Sep 23, 2022

Issuer Literally Crosses Out ETFs in Filing as Foreign-Share Plans Stall

, Bloomberg News

(Bloomberg) -- All three issuers that had proposed single-stock ETFs tracking foreign companies now appear to have scrapped their plans.

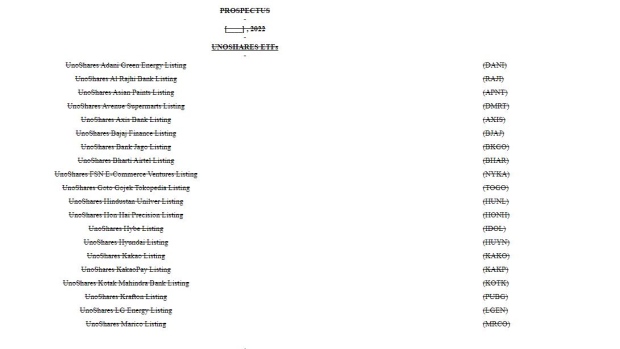

Less than a week after first Roundhill Investments and then Kelly Intelligence notified the Securities and Exchange Commission they didn’t intend to proceed with the registration process for the new products, Tema Global Ltd. updated its own filing to literally cross-out funds targeting overseas shares.

The unusual move -- to strike through the text for dozens of ETFs -- indicates the firm has also decided not to proceed with the products, which would have given American investors easy access to the performance of companies not bound by US listing standards.

Maurits Pot, portfolio manager for the Tema ETFs, declined to comment on the updated filing.

Alongside the withdrawal of plans for a slate of leveraged funds this week, it all marks a setback in the rush to offer single-stock ETFs, which debuted in the US in July. However the race will continue, according to Henry Jim, ETF analyst at Bloomberg Intelligence.

“We’re seeing product evolution at play, as issuers try new structures and strategies to capture all that cash sloshing around on the sidelines,” he said. “Although these withdrawals may seem like a setback for the issuers and the industry, I expect to see different approaches show up with the goal of delivering exposure to overseas single stocks.”

The first single-stock ETFs in the US delivered leveraged or inverse exposure on major domestic businesses. They were greeted with warnings from SEC officials concerned about the risks, though regulators didn’t block any from listing. After that, issuers drew up plans to offer one-to-one exposure on less-accessible foreign companies.

Most of the overseas businesses that were being targeted don’t have depository receipts trading on American exchanges, so they aren’t required to meet the same financial reporting standards as a US-listed company.

Read more: Wall Street Rush Into Single-Stock ETFs Takes Risky Foreign Turn

While the plans from Roundhill and Kelly stuck mainly to well-known large cap names such as Samsung Electronics Co. and Adidas AG, Tema went further by aiming to offer exposure to smaller cap companies in emerging markets including Zomato Ltd. and Bank Jago.

The firm also targeted some Chinese companies that already have depository receipts listed in the US, such as Alibaba Group Holding Ltd. and Baidu Inc. Those businesses currently face the prospect of being delisted if they don’t allow American regulators to fully review their audits.

Tema’s filing includes details of multiple other funds that look set to go ahead, including a luxury goods product and an ETF targeting companies in the asset management industry.

©2022 Bloomberg L.P.