Mar 30, 2023

IMF Says BOJ Should Avoid Premature Exit from Monetary Easing

, Bloomberg News

(Bloomberg) -- The International Monetary Fund said the Bank of Japan should avoid a premature exit from monetary easing and outline conditions for raising its negative interest rate in order to improve its communication.

“Any changes to monetary policy settings will need to be well communicated to facilitate smoother transitions and protect financial stability,” the fund said Friday at the conclusion of its latest Article IV consultation report on Japan. Abrupt policy framework change would impose risks on the economy, it said, as the central bank headed for its first governorship change in a decade.

Following the report’s release, the IMF mission chief to Japan Ranil Salgado clarified that the IMF isn’t recommending any telegraphing in advance for a shift in yield curve control, as that could lead to a buildup in speculative pressures.

“We are focused more on communication related to the policy rate, the short term rate and explaining conditions under which the short term rate could be moved,” Salgado said during an online press conference. “That’s basically providing forward guidance on the short term rate to ensure that it will not be changed until the BOJ is very confident that the policy target will be sustained at 2% or higher over the medium term.”

Enhancing communication with financial markets is one of the key tasks Kazuo Ueda will likely have to tackle once he succeeds Haruhiko Kuroda as governor on April 9. One challenge is that any indication of a shift in the yield curve control program could trigger a massive bond selloff, leaving some economists predicting that an end to YCC could come very abruptly.

Ueda has said it’s appropriate to keep up massive monetary easing for the time being, while a majority of BOJ watchers expect its main policy settings to be tightened by June.

About 70% of economists said they see problems in BOJ’s policy communications following a surprise YCC tweak in December that shocked global financial markets. The BOJ currently says it expects short- and long-term rates to remain at their present or lower levels without linking it to any economic conditions or calendar date.

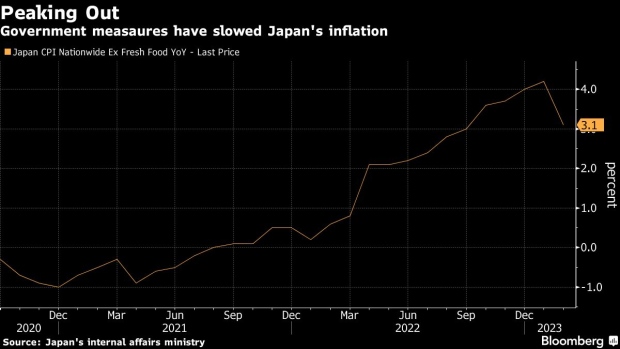

The IMF said it expected inflation to peak in the first quarter of this year and fall below the BOJ’s 2% target by the end of 2024, largely in line with the BOJ’s outlook. Continued monetary easing was needed to keep inflation anchored above the goal, it said, adding that a recent rise in workers’ salaries was probably not enough.

“Amid a tighter labor market, base wage growth is expected to accelerate in 2023, but will likely stay below the level that the BOJ considers consistent with achieving the 2% inflation target in a sustainable manner,” the IMF said.

Still, the IMF said inflation risks are tilted to the upside in the short term and reiterated its January advice that the BOJ consider boosting flexibility in long-term yields to address the side effects of prolonged easing. Options include raising its 10-year yield target, widening the yield trading band, switching back to a quantity goal for bond buying and aiming at a shorter-maturity yield, the fund said.

--With assistance from Erica Yokoyama.

(Updates with comments from IMF mission chief to Japan)

©2023 Bloomberg L.P.