Nov 28, 2022

Paraguay Puts 2023 Bond Sale Plans on Hold Due to Higher Rates

, Bloomberg News

(Bloomberg) -- Paraguay plans to stay away from global bond markets for the time being due to the increase in interest rates, seeking to finance its spending needs with loans from multilateral lenders early next year, Deputy Finance Minister Ivan Haas said.

The government is likely to postpone the sale of as much as $548 million in bonds it had anticipated for early 2023 until it has more visibility on the direction of rates, Hass said in an interview.

Emerging market borrowers like Paraguay will pay more to sell dollar debt in the months ahead after the Federal Reserve raised its key rate by 375 basis points to 4% this year, with another increase of half a point expected in December. Paraguay would have to pay 7% now to sell the 2033 global bond it issued in January 2021 at 2.7%, Haas said.

“We want to be very cautious in choosing when we go to market,” Haas said from Asuncion. “We are going to wait a little bit. We don’t want to go to market at peak rates.”

Read More: Emerging-Market Bond Laggard Asia Is Primed for Rebound in 2023

The 2023 budget bill currently in the Senate would authorize the government to borrow about $548 million from debt markets or multilateral lenders. The budget also includes loans for $250 million from the Inter-American Development Bank and about $287 million from CAF, Haas said.

Read More: Paraguay Ditches Local Bonds, Pivots to Multilaterals on Rates

Higher benchmark rates also mean Paraguay is in no rush to refinance its global bonds due next year, Haas said. The government will pay the $238 million outstanding balance on the bond that matures next January using money from a World Bank loan, he said.

“I don’t think we will do any liability management operations if rates continue at these levels,” Haas said. “The next major maturity of one of our bonds is in 2026.”

Recovery Year

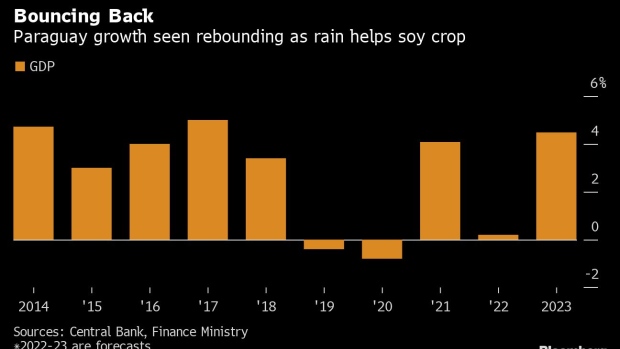

The government sees growth accelerating from almost zero to 4.5% next year on expectations the farm sector will recover from a deep drought that slashed soy production more than 50% to about 4 million metric tons in 2022.

“The agriculture season is off to a very good start,” Haas said. “Planting was done in September and October with good rain, something that didn’t happen the previous season.”

Read More: Paraguay Farmers Finish Soy Planting After Rains

The outlook for the economy may also be affected by presidential primary elections next month and general elections in April that will see Paraguayans elect lawmakers and a new president. President Mario Abdo Benitez, whose five-year term ends in August, is barred by law from seeking re-election.

“None of the candidates that might have a chance of winning imply a change in the economic model. That risk doesn’t exist,” Haas said. “I think that creates a certain peace of mind related to this electoral process.”

Other key points from the interview:

- The two-year Policy Coordination Instrument with the IMF seeks to revitalize Paraguay’s reform agenda, address institutional shortcomings flagged by credit rating companies

- Under the PCI, the government agreed to sponsor several reform bills including an overhaul of civil servant pensions and the creation of a pension system regulator

- Self-regulated pension funds could represent a source of “systemic risk,” Haas said.

©2022 Bloomberg L.P.