Mar 24, 2023

London’s West End Offices Are Busier Than The City, Goldman Says

, Bloomberg News

(Bloomberg) -- The “buzz” of London’s West End is helping the shopping and theater district attract superior office occupancy to the capital’s financial center after the pandemic, according to Goldman Sachs Group Inc. analysts.

Offices in the West End, also known for its bars and restaurants, are almost fully occupied, while about 5% of the best office space in the City of London was vacant as of December, the bank said in a note Wednesday.

The West End offers better transport links to the suburbs than the City of London, and its leisure and entertainment venues are helping entice younger workers back to the office, Goldman analyst Tom Musson said in an interview.

“It has the most buzz, the most culture, the most life,” he said, while noting that many businesses are choosing the district’s smaller office buildings over the City’s sprawling locations.

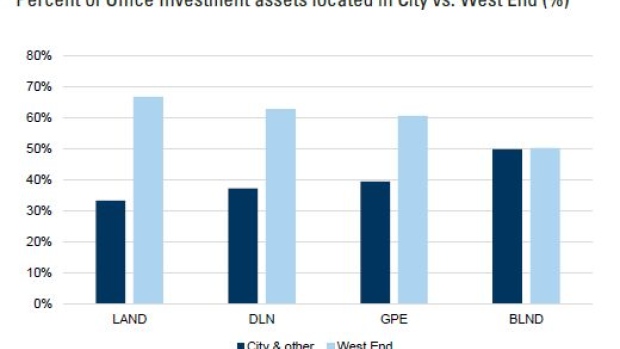

Goldman downgraded City-exposed British Land Co. Plc to sell, sending the stock down about 10% since its note was published on Wednesday. British Land’s sites in the City of London include Broadgate, whose tenants include UBS Group AG and TP ICAP Group Plc.

Goldman’s buy-rated stocks include Great Portland Estates Plc and Derwent London Plc, which have greater West End exposure.

“There is a search for adding a bit more of a hybrid environment as opposed to traditionally heavy office areas,” another Goldman analyst, Jonathan Kownator, said in the interview. “You walk around the City and, at some point, you think it’s a bit dead.”

©2023 Bloomberg L.P.