Mar 1, 2021

Larry Berman: The bond vigilante is back

By Larry Berman

Larry Berman: Bond vigilantes are back

A bond vigilante is a bond market investor who protests monetary or fiscal policies considered inflationary by selling bonds, thus increasing yields.

The U.S. Federal Reserve’s balance sheet is massive right now, and the central banks of the world will most likely win the short-term fight against the vigilantes in this day and age of unlimited money printing. However, recent action in the bond market suggests we may see a “Battle at the O.K. Corral” in the coming months. The bond vigilante has been absent for at least a decade with deflationary forces being very powerful.

The question will be: Is the Fed’s balance sheet really unlimited? Bitcoin investors think so! When investors perceive that inflation risk, or credit risk, is rising they demand higher yields to compensate for the added risk. The term refers to the ability of the bond market investors to serve as a restraint on the government's ability to overspend and over-borrow.

When I look at the 40-year trend of falling rates, I am dumbfounded by those calling it over. That is impossible to do from my perch given this long-term chart. The trend of lower-yield lows and lower-yield highs is still well intact. To see the end of this trend, there would probably need to be a sustained 10-year yield above 3.50 per cent. The last time the Fed started to raise rates, in 2017, they had to cut them back to zero as the economy simply could not handle the higher rates. Equity markets collapsed in the fourth quarter of 2018 and forced the Fed to reverse their tightening cycle. Equity markets do not like higher yields.

To wit, economist David Rosenberg wrote last week:

“As for the super-leveraged U.S. economy, it has never before been so susceptible to shifts in the interest rate landscape, as each 100 basis point back-up now siphons US$800 billion, or 4 per cent of GDP, into incremental debt-service charges.”

The Next Policy Tool: Enter Yield Curve Control

The history of yield-curve control is notable in Japan and in the U.S. after WWII ended. In what is very obvious today, President Harry S. Truman and his treasury secretary still favoured a policy that could stimulate the economy. However, by 1947, inflation was over 17 per cent, as measured by the year-over-year percent change in the consumer price index (CPI). So, the Fed ended the peg on short-term rates in an attempt to combat developing inflationary pressures. The stock market is sensitive to inflationary pressure.

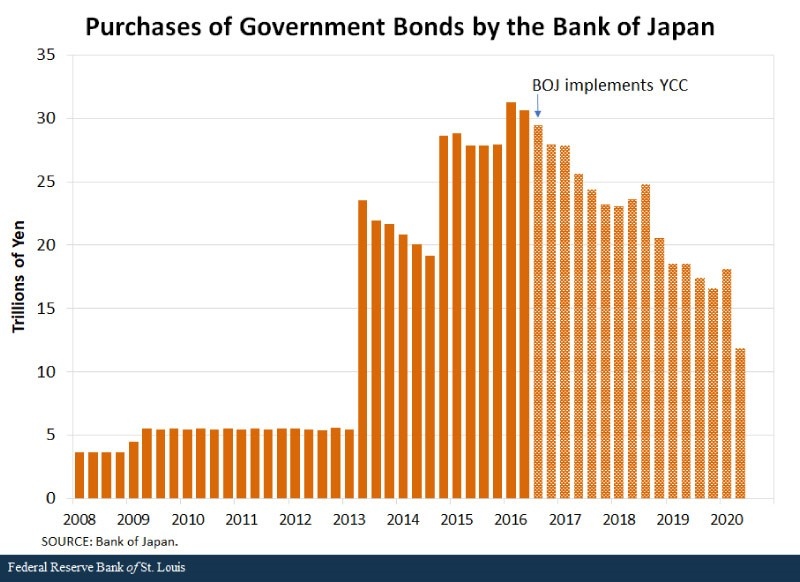

Yield curve control is a more formalized type of quantitative easing. Japan officially embraced this a few years ago by saying they would buy all bonds in excess of a certain yield. The interesting thing is that they ended up buying fewer bonds. The peg on longer-term rates contributes to faster money growth and increased inflationary pressures. By 1951, annualized inflation was over 20 per cent, and monetary policymakers insisted on combating inflation. Against the desires of fiscal policymakers, interest rate targeting was brought to an end by the Treasury-Fed Accord in March 1951.

I believe that the central banks seeking inflation is a double-edged sword. I do not see a viable path where the central banks can do anything else by monetizing future deficits… I’m happy to debate this. They simply cannot afford to see higher rates.

While it’s true that inflation pressures suggest a strong economy, which will help fiscal balances, the natural rate of growth is simply too low given the demographic challenges ahead. Look for the bond vigilantes to stress test the central banks of the world, which likely keeps equity market volatility high. It is clear to me that equity markets are trading at such high multiples because rates are low. Managing inflation expectations in the coming years will be critical for market stability. The bond vigilante will most certainly give the central banks a test and I think the next step for central banks is yield curve control, especially when Fed Chair Jerome Powell says they can do more.

The Australian central bank began to signal yield curve control over the past week by committing to buy long bonds, basically to prevent rates from rising. That may bring some unwanted inflation over time if fiscal policies remain hot. I think the economic output gap is too wide to see much more than “transitory inflation,” as the Fed calls it.

Our Spring weekly Berman’s Call virtual roadshow is back. Register a www.etfcm.com or at www.investorsguidetothriving.com. The format this series will be a 30-40 minute weekly presentation that changes each week to current market developments and a 30-40 minute Q&A.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com