Sep 28, 2022

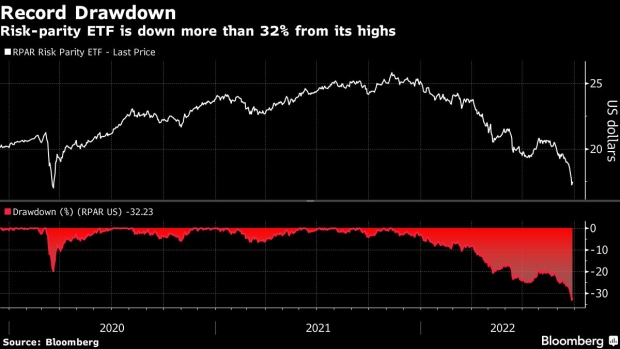

Risk-Parity Strategy Disappoints as ETF Posts Record 32% Drop

, Bloomberg News

(Bloomberg) -- Anyone paying even slight attention to markets these days knows there’s no place to hide as everything from stocks to bonds to commodities is getting hit. That’s bad news for risk-parity strategies that look to maximize diversification across asset classes.

The $1.1 billion RPAR Risk Parity ETF (ticker RPAR) is down more than 32% from its November 2021 high, a record drawdown, according to data compiled by Bloomberg. Before Wednesday, the fund had dropped for six straight sessions -- the longest streak of declines since October 2020. It rose 1% Wednesday morning when markets opened.

“It’s supposed to be a diversified fund -- holding major asset classes: stocks/bonds/gold/TIPS, to basically ‘weather’ when volatility hits one of the asset classes,” said Todd Sohn, ETF strategist at Strategas Securities. “But we are in this environment with inflation still high and bond yields now making multi-decade highs that no one has experienced in 40 years.”

It’s been a “perfect storm” for risk-parity strategies, he added.

These types of strategies allocate money across all asset classes based on volatility, therefore taking equal risk in each. But risk parity suffered this year as both stocks and bonds have been battered as the Federal Reserve fights to tamp down sticky inflation. An S&P risk-parity index had through Tuesday notched 11 straight sessions of declines -- the longest streak since 2012.

From Bloomberg Opinion: Risk Parity Funds Have Failed to Work as Advertised: Aaron Brown

It’s been hard to miss just how miserably the risk-parity strategy has performed. On Tuesday, Jeffrey Gundlach, chief investment officer of DoubleLine Capital, tweeted that “risk parity is clearly not working out so far this year,” noting that tech stocks and long-maturity Treasuries are down.

©2022 Bloomberg L.P.