Sep 3, 2021

How to pay for that massive tuition bill during the pandemic

, BNN Bloomberg

Rachel Morency entered her first job interview after applying to almost a dozen without getting any response.

She answered virus-screening questions, had her temperature taken and then stood six-feet-apart from a computer screen showing her interviewer, who had to stay home because they were exposed to COVID-19.

“I mean it’s hard finding a job to pay for school during COVID. Everything is different, you’re putting yourself at risk by just going in and then you don’t even hear back from them, you don’t get that ‘I’m sorry we won’t be going any further,’” the 23-year-old said.

“I had to work last year during COVID to save for my masters which was scary, but now it’s hard because you have to juggle school with finding a job and that work-life balance.”

While completing her masters of science in clinical mental health counselling at Lynn University, Morency left Toronto during the pandemic to move in with her parents in their new home in Boca Raton, Fla.

“It’s different during the pandemic and it’s harder to find a job. I’m just ecstatic I could get this one physical interview after all the posts I applied to,” she said.

Morency’s not the only one who has been struggling to pay for post-secondary tuition during the COVID-19 pandemic.

“If you go back as far as 2019 a lot of students were still able to get jobs one way or another and it’s more difficult now,” Barry Choi, personal finance expert and author of Money We Have, said in an interview.

“Even in 2020 there was still programs like the Canada Emergency Student Benefit (CESB) and most of those options have run out now so it’s a lot trickier.”

A survey conducted by the Angus Reid Institute on behalf of Credit Counselling Canada found that 46 per cent of parents said their child is feeling additional financial pressure due to the lack of job opportunities coming into the 2021 fall semester.

On top of that, around one-out-of-four parents said their child has taken on more debt to pay for their upcoming school year.

BNN BLOOMBERG POLL: Are you concerned about paying for your or your child’s post-secondary tuition this year?

— BNN Bloomberg (@BNNBloomberg) September 2, 2021

The average tuition cost per year at a Canadian university is around $6,580 for an undergraduate degree and $7,304 for a graduate program, according to Statistics Canada.

To help pay off the massive tuition price tag this semester, some personal finance experts say it’s all about looking for every opportunity where you might be able to save some money.

“Apply for scholarships, grants (a lot of this free money goes unclaimed) and government assistance,” Melissa Leong, author of Happy Go Money, said in an interview.

“Then contact your financial institution to see if you can talk to an advisor about your situation and inquire about any bank relief programs.”

Another method Leong suggested to help pay for tuition is finding side hustles that work around your schedule.

“The e-commerce and gig economy have opened up many different options for people, there are websites like UpWork and Fiverr that allow you to make even the smallest amounts of money for skills that you might not even appreciate that you have,” Leong said.

“This younger generation is tech-savvy, they’re extremely well-versed with digital content creation and there are a lot businesses that have launched during the pandemic who are looking for skills that young people have.”

But even if you’re able to scrap by with tuition costs for the fall semester, students will still have to find thousands of dollars to pay for their winter session just four months later.

A good financial habit many personal finance experts recommend picking up is creating a budget that will help make sure you have enough money for following semesters.

Robyn K. Thompson, president of Castlemark Wealth Management Inc., said budgeting can sometimes come with a bad reputation but it’s important to get a handle on what funds you have and what expenses you need to pay.

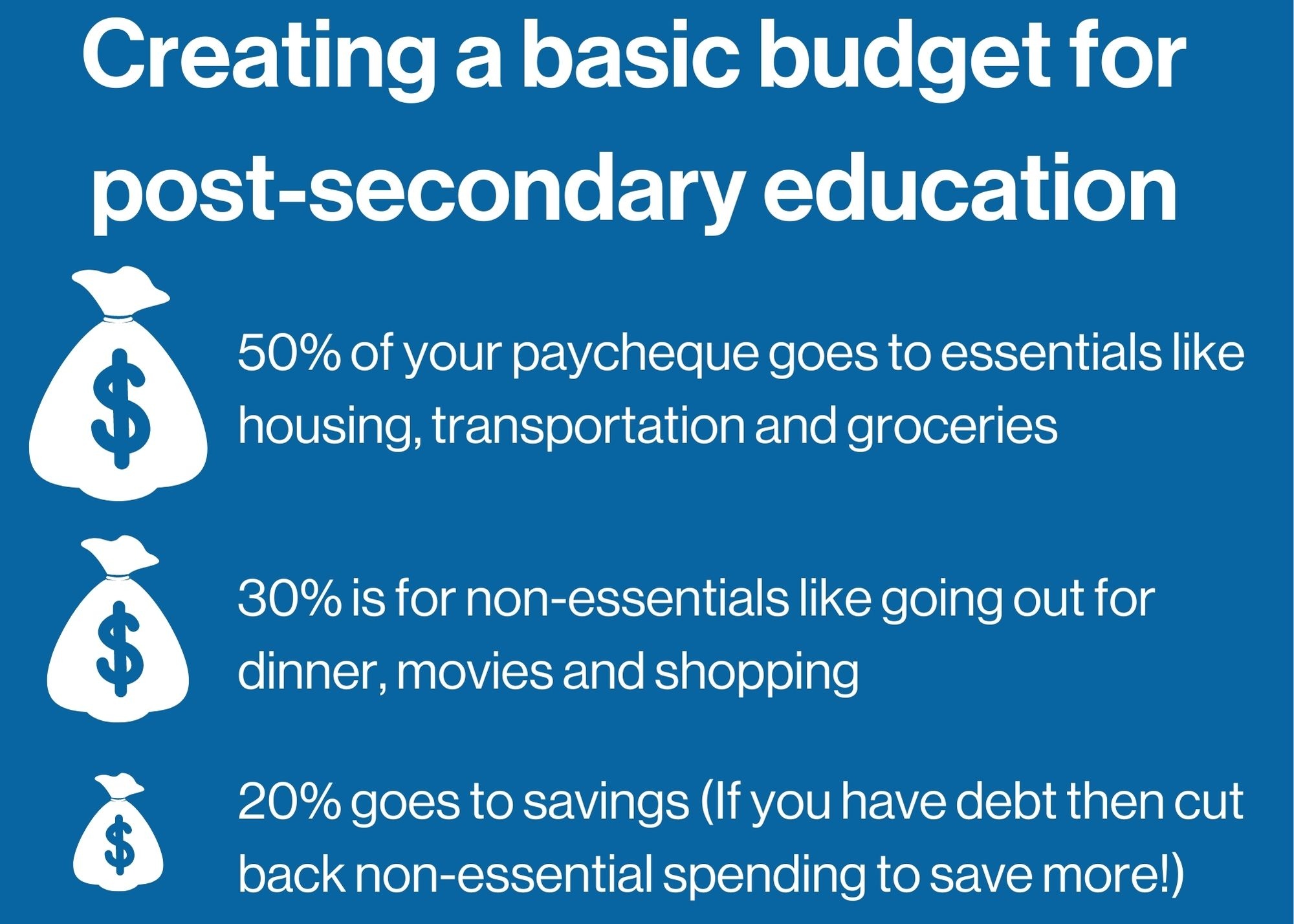

“I recommend the 50/30/20 split when it comes to allocating money for your budget,” Thompson said in an email.

“Spend 50 per cent of your budget for essentials like housing, groceries and food, 30 per cent for non-essential or discretionary spending and at a minimum 20 per cent for savings. If you are carrying debt you should look to allocate more from the discretionary side and pay down that debt.”

Despite budgeting and applying for every grant, loan and bursary in sight, some university and college students still might not be able to afford the hefty lump sum.

Jessica Moorhouse, financial counsellor and personal finance blogger for JessicaMoorhouse.com, said from her own experience, sometimes you just need to accept that you can’t take a full course load.

“There were definitely times where I couldn’t get too many loans because my parents earned too much but they didn’t pay for my school and I was working as much as I could but still couldn’t pay for it so I had to cut my course load,” Moorhouse said.

“Take a look at the bill you got when you registered for courses, if it is totally out of reach even if you were to borrow as much as you can, that might mean that you have to look at a part-time student, part-time worker situation.”

Moorhouse explained students need to take a step back and remember that it’s OK to switch programs, take a break from school or even finish post-secondary education a few years later than you expected.

“It might just be about adjusting your timeline and not thinking that you’re a failure because you won’t do it in four years. In the grand scheme of things when you’re working in your 30s it won’t matter if you took an extra year or even two to finish your degree.”