Mar 30, 2023

HSBC’s Quinn Pressured Staff to Give Friend a Loan, Lawyers Say

, Bloomberg News

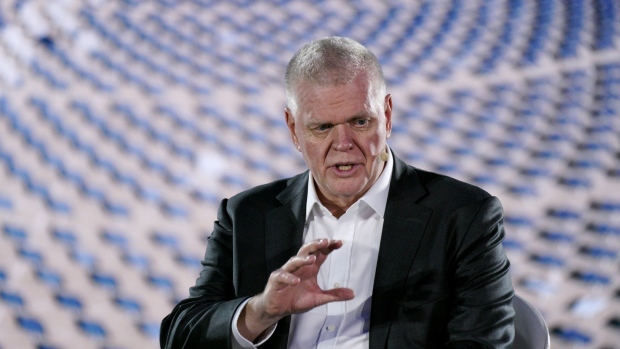

(Bloomberg) -- HSBC Holding Plc’s chief executive officer Noel Quinn and other senior managers were accused in a London lawsuit of pressuring the bank’s staff to loan millions of pounds to a friend’s real estate firm, where Quinn’s daughter worked.

After Quinn and a senior manager intervened, HSBC gave Mar City Plc a £40 million ($49.3 million) credit facility and handed the couple behind the firm a £10 million personal loan to be channeled into the then AIM-listed company that faced a liquidity crunch in late 2014, lawyers for Tony and Maggie Ryan said in court filings.

The Ryans are seeking damages from HSBC for allegedly using the loans to effectively take control of the company and drive it into insolvency, lawyers for the couple said in the documents prepared for a High Court hearing this week. Quinn is accused of inducing his “long standing” friends to take the loan.

HSBC denies all the allegations. The accusations by the couple “are selective, inaccurate and incomplete,” the bank’s lawyers said. The inaccuracies in their “evidence are too numerous for HSBC to address each and every one.”

The Ryans don’t have any explanation on how the company could have been saved or how HSBC prioritized its own interest over Mar City’s, the lender’s lawyers said during the hearing on Wednesday. They offer “no explanations as to which assets of MCPLC were supposedly stripped,” Bridget Lucas, HSBC’s lawyer, said.

Quinn, who was head of Asia Pacific commercial banking at the time, denies telling Ryan that the loan management unit at the bank was “like the wild west,” the lender said in their court filing. A spokesperson for HSBC declined to comment further.

Ultimately, the homebuilder suffered financial difficulties and entered administration in 2016.

It’s the second attempt at winning the claim that was earlier shot down by a London judge. The Ryans won a rehearing after an appeals court said a previous judge should have withdrawn from overseeing the the case because a loan from HSBC to a hot yoga studio owned by Judge Nigel Gerald and his wife raised the “perception of possible bias.” There was no finding of actual prejudice.

The Ryans lost a ruling in June 2022 when Gerald viewed their allegations as having “no evidence” and an attempt to “blacken” the name of HSBC, according to the judgment.

HSBC asserts it repeatedly tried to help Mar City restructure, the ruling said.

--With assistance from Harry Wilson.

©2023 Bloomberg L.P.