Nov 28, 2022

Resurgent Yen at Risk of Bigger Moves Still If 1998 Is Any Guide

, Bloomberg News

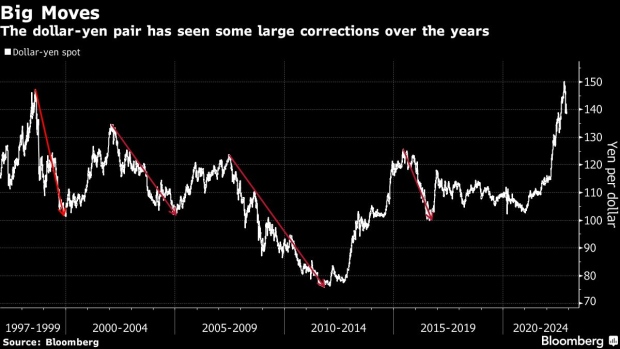

(Bloomberg) -- The yen is rebounding rapidly after tumbling last month to its weakest level in four decades and there could be more turbulence ahead if the currency echoes its behavior from previous tumultuous episodes.

“The potential for a whipsaw correction similar in magnitude to what we saw in 1998/1999, 2002/2004, 2007/2011 or 2016, is clear,” wrote Kit Juckes, Societe Generale SA’s chief foreign-exchange strategist.

The Japanese currency has taken another leg higher in recent days, fueled in part by the potential fallout from China’s deteriorating Covid situation, which is hurting riskier assets. It’s reclaimed, to a certain extent, the mantle of go-to haven that had appeared to fade in recent months as investors focused more intently on interest-rate differentials. With Bank of Japan rates firmly anchored near zero and other central banks raising borrowing costs, that dynamic had weighed against the yen. Now there is more talk of where the Federal Reserve -- and others -- might halt rate hikes, which has helped alleviate some of the pressure from dollar strength.

The yen has climbed more than 7% against the greenback in November, outstripping gains for all of its Group-of-10 peers, and is more than 10% above the multi-decade nadir it reached on Oct. 21. It was an outperformer again on Monday, fueled in part by increased social unrest in China in response to the President Xi Jinping’s Covid Zero policy. At one point it appreciated 1.2% to 137.50 per dollar, its strongest level in three months, before paring its gain to trade around 138.88 per dollar. It was the only G-10 currency to gain ground againsst the greenback, which surged Monday against the rest of its most traded peers.

The dollar is also historically a major haven currency for investors and has acted that way for much of this year, but it appears to be acting less in that role amid the moves of recent weeks. A large part of that is the softening of inflation concerns and the pullback in market expectations for how high Fed might take the US central bank’s benchmark rate, which reduces the yield advantage the greenback offers. Still, apart from the yen, it remained the standout destination for FX traders in Monday trading, with the Australian and Norwegian currencies among the biggest laggards.

Writing in a note to clients on Monday, Societe Generale’s Juckes points in particular to the situation from 1998/1999 as being potentially instructive. Back then the dollar-yen pair fell from more than 147 to less than 102 -- a lot further than it has moved so far in this episode -- before it bottomed out and eventually recovered to around 135 in 2002. He also notes that investors from Japan have been “significant sellers” of foreign bonds this quarter, which he describes as “hardly surprising but a positive for the yen on days when geopolitics, energy prices and the BOJ’s current policy stance aren’t dominating the market.”

(Updates prices.)

©2022 Bloomberg L.P.