Sep 20, 2022

Quants Are Back Making Money on Factor Trades Like Good Old Days

, Bloomberg News

(Bloomberg) -- The worst year for stocks since the global financial crisis is bringing back the good old days for a once-revolutionary breed of quant investor who took a big beating in the cheap-money era.

Machine-powered funds that slice and dice equities on their traits like how cheap they look or how fast they’ve risen -- known as factor investing -- are making money time and time again this year, while the likes of discretionary hedge funds and speculative day traders crater in the market crash.

With rising interest rates on historic inflation bringing an abrupt end to the leadership of Big Tech, pandemic-era extremes are reversing. Mega-capitalized companies are no longer gobbling up gains in stock benchmarks, while the performance gap between the winners and losers in the S&P 500 has jumped to the most in more than a decade, S&P Global data show.

All that is firing up rules-based managers, who like to spread out their bets. Strategies that bid up low-volatility or high-momentum companies are in the green and value shares -- those with low prices relative to some fundamental indicator like earnings -- are extending their post-lockdown comeback.

Five of the most popular factor styles -- value, momentum, quality, size and low volatility -- have all have made money in 2022, Dow Jones market-neutral indexes show. The AQR Equity Market Neutral Fund -- a long-short product that employs multiple factors -- is up 15%.

While many long-only factor strategies have struggled to escape this year’s stock rout, they’re still beating the market. One long-only index from Research Affiliates comprising those five factors is outperforming the broader benchmark by the most since 2004, though it remains underwater for the year.

“When it rains, it pours,” said Eugene Barbaneagra, a portfolio manager at SEI Investments Co. “We had this drought for many years, and now we have multiple drivers driving this positive outcome.”

It’s early days yet. But there are good omens in 2022 investing trends for those betting that the end of the low-rate era will kickstart an extended bout of outperformance for the multi-trillion-dollar factor industry.

For a start, megacaps like Meta Platforms Inc. and Alphabet Inc. are falling the hardest in the rate-spurred selloff that’s lashed the most expensive equities, with the regular cap-weighted S&P 500 set for its worst year versus its equal-weighted counterpart since 2013.

While factor investors come in all shapes and size, the more diversified performance in the market is good news for quants overall, since their whole philosophy is allocating to a broad slate of shares rather than investing in any particular stock or industry.

“We have an equity market which is better diversified, which is less concentrated in a few names,” said Bruno Taillardat, head of smart beta and factor investing at Amundi SA, who helps oversee 29 billion euros ($29 billion). “Dispersion for us is opportunity.”

These managers are also typically more exposed than other types of investors to a value strategy, which is now up 48% from a 2020 trough, a Dow Jones market-neutral index shows. As rates climb, shares with lower multiples are looking like they have less room to fall. Energy companies -- typically favored by long-only value funds -- have also been inflationary markets’ biggest winners.

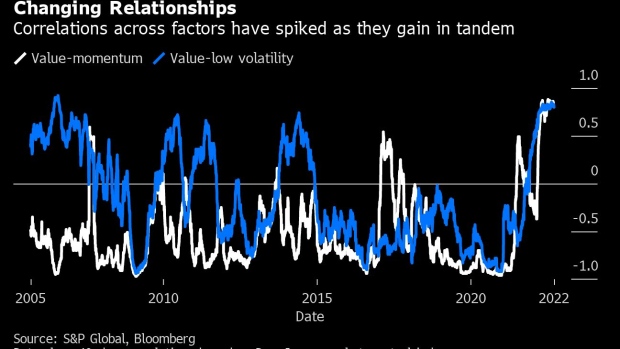

With the S&P 500 down 18% this year, the momentum trade -- buying recent winners and selling losers -- has been piggybacking on value’s outperformance after rotating into winning cheap names like Exxon Mobil Corp. Price moves for both factors, which have been swinging in opposite directions for most of the past two decades, are now trading near the tightest positive link in data going back to 2002.

Meanwhile, the strategy of buying the least-volatile stocks is also mounting a comeback as a refuge from the equity storm, with a market-neutral index for the trade set for the best year since 2018. It means value and low volatility are at the highest correlation since 2006.

The elevated level of co-movement suggests a risk these factors could fall together if there’s another market regime shift. Mark Diver, a strategist at Sanford C. Bernstein, warns that cheap stocks typically underperform in a recession, which is looking increasingly likely. The firm now recommends a more defensive version of the value trade, such as buying stocks with high dividends and free-cash-flow yields.

At PGIM Quantitative Solutions, which manages $91.5 billion, head of quantitative equity Stacie Mintz says the firm’s stock funds now have a lower value tilt after the factor’s epic rebound. Yet she remains optimistic about an extended recovery -- given cheap shares are still trading near the widest discount ever to growth peers.

“There’s still a long way to go,” she said.

©2022 Bloomberg L.P.