The pandemic-driven surge in residential real estate demand has sent Canadian housing affordability spiraling to its worst level in more than three decades, according to a new report from RBC Economics.

According to RBC, aggregate home ownership costs as a percentage of median household income rose 0.9 percentage points in the first quarter of this year to hit 52 per cent, the highest level since 1990. Affordability in the single-family home segment was even more dire, hitting 56.8 per cent in the quarter.

In a report published Tuesday, RBC Senior Economist Robert Hogue said that the “housing mania” was unlikely to subside any time soon.

“Tight demand-supply conditions maintain intense upward pressure on home prices. This is poised to raise the ownership bar higher-still for buyers in most markets, including smaller cities and rural areas that have attracted a lot of interest during the pandemic,” Hogue said.

“In big cities, the affordability of condo apartments—the more viable option for many buyers—will likely erode as prices have recently begun to firm up.”

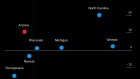

RBC noted that the erosion in housing affordability was broad-based, with only the prairies and parts of Atlantic Canada remaining affordable to the average worker.

While there has long been some degree of heat in Canada’s major population centres – average home prices in Toronto and Vancouver are sitting well above $1 million – the heat has spread outward into bedroom communities as remote work allowed Canadians to move further afield.

That’s triggered double-digit price increases in communities in the Fraser Valley outside Vancouver and in the likes of Toronto suburbs such as Brampton and Pickering.

Hogue said that migration to the suburbs has triggered bidding wars, further eroding affordability.

“Bidding wars—a phenomenon previously confined to the most expensive markets—spread to many regions, resulting in steep price escalations,” he said. “The attendant rise in ownership costs far exceeded buyers’ income gains in the first quarter of 2021.”