Nov 28, 2022

Polish Central Banker Flags Rate Cuts Even as Inflation Soars

, Bloomberg News

(Bloomberg) -- Poland’s central bank is likely to begin cutting interest rates late next year, with borrowing costs now at a sufficient level to bring inflation under control, policy maker Ireneusz Dabrowski said.

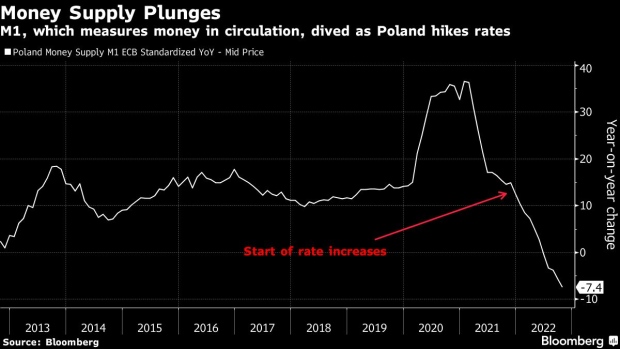

Even as inflation in Poland approaches 18% and other central bankers warn against easing off rate hikes, Dabrowski said in an interview that falling money supply, rising consumer deposits and weakening demand all point to abating price pressure. Investors are pricing in as much as half a percentage point of cuts a year from now, trading data show.

“Markets are correct to assume that -- already next year -- we may see the first rate cuts,” Dabrowski said in Warsaw on Friday, putting a reduction in the rate closer to 6% from the current level of 6.75%. “Our interest rate is now well calibrated to lower both headline and core inflation.”

Dabrowski’s remarks clash with more cautious stances laid out by his colleagues on Poland’s rate-setting committee, including Cezary Kochalski and Governor Adam Glapinski.

Both have said that it’s premature to speculate about the timing of rate cuts after the central bank brought a halt to a string of rate increases in the last two months, while raising forecasts or inflation. Price increases are currently projected to return within the central bank’s target range in late 2025.

The Monetary Policy Council is facing criticism, including within its own ranks, that it’s backing off inflation fighting to avoid a slowdown in growth. Joanna Tyrowicz, the most vocal supporter of further rate increases, has said she saw no reasons to pause the hikes, forecasting that inflation -- increasingly driven by domestic demand -- will climb substantially next year.

Dabrowski, who has consistently voted with the majority on the MPC since his first meeting in March, said the main rate ranging between 6% and 7% would have a positive impact on the economy.

Poland isn’t experiencing a wage-price spiral, with wages falling in real terms because “workers feel we have a slowdown and they are not escalating their pay demands,” he added.

Faltering Consumer Demand Signals Polish Rate Hikes May Be Over

The most recent data show that consumer demand, a key driver of Poland’s economic expansion in past years, is losing steam as a cost-of-living crisis takes hold. Wages are no longer keeping pace with inflation, further eroding the purchasing power of consumers. The economy slowed in the third quarter, but still performed better than predicted and avoided stagnation.

“We’re going to fight inflation, but not at the expense of a dramatic drop of the gross domestic product,” he said. “Frantic rate increases won’t do anything and may end up being counterproductive by hitting growth hard.”

©2022 Bloomberg L.P.