Jun 27, 2022

Mike Philbrick's Top Picks: June 27, 2022

BNN Bloomberg

Mike Philbrick's Top Picks

Mike Philbrick, chief executive officer, ReSolve Asset Management

FOCUS: Exchange-traded funds

MARKET OUTLOOK:

Inflation Shock to Growth Shock – This May Not Get Easier

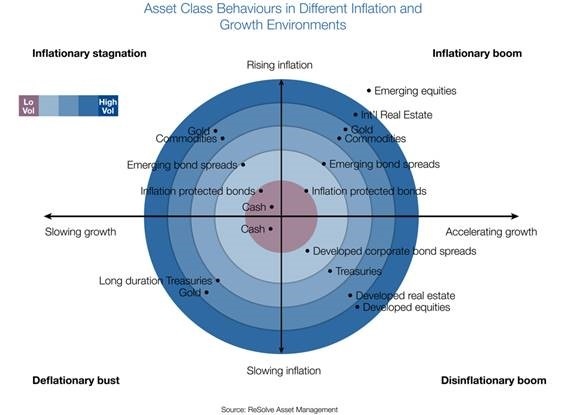

There are four economic regimes created by two dynamics: growth and inflation. These regimes greatly inform whether specific asset classes will thrive or wilt depending on the current economic regime we find ourselves in.

Figure 1 below illustrates the framework showing which asset classes might be expected to thrive under differing economic conditions. Assets toward the middle are least sensitive, while assets toward the edge of the diagram are most sensitive to each regime.

Recently markets have been experiencing and adjusting to an inflationary shock and many traditional portfolios have lacked exposure to the asset classes that thrive under these conditions, leaving investors with disappointing results. Further, the response of central banks and governments to raise interest rates in an attempt to deal with the inflationary impulse has had the consequence of slowed economic growth. This could tip the economy into a recession leading to a subsequent growth shock.

The past decade has been characterized by benign inflation, abundant liquidity and sustained economic growth globally. These qualities favoured traditional portfolios of developed market stocks and bonds, such as the ubiquitous 60/40 ‘balanced’ portfolio but these portfolios are showing their vulnerabilities in 2022. The economic regime has shifted to one where stocks and bonds have declined in unison.

If investors are to succeed in the current economic regime, today’s portfolios must be prepared to weather periods of poor global growth, that are accompanied by large swings in inflation, and tightening financial conditions.

The 1970s offer a meaningful case study, as stagnating economic growth coupled with high and accelerating inflation produced negative real returns for stocks and bonds for over a decade. Investors wanting to avoid these outcomes are going to have to look beyond tradition to thrive.

- Sign up for the Market Call Top Picks newsletter at bnnbloomberg.ca/subscribe

- Listen to the Market Call podcast on iHeart, or wherever you get your podcasts

TOP PICKS:

Horizons U.S. 7-10 Year Treasury Bond ETF (HTB TSX)

It seeks to replicate, to the extent possible, the performance of the Solactive U.S. 7-10 Year Treasury Bond Index (total return), net of expenses. In times of market stress, improving the credit quality of your fixed-income sleeve with U.S. sovereign bonds denominated in U.S. dollars can help protect your portfolio from economic growth shocks. Historically, when stock markets have a period of “risk-off” and sell-off, these bonds have experienced a flight to quality and increased in value. Both the exposure to high-quality sovereign bonds and the U.S. dollar can help offset losses in the equity sleeve of your portfolio.

BMO Short-Term US TIPS ETF (ZTIP TSX)

It seeks to replicate, to the extent possible, the performance of a 0-5 year U.S. government inflation-linked bond total return index, net of expenses. Real return bonds or Treasury Inflation-Protected Securities (TIPS) are government-issued bonds that are indexed to inflation. Thus, when inflation rises, TIPS can generate greater returns compared to bonds that are not inflation-linked. They are designed for investors looking for inflation-protected income.

iShares MSCI Min Vol Canada ETF (XMV TSX)

It seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the MSCI Canada Minimum Volatility Index (CAD), net of expenses. Minimum Volatility ETFs are core equity exposures that have delivered market-like returns with less risk. Because they can help weather the ups and downs of the market, they can help give investors the confidence to stay invested. Historically minimum volatility exposures lose less during market declines—while still capturing meaningful gains during upswings.

PAST PICKS: July 16, 2021

Horizons Enhanced Income Gold Producers ETF (GLCC TSX) old ticker (HEP TSX)

- Then: $29.90

- Now: $25.18

- Return: -16%

- Total Return: -9%

iShares Canadian Real Return Bond Index ETF (XRB TSX)

- Then: $26.38

- Now: $22.14

- Return: -16%

- Total Return: -15%

3iQ CoinShares Ether ETF (ETHQ TSX)

- Then: $9.89

- Now: $6.20

- Return: -37%

- Total Return: -37%

Total Return Average: -20%

| DISCLOSURE: | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| HEP TSX | N | N | N |

| XRB TSX | N | N | N |

| ETHQ TSX | Y | Y | N |