Jun 5, 2023

PayPal’s 80% Stock Plunge Hasn’t Soured Wall Street

, Bloomberg News

(Bloomberg) -- For the majority of PayPal Holdings Inc. analysts, the only way is up. Trouble is, the stock keeps going down.

About two thirds of the more than 50 Wall Street firms covering the digital-payments company has a buy or equivalent rating on the shares, according to data compiled by Bloomberg. And not one has a sell, the data show, something that can’t be said of Apple Inc., Microsoft Corp., or even the latest market darling Nvidia Corp.

Analysts were similarly bullish in mid-2021, when pandemic-fueled revenue growth was pushing the stock to record highs. No one predicted the plunge of about 80% that sent PayPal spiraling to a six-year low late last month. This time around, the market is treading more carefully.

Tejas Dessai, an analyst at Global X ETFs, said investors are “broadly skeptical of fintech names” given their sensitivity to the consumer economy at a time of high interest rates and inflation. “What makes things harder for PayPal is poor growth and continuous margin pressures,” he said. While the stock is a 5.1% holding in the Global X Fintech ETF, the fund has been cutting its position since October last year, data compiled by Bloomberg show.

The San Jose, California-based company has lost nearly $300 billion in market value as revenue growth that was turbocharged during the Covid-19 pandemic has slowed dramatically. The latest issue to rankle investors is sluggish profit margins.

Still, PayPal has one key attraction — it’s dirt cheap. At 12 times projected profits, the stock is trading at a record-low valuation and is cheaper than 90% of the companies in the Nasdaq 100, according to data compiled by Bloomberg.

For some analysts, being cheap isn’t enough of a reason to buy.

“Given the change in interest dynamics combined with slowing growth, we don’t see PayPal regaining peak price-to-earnings multiples seen during the pandemic,” said Logan Purk, an analyst at Edward Jones. He was one of three long-time bulls to downgrade the stock after PayPal’s margin forecasts for the full-year disappointed.

“PayPal continues to focus on its largest core accounts, which should help drive solid volume growth,” Purk said. “However this business tends to be lower margin. We question how long PayPal can offset margin pressures with its disciplined cost control.”

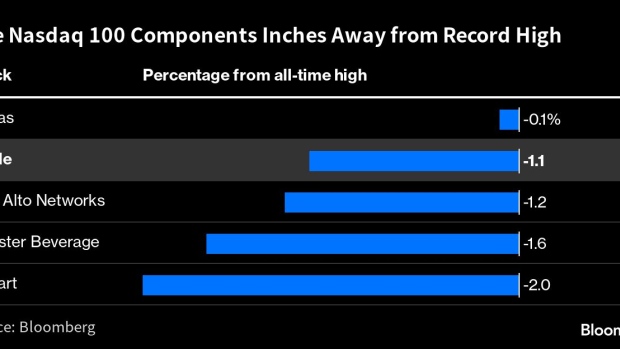

Tech Chart of the Day

Apple rose as much as 1.6% to $183.86 on Monday to set a fresh all-time high ahead of its most significant product launch event in nearly a decade. The iPhone maker, which is expected to announce its mixed-reality headset later on Monday, is also inching closer to a historic threshold: a $3 trillion market valuation.

Top Tech Stories

- Apple’s next big thing is finally here, with the company set to announce its mixed-reality headset at its annual Worldwide Developers Conference.

- Byju’s, India’s most valuable startup, plans to make a quarterly interest payment of about $40 million on a loan that has been at the center of the beleaguered firm’s financial troubles, according to people familiar with the matter.

- Twitter is hiring a senior executive from NBCUniversal to join incoming Chief Executive Officer Linda Yaccarino, the network chief tapped last month to improve the social-media company’s relations with advertisers.

- A proposed class-action suit in Israel is accusing data collection company Bright Data of selling personal information about minors that it pulled from Facebook and Instagram, allegedly in violation of local privacy laws.

--With assistance from Tom Contiliano and Rheaa Rao.

(Updates the Tech Chart of the Day section.)

©2023 Bloomberg L.P.