China Home Prices Fall as Slump Shows Few Signs of Abating

China’s home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market.

Latest Videos

The information you requested is not available at this time, please check back again soon.

China’s home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market.

PricewaterhouseCoopers LLP said it will investigate an anonymous letter circulating on social media that made “false allegations” about the company and its partners over its role in auditing China Evergrande Group.

A Hong Kong bank has filed a request for a court to wind up Chinese developer Times China Holdings Ltd., marking another case where a lender has actively pursued liquidation of a distressed builder.

New York lawmakers agreed to the most sweeping changes in New York housing policy in years in a $237 billion budget deal, Governor Kathy Hochul said Monday.

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

Nov 25, 2021

By Noah Zivitz

Prices in red-hot Canadian housing markets could be at risk of a "significant" correction amid extreme valuation and policy uncertainty heading into the new year, according to one of the country's best known mortgage experts.

Rob McLister, a self-professed "rate watcher" and founder of RateSpy.com, said the Bank of Canada's plan to start raising interest rates next year is just one - albeit the most important - factor that in his mind is creating a risky outlook for housing in 2022.

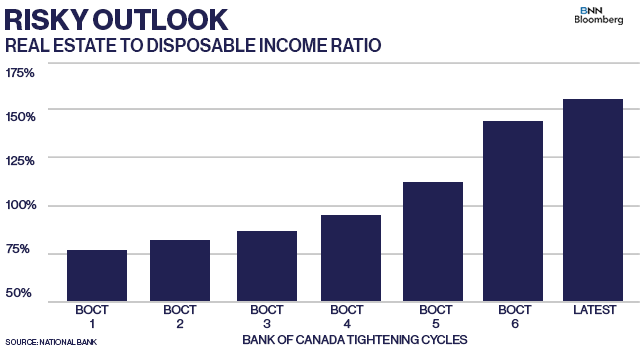

He cited analysis released this week by National Bank's economics and strategy team that showed the total value of Canadian real estate assets was roughly five times national disposable income as of the second quarter of this year, compared to the average of 300 per cent prior to recent rate-hike cycles for the Bank of Canada.

"Almost no other country in the world (compares to that ratio)," McLister said in an interview Wednesday. "When you get that all-important leg on the table -- which is interest rates -- being kicked out next year, couple that potentially with some more tightening by regulators and a higher potential mortgage qualifying rate, it raises a lot of questions about real estate next year."

The prospect of regulatory adjustments in the face of rising home prices was put back on the table this week when Peter Routledge, the superintendent of financial institutions, warned about the "marginally more fragile" state of household credit as Canadians have layered on debt to get into the housing market.

Routledge specifically cited the incoming implementation of new capital requirements for banks under the Basel III protocol, and told the public to "stay tuned" for the outcome of the Office of the Superintendent of Financial Institutions' annual review of the minimum qualifying rate (more widely known as the mortgage stress test) in the coming weeks.

Currently, OSFI requires home buyers who put down at least 20 per cent up front to show they'd be able to service their mortgage obligations at their contract rate plus two per cent or 5.25 per cent, whichever is higher. The same requirements apply for insured borrowers (who put down less than 20 per cent up front) under the stress test that falls under the finance department’s purview.

Routledge also expressed caution in his speech about the use of home equity lines of credit (HELOCs) that are being combined with mortgages. HELOCs allow homeowners to borrow up to 65 per cent of the value of their home. When combined with a mortgage, that limit rises to 80 per cent. Routledge said the combined structures make it more challenging to track risk in lenders' loan books.

McLister said it's at times like the present, when worries about housing market stability grow louder, that regulators and policymakers might be tempted to make "little policy tweaks" and that HELOCs could be targeted in the new year in an effort to cool the heat that most recently saw October home sales hit a record in Calgary, while the average selling price climbed to an all-time high in the Greater Toronto Area last month.

"If you're sitting on a house that went up $500,000 in value, that's potentially five 20-per cent down payments on five other houses if you choose the right lender," McLister said. "The point is, people are taking their newfound equity and redeploying it in the real estate market because that to them is one of the safest no-lose investments."

That notion of housing as a sure-fire way to grow wealth was debunked, however, by a top Bank of Canada official this week. In a speech Tuesday, Deputy Governor Paul Beaudry sounded the alarm on the "sudden influx of investors" who have turbocharged home-price growth, and cautioned that trend could give rise to an eventual correction.

Indeed, that's a prospect McLister mapped out in his interview, while pointing to the poster child for this year's so-called meme stock rally as an example of what can happen when a frenzy comes undone.

"I think that where you see the challenge is with investors who have multiple properties," he said." So they can sell off one or two and they've still got a roof over their head; and then you see that type of thing snowballing a little bit, and then you see individuals maybe taking some money off the table... valuations are extreme and we’ve seen extreme valuations correct significantly all over the world in all kinds of different markets."

"It's like any other asset. You know, you see Gamestop go up to US$300, that corrects real quick because prices get totally detached."

While McLister said he's uneasy about the outlook for home prices next year, he's not forecasting a calamity. And that's for one simple reason: buyers still need a roof over their head, which won't come cheap.

"The thing is, people have got to live somewhere. And so it's real hard to say, 'Okay, prices are at just stupid levels, I'm going to sell.' Where are you going to go? What, are you going to rent? Rents are high (too)."

And regardless of the magnitude, concern about a possible correction is not universally held.

Dennis Mitchell, chief executive and chief investment officer of Starlight Capital, is dubious about the chances of a sharp pullback in home prices.

In an interview Thursday, he pointed to the labour market as the primary reason why he’s more confident about the stability of home prices despite the prospect of higher interest rates next year. He noted the recovery since the darkest days of the pandemic, as unemployment improved to 6.7 per cent in October from almost 14 per cent in mid-2020 and as wage growth as picked up.

“If the cost of servicing your mortgage goes up $100 a month and your wages go up $300 a month, that's not the recipe for a housing correction, alright?

“Are we going to see the gains that we've seen in the last two years? Absolutely not. ... but for a significant correction you need a significant interruption in employment."