Nov 27, 2022

Retailers’ Inflation-Fighting Discounts Yield Modest Growth on Black Friday

, Bloomberg News

(Bloomberg) -- US retailers eked out modest growth over Black Friday weekend with deep discounts that lured shoppers seeking a reprieve from stubborn inflation.

In-store traffic ticked up 2.9% at brick-and-mortar retailers versus 2021, according to preliminary data compiled by Sensormatic Solutions. Salesforce Inc. said the average consumer discount on Black Friday was expected to be greater than 30%, up from 28% last year and close to the 33% rate in 2019.

“Actual sales volumes reflect a little inflation, but it’s also reflecting some growth,” Bloomberg Intelligence analyst Jennifer Bartashus said by phone Sunday.

Retailers struggled to keep their shelves stocked last year because of supply-chain bottlenecks and got burned earlier this year after over-ordering -- which has forced them into deep markdowns to flush out excess inventory. During the current holiday season, inflation is making that balance harder. Some retailers are banking on volume to make up for the discounts, while others are trying to spark repeat visits by getting shoppers in the door, Bartashus said.

“Inflation has made it very difficult for retailers, even some of the most seasoned retailers,” to effectively manage inventory, she said. “They had to make sure they were able to right-size inventory, have the right promotions, get people spending, and finish up the year on a strong note.”

An S&P retail index climbed 1% at 9:52 a.m. in New York amid moderate declines in broader US stock gauges. The retail index tumbled 30% this year through last week, while the S&P 500 index fell 16%.

Amazon.com Inc. climbed 2.3% in Monday trading. Target Corp. advanced 1.2%, and Walmart Inc. and Best Buy Co. rose less than 1%.

‘Fewer Items’

While Cyber Monday results will paint a fuller picture of demand, retailers managed to meet expectations, Bartashus said. Even accounting for inflation, sales were slightly up overall.

Online sales during the biggest US shopping day of the year rose 2.3% to $9.12 billion, Adobe Analytics said Saturday. That was slightly ahead of the company’s initial projection of $9 billion, although the percentage increase lagged far behind the country’s inflation rate, which is running at almost 8%.

“People are still buying fewer items given that they’re stretching their wallets further,” said Rob Garf, Salesforce’s vice president of retail.

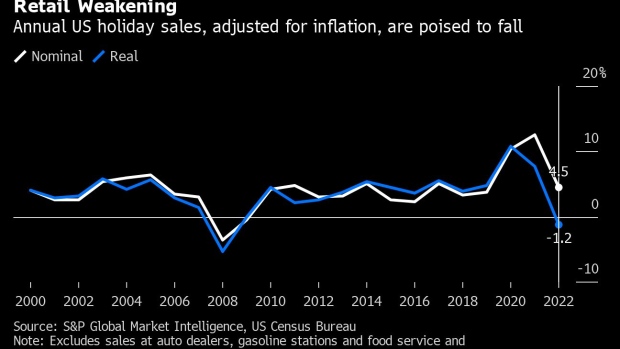

While a definitive accounting of sales isn’t available yet, S&P Global Market Intelligence last week forecast that after adjusting for inflation, seasonal sales are likely to fall 1.2%, the first decline since 2009.

During the Black Friday weekend, customer traffic was solid but not strong, Noah Zatzkin, an analyst at KeyBanc Capital Markets Inc., said in a report.

In-store traffic was lighter in part because the doorbuster deals that had shoppers lining up at 5 a.m. have been replaced by earlier online promotions, Bartashus said. More stores are offering “all-store” discounts instead of just select items. And shoppers are increasingly going back to pre-pandemic habits, such as waiting until later in the holiday season to make purchases, Cowen Inc. analyst Oliver Chen said in an interview with Bloomberg TV.

From a retailer profitability standpoint, Black Friday discounts weren’t as deep as feared, said Dana Telsey of Telsey Advisory Group.

There were pockets of growth in categories such as toys, or clothing for professionals seeking to update their wardrobes for return-to-office.

Shoppers spent their money primarily on electronics, smart-home items and audio equipment, while toys and sporting goods performed well, Adobe said. Hot items included toys such as Fortnite, Roblox and Bluey. Shoppers also bought up Xbox Series X and PlayStation 5 devices, as well as drones and Apple MacBooks, Adobe said.

--With assistance from Olivia Rockeman and Brendan Case.

(Updates with shares in sixth paragraph, analyst comment in 12th paragraph.)

©2022 Bloomberg L.P.