Feb 16, 2022

Inflation is now running hot in 80% of Canada's price categories

, Bloomberg News

Inflation hits 31-year high

Consumer price pressures aren’t just accelerating, they’re broadening -- and that could spell trouble for the Bank of Canada.

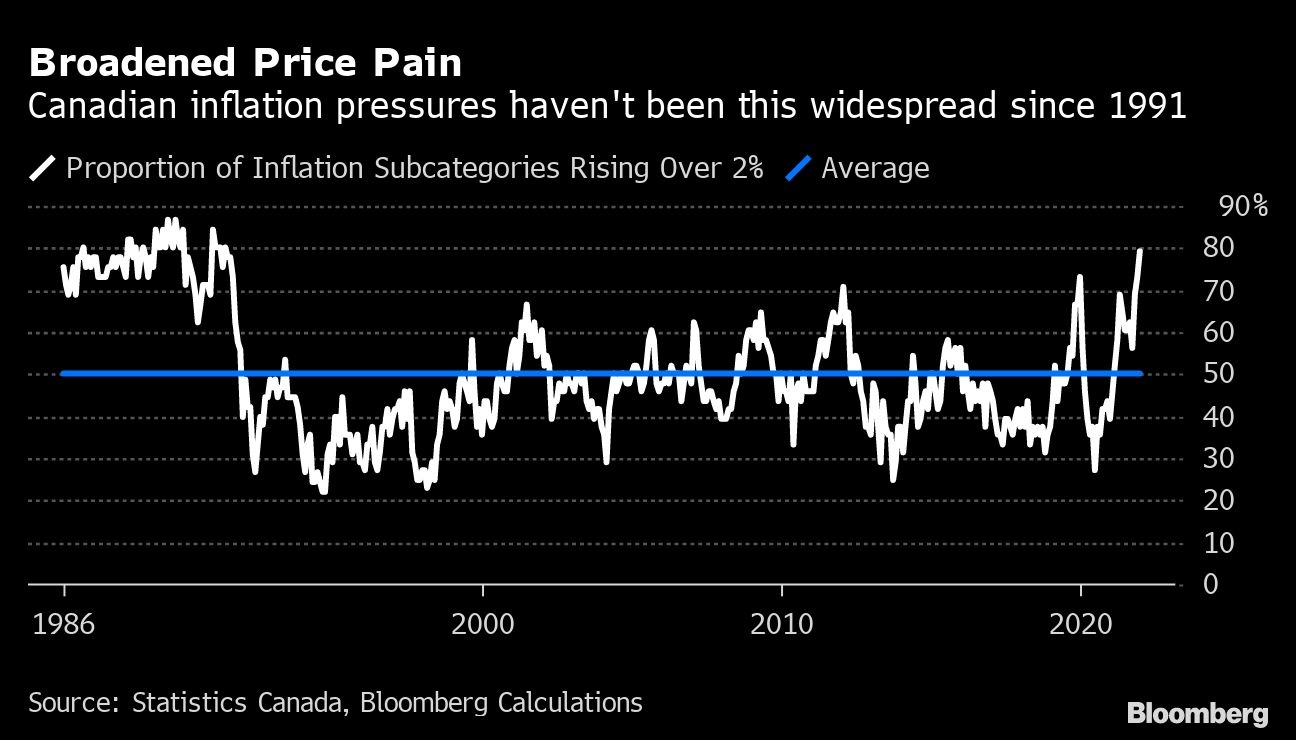

It’s getting difficult to argue the acceleration of inflation to three-decade highs is transitory or being imported from abroad. Nearly 80 per cent of the 48 subcategories in Canada’s consumer price index are now rising by more than 2 per cent, according to Bloomberg calculations on data released Wednesday by the national statistics agency.

That’s the highest proportion since 1991, far exceeding the 50 per cent average. Around two-thirds of prices are rising more than 3 per cent, the upper end of the Bank of Canada’s targeting band.

The broader the price pressures the more likely it could drive up inflationary expectations -- making it more difficult for the central bank to return to target, according to according Desjardins Securities Inc.

“This is no longer just a supply-chain issue,” Royce Mendes, head of macro strategy at Desjardins, said by email.