Jun 9, 2023

Hedge Funds Pile Into Bullish Oil Wagers Amid Saudi’s Surprise Oil Cut

, Bloomberg News

(Bloomberg) -- Saudi Arabia’s surprise move to cut 1 million barrels a day of its own output has emboldened markets bulls, while the kingdom’s ominous warning on short-selling seems to have sent some bears into hiding.

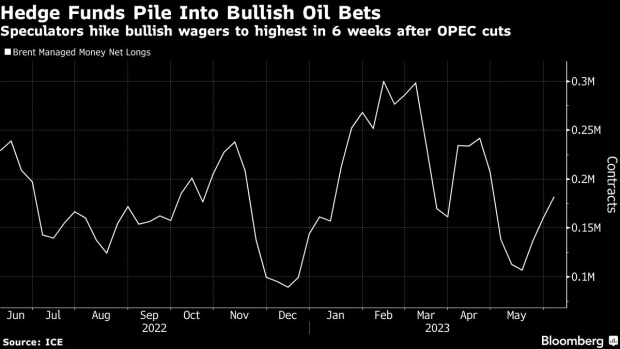

Hedge funds boosted bullish bets on Brent and WTI crude in the week ended June 6, with long positions on the global benchmark reaching a six-week high. At the same time, money managers unwound bearish bets. The shift comes as Saudi Arabia pledged to cut output to “stabilize” the market, shorthand for halting a price slump. Prior to that, Saudi Energy Minister Prince Abdulaziz bin Salman warned that speculators betting on falling prices better “watch out.”

In the lead up to last weekend’s OPEC+ meeting, non-commercial players such as hedge funds had amassed the most bearish stance in over a decade across major oil contracts such as crude, diesel and gasoline. Despite the output cuts, oil prices have failed to rally as investors remain focused on the global economic outlook.

--With assistance from Julia Fanzeres.

(Adds CFTC data on US crude positioning)

©2023 Bloomberg L.P.