Jun 4, 2023

Japan’s Rapid Return of Tourists Helping Fuel Inflation for BOJ

, Bloomberg News

(Bloomberg) -- Foreign tourists packing flights to Japan are helping the economy climb out of a recession with spending power that is also fueling upward pressure on hospitality-sector pay and prices.

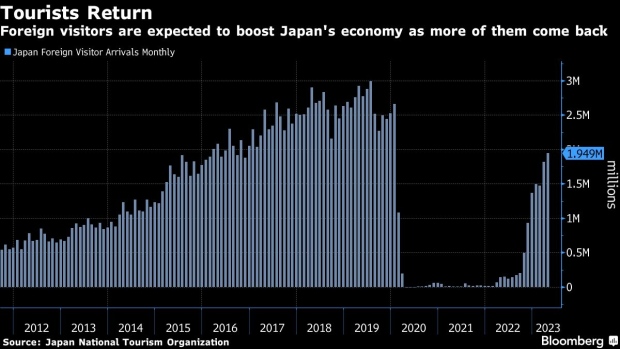

Almost two million visitors arrived from overseas in April, compared with less than 140,000 a year earlier, according to Japan’s National Tourism Organization.

While that’s still a ways off pre-pandemic levels of almost three million per month, the return of spending by foreign tourists has already accounted for 1.1 percentage point of the 1.6% annualized growth in the first three months of this year, according to Bloomberg Economics.

Tourism spending in the cities and regional sight-seeing spots combined with a chronic labor shortage is supporting the kind of upward momentum in wages and price levels that Bank of Japan Governor Kazuo Ueda wants to see before he can consider changing policy.

Yohei Fujiwara, the head of Japanese-style inn in Nagano on the historic Nakasendo trail between Tokyo and Kyoto, is among the hoteliers welcoming the return of foreign travelers who appear far less price sensitive than their Japanese counterparts.

“From the perspective of foreigners, we charge just a hundred bucks a night,” said Fujiwara, who bumped up his prices by 8% last year. “Only Japanese visitors who’ve been here before think that’s expensive.”

Fujiwara says his hotel is almost fully booked for the rest of the year. But fully booked doesn’t mean full capacity.

The innkeeper said he only has enough staff for half the guests he has rooms for. Like many hotels in the area, Fujiwara’s may have to raise pay to attract staff as Japan’s aging and shrinking population continues to squeeze the availability of personnel.

Figures for March show that while average wages nationally rose just 1.3% from a year earlier, pay at restaurants and bars rose 13%.

According to a report by the Teikoku Data Bank, three quarters of hotels said they had a shortage of full-time workers in April, the highest level among surveyed sectors. Some 85% of restaurants said they don’t have enough part-time workers.

“Inbound demand is a factor accelerating the momentum of service prices and wage gains,” said Keiji Kanda, economist at Daiwa Institute of Research. “This is an element supporting the path targeted by the BOJ as labor shortages push up pay with a ripple through to prices.”

Leaning on tourism has been a key prop for Japan’s economic growth plans for the past decade.

Visitors bring spending to regional areas struggling with a flow of young people to the big cities. Former Prime Minister Shinzo Abe set a goal of reaching 60 million foreign tourists per year by 2030, three times more than in 2015. The number hit a record high of 32 million in 2019 but even that sharp gain left Japan well below the 218 million visitors welcomed by France in the same year.

“Japan’s economy would have been in big trouble without inbound spending,” Yoshiki Shinke, senior executive economist at Dai-Ichi Life Research Institute, referring to is sputtering state after it shrank for two consecutive quarters in the second half of last year. “There is room for more of a rebound. Japan is cheap for them due to a weak yen.”

Japan’s currency hit a six-month low last week against the US dollar. For those using the greenback, everything in Japan offers about a 30% discount compared with the end of 2019. When the yen hit 150 against the US currency last year, a slew of local media reported that people abroad were changing money into the yen to prepare for visiting Japan after the pandemic.

Online travel Asia-Pacific travel agent Agoda, part of Booking Holdings Inc., has seen a surge in reservations for Japan.

“Japan is not only the No. 1 inbound destination for us, it’s also the fastest growing inbound destination for us,” said Agoda CEO Omri Morgenshtern at a press briefing in Tokyo last week.

And there’s still scope for more growth.

Hidefumi Murota, who runs three Japanese style pub restaurants specializing in fresh fish in Hakodate, Hokkaido, said he is much more optimistic about business since direct flights from Taipei to Hakodate resumed in May. He’s seen more tourists from South Korea, too.

“Things aren’t in full swing like they are in Tokyo yet,” Murota said. “I also want to see visitors from China coming back here soon.”

The return of Chinese visitors would add significant heft to the spending impact of tourists. They accounted for 37% of all inbound expenditure in pre-pandemic 2019, a share that has fallen to around 10% so far this year, according to Japan’s Tourism Agency. South Koreans currently top the list with about a fifth of tourist spending in Japan.

Prime Minister Fumio Kishida’s cabinet is targeting inbound spending to hit 5 trillion yen ($35.7 billion) a year as soon as possible, to beat its peak of 4.8 trillion yen four years ago.

Economist Shunsuke Kobayashi of Mizuho Securities Co. indicates that the government could think bigger. He sees the size of inbound spending reaching as much as 8 trillion yen.

The boost to spending could help the economy return to its pre-Covid size before a sales tax hike in late 2019. Until that becomes certain, it seems unlikely the BOJ would step back from stimulus.

But the real driver of change is the sustainability of inflation. While Japan’s main gauge of inflation has started to show prices cooling, a measure of the deeper inflation trend is above 4%. That’s the highest level since 1981.

Ueda still sees the main indicator of prices slowing below 2% toward the end of the fiscal year that started in April. But if it continues to stay above 2%, with demand-pull factors such as inbound spending helping support it, the argument for sticking with stimulus will become increasingly difficult.

Former BOJ board member Makoto Sakurai said the cost-push elements in Japan’s inflation are getting less significant as demand starts to kick in. The spending by visitors will help for sure, he added.

“Inbound tourism is back to about 70% of what it was,” Sakurai said. “There’s little concern that this demand won’t keep growing.”

--With assistance from Supriya Singh and Reed Stevenson.

©2023 Bloomberg L.P.