Jun 1, 2023

SBB’s CEO Heads to London in Need of Buyers to Save His Company

, Bloomberg News

(Bloomberg) -- Ilija Batljan, the founder and dominant shareholder of embattled Swedish landlord SBB, stepped down as chief executive officer in a dramatic move that highlights the uphill battle he faces to save his $13 billion empire.

Batljan, who founded Samhallsbyggnadsbolaget i Norden AB in 2017, will hand off executive responsibility as of June 5, the Stockholm-based company said Friday in a statement. He will be replaced by Leiv Synnes, who has served as chief financial officer of Akelius Residential Property AB since 2014. Shares soared as much as 69% after trading resumed in Stockholm.

“As the founder and a major shareholder in SBB, it is my role to take responsibility in a challenging time,” Batljan, who will remain on the board, said in the statement. “My faith in SBB is intact.”

Batljan, 55, was the driving force behind SBB’s rapid, debt-fueled expansion and became the center of the company’s turmoil. The former war refugee’s credibility was damaged after a series of statements dismissing the company’s vulnerabilities. Just days before a downgrade of the company’s credit rating to junk status, he had boasted that SBB met “all the criteria” to have S&P Global Ratings drop its negative outlook.

Read More: The Face of Sweden’s Property Bust Fights for $13 Billion Empire

Batljan held 8.3% of SBB’s shares and almost 32% of the votes in SBB as of April 26, according to company’s website. His investment firm announced late Thursday that it will postpone the publication of its quarterly report to June 9 from May 31. Ilija Batljan Invest AB recently skipped interest payments on its hybrid bonds.

The surprise move came after Batljan traveled to the City of London this week and spoke to a number of investors about selling individual assets as well as the whole company, said a person familiar with the process. The Canadian investment group Brookfield Asset Management is among investors involved in early stage talks to evaluate the real estate firm’s portfolio, said other people, who asked not to be identified as the meetings weren’t public.

Analysts see a full sale unlikely and buyer interest is expected to focus on assets such as SBB’s elderly care homes and residential units. The company’s dwindling prospects have also raised political concern, given its ownership of many public-sector buildings.

A representative for the Stockholm-based company declined to comment on the process when contacted by Bloomberg News. Brookfield also declined to comment.

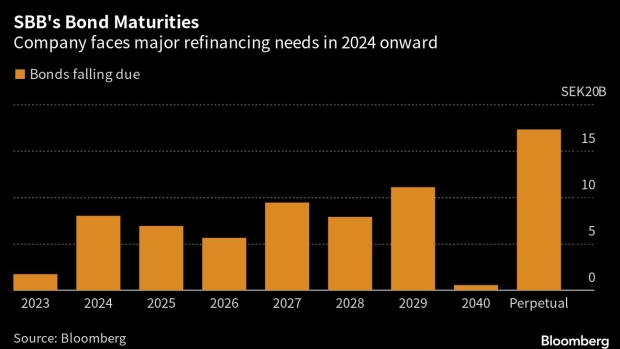

The landlord faces urgency to find cash after the stock slumped to the lowest level since its debut in 2017. Options are narrowing. The company has already paused some hybrid bond coupons, scrapped a dividend and emergency rights issue and has even hired the services of JPMorgan Chase & Co and SEB AB to drum up some support.

“With Leiv Synnes as the new CEO, SBB gains a new, highly qualified force that can manage the company with full focus and support the board of directors in the strategic review,” Chairman Lennart Schuss said in the statement.

(Updates with market reaction beginning in seventh)

©2023 Bloomberg L.P.