Mar 28, 2023

Options Traders Make Record Bets on $3 Billion Regional-Bank ETF

, Bloomberg News

(Bloomberg) -- A $3 billion exchange-traded fund tracking regional banks has become the battleground for traders placing their wagers on the outlook for the industry following the recent financial turmoil.

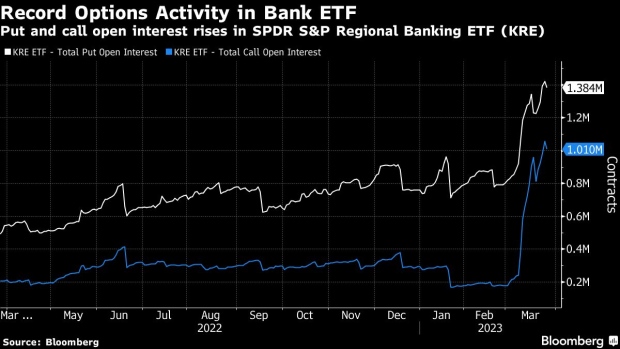

Options that bet both for and against the SPDR S&P Regional Banking ETF (ticker KRE) have hit record levels in March, with the fund tumbling almost 30% in the span.

Total put open interest, which measures the amount of bearish options activity, jumped to a record of 1.42 million contracts on Friday, up 60% from the day before a collapse in regional banks. Over the same stretch, total call open interest more than quadrupled to 1.05 million, also the highest ever.

In just weeks, KRE went from a niche sector vehicle to one of the most heavily traded ETFs on Wall Street, underscoring how fast-money investors flock to the liquid, easy-to-trade wrapper during tumultuous markets.

Following the first signs of banking stress in mid-March, KRE daily trading volume hit a record $4.9 billion. The fund is on pace for its biggest monthly volume in March since its inception in 2006.

“KRE has become a favorite for investors and speculators to trade. Some of the activity for hedging, some for outright directionality,” said Dave Lutz head of ETFs at JonesTrading.

KRE, which has New York Community Bancorp Inc. and Regions Financial Corp among its top holdings, whipsawed Tuesday as investors remained on edge with the US Senate hearing on the string of US bank failures.

Top US financial officials on Tuesday outlined what’s likely to be the biggest regulatory overhaul of the banking sector in years, in an initiative aimed at addressing underlying issues that contributed to the collapse of Silicon Valley Bank and other US regional lenders.

--With assistance from Lu Wang.

(Adds details on Senate hearing)

©2023 Bloomberg L.P.