Jun 22, 2022

Inflation surges to 7.7% in Canada, fastest pace since 1983

, Bloomberg News

Inflation is a top national issue: Nanos Research

Consumer price inflation accelerated to a four-decade high, adding pressure on the Bank of Canada to deliver more aggressive interest rate hikes in coming weeks.

Annual inflation rose to 7.7 per cent last month, up from 6.8 per cent in April, Statistics Canada reported Wednesday in Ottawa. That’s the highest since January 1983 and well above economist expectations for a 7.3 per cent increase. The inflation gauge rose 1.4 per cent from a month earlier with gasoline, hotel rates and cars among the largest contributors to the gains in May.

The average of core measures -- often seen as a better indicator of underlying price pressures -- rose to 4.73 per cent, a record in data back to 1990.

Benchmark Canadian two-year yields dropped as low as 3.260 per cent amid a global rally in government bonds. The Canadian dollar pared losses to trade at $1.2940 per U.S. dollar as of 11:25 a.m.

Wednesday’s report illustrates the urgency for Governor Tiff Macklem to quickly withdraw stimulus from an overheating economy amid concern price pressures are becoming entrenched in the economy.

The numbers show an acceleration of price pressures, coupled with a broadening of inflation into other goods and services -- a trend that is narrowing the central bank’s ability to maneuver the economy into a soft landing.

Markets are now fully pricing in a 75-basis-point rate hike by the Bank of Canada next month, which would bring its policy rate to 2.25 per cent. That rate is expected to reach as high as 3.5 per cent by the end of this year. Prime lending rates offered by commercial banks are typically a little more than 2 percentage points above the policy rate.

“There was no rest for those of us growing weary of escalating inflationary pressures in May,” Andrew Grantham, an economist at Canadian Imperial Bank of Commerce, said in a report to investors. “The higher than expected inflation figure will have markets pricing an even greater probability of a 75bp hike in July.”

Asked about the possibility of a super-sized move, Senior Deputy Governor Carolyn Rogers reiterated the central bank needs to continue raising borrowing costs.

“We’ve been clear all along the economy is in excess demand, inflation is too high, rates need to go up,” Rogers said Wednesday at a conference in Toronto organized by the Globe and Mail newspaper. “We’ll get it there.”

POLITICAL FALLOUT

Prime Minister Justin Trudeau’s government has also been under pressure from opposition parties and economists to do more to stem inflationary pressures and help households offset the cost of living, though his administration has been wary of taking any new measures.

Like other countries, Canadian households are being hit by record gasoline prices, paired with surging food costs.

After a small reprieve in April, gasoline prices shot up again in May, rising 12 per cent during the month and gaining 48 per cent from a year earlier. Food costs rose a smaller 0.8 per cent last month, but are up 8.8 per cent from a year earlier.

The 7.7 per cent annual reading may not even represent the peak, given that gasoline prices have picked up further in June.

There are also more signs that imported inflation is spilling over into domestic price gains, with the cost of services rising 5.2 per cent from a year earlier, the fastest pace since 1991.

What Bloomberg Economics Says...

“Food and energy prices factored heavily in the surprise, but the full range of core measures also accelerated -- leaving little in the way of nuance that might argue against stepping up the pace of hikes next month.”

--Andrew Husby, economist

Excluding food and energy costs, inflation was also up 5.2 per cent -- a three-decade high.

The cost of living is increasing at twice average wage gains in the country, adding a major headwind to the economy.

Wednesday’s report includes updated basket weights, as well as the inclusion of used car prices for the first time. The statistics agency said the changes didn’t have an impact the consumer price index for May.

The inflation surge has made the Bank of Canada a target of criticism, with some politicians accusing Macklem of moving too slowly.

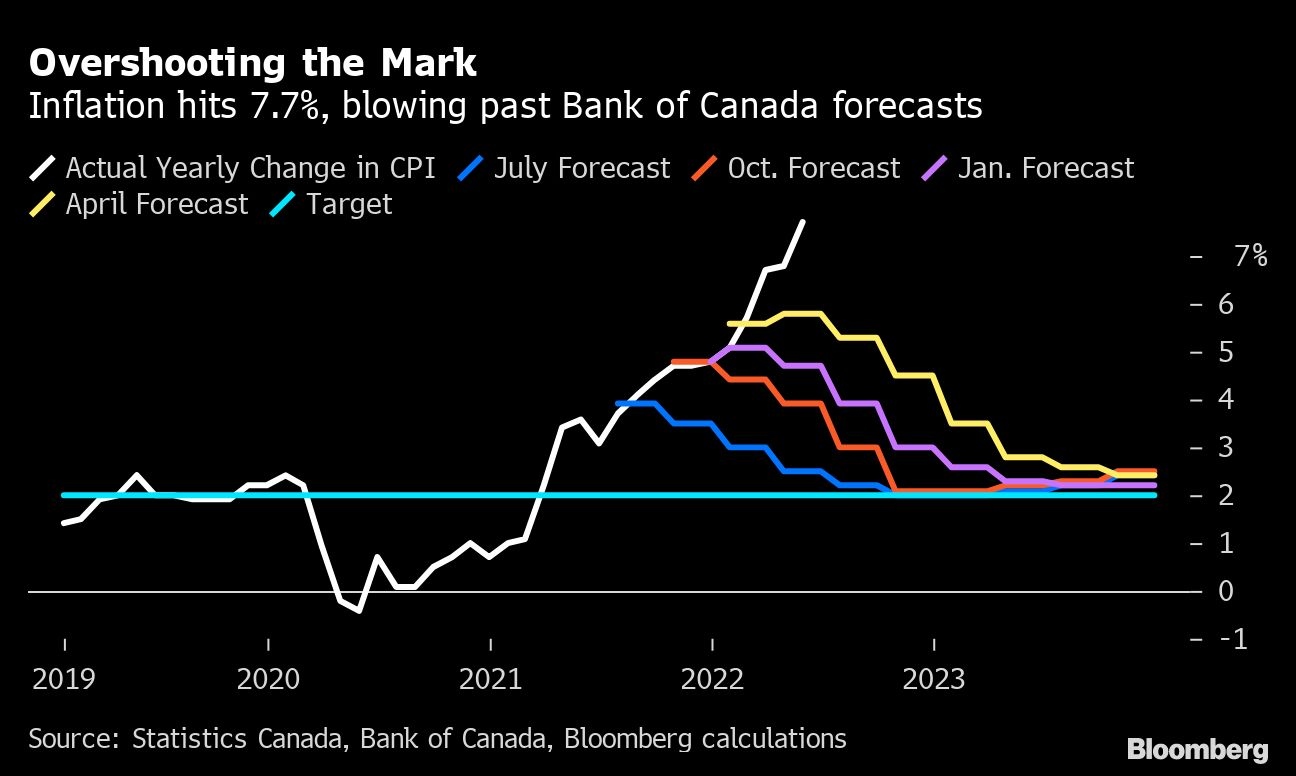

The central bank has consistently failed to anticipate the growing inflationary pressures, putting it well behind the curve on interest rates. In its last quarterly forecast in April, the central bank predicted inflation would average 5.7 per cent in the first half of 2022.