Ltd. and its parent Ecopro Co. Ltd. have more than doubled this year even as they drew in roughly 3 trillion won ($2.3 billion) worth of shorts, the biggest ever on a quarterly basis, Bloomberg-compiled data showed. This came as day traders bought a net $1.23 billion worth of the stocks while foreign funds and institutional investors sold.

“They have become meme stocks, beyond the realm of fundamentals,” said An Hyungjin, chief executive officer at Billionfold Asset Management. “We know in the long term their stock prices will fall like what we have seen in GameStop, but in the short term, short players are having a hard time.”

Retail investors’ love for EV supply-chain shares drove the Kosdaq Index 23% higher this quarter, making it among the best performing small-cap measures in the world. Interest in South Korea’s battery makers is growing as Chinese competitors face increased scrutiny from the US and as retail investors buy stocks ranging from lithium suppliers to battery recyclers amid a lack of momentum in semiconductor and automaker shares.

The sector’s rapid climb has attracted more short bets. Bearish bets on L&F Co. Ltd. were higher this quarter compared to the previous three months. Meanwhile, short selling turnover in Kospi Index-member Posco Future M Co., formerly known as Posco Chemical Co., was at the highest in at least 13 quarters, according to data analyzed by Bloomberg.

Larger firms, the likes of LG Energy Solution Ltd. and LG Chem Ltd., have yet to see such high short selling volumes this year, but this is partly due to their low share floats and large market capitalization. Gains in LG Energy and LG Chem have also been modest in comparison to their small-cap peers.

Proponents of EV stocks say there is still room for them to run given that many of them, including the Ecopro group stocks, are seen to have reliable suppliers and are generating profits.

“It’s different from GameStop, which was a real meme stock,” said Ahn Hyunsang, chief executive officer at Korea Investment Research Institute.

--With assistance from Karen Yang and Ishika Mookerjee.

©2023 Bloomberg L.P.