Jun 1, 2023

Investors Are Dumping Value Funds to Shovel Money Into AI Bets

, Bloomberg News

(Bloomberg) -- Equity smart-beta exchange-traded funds in the US saw record outflows in the month of May, with outsized drops in value funds targeting cheap stocks.

Even as US-listed equity ETFs gained $12.5 billion in assets last month, so-called smart-beta ETFs — which generally target stocks according to a specific trait like growth or momentum — saw net outflows in May, per monthly data compiled by Bloomberg Intelligence since 2016. Much of the dip came from a decline in assets in value funds, which saw outflows nearing $6 billion.

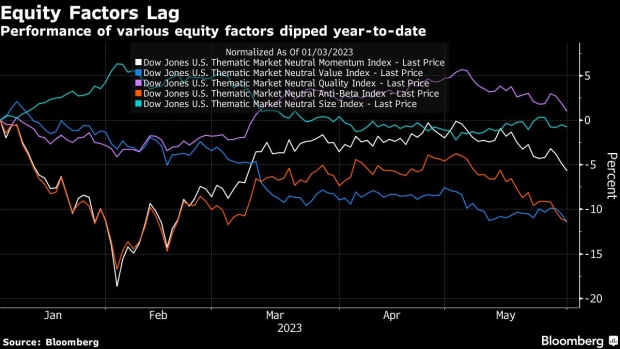

Year-to-date, value ETFs have floundered in a market led by a handful of pricey megacap tech companies. The Dow Jones U.S. Thematic Market Neutral Value Index dropped some 11% through Wednesday’s close, more than any of the other indexes tracking some of the most popular factors: momentum, quality, size, and low volatility.

Value funds tend to favor financials and energy companies but have low exposure to tech — meaning they have missed out on the artificial intelligence craze that’s driven the S&P 500 Index higher this year.

“It’s a bunch of FOMO and crowd in to what’s working,” said Larry Berman, chief investment officer at ETF Capital Management.

If the trend holds this month, equity smart-beta ETFs will see their first semi-annual outflows since 2009, with some $11 billion in outflows through the end of May. That’s following inflows of $138 billion last year and $173 billion in 2021.

In 2021, value ETFs boasted the largest inflows of any category of smart-beta funds tracked by BI. Even last year, the category saw some $21 billion in inflows, trailing more popular factor strategies targeting high-dividend yielding companies and growth. Investor interest in value was buoyed as the Dow Jones factor index surged 24% in 2022.

“Value as a factor tends to perform well in a rising rate environment,” said JPMorgan strategist Peng Cheng.

Rising rates might signal bullish economic conditions and the perception that value stocks offer lower duration risk, Cheng added. Now markets are expecting that the rising rate regime is nearing its end, he said.

So instead of cheap stocks, investors seem more keen to throw money at megacap tech names that have so far driven the S&P 500’s year-to-date gains. Wall Street has pumped cash into the likes of Meta Platforms Inc., Alphabet Inc., and Nvidia Corp., with many investors arguing they are defensive plays in a weakening economy.

Over the past month, much has been made of big tech’s outperformance, which Bloomberg Intelligence’s Athanasios Psarofagis said may have signaled to investors that it is time to pull money from value funds that have underperformed this year.

“It’s a factor that’s always disappointing,” he said. “You have these bouts of outperformance, but it seems like over the long term, it’s just disappointed people for a very long time.”

Read More: BlackRock’s $9 Billion Quant ETF Set to Lean in on Nvidia, Tech

While value saw the largest outflows in May, funds targeting low volatility, momentum and high-dividend yielding companies also posted net outflows, per BI data. Thus, smart beta’s poor performance is more than just a turn away from value funds.

“Longer-run, we think smart beta has become passe,” said Drew Pettit, director of ETF analysis and strategy at Citigroup. “Many thematic funds provide a growth angle when needed. And traditional sector and infrastructure funds were useful inflation protection pieces. Smart beta alone doesn’t sell. It has competition.”

©2023 Bloomberg L.P.