Jun 16, 2022

Freeland leans on existing programs to combat inflation

, Bloomberg News

Missed opportunity to provide relief to struggling small businesses: Advocacy group CFIB

Canada’s finance minister warned of a difficult exit from the pandemic as soaring prices and rising rates squeeze consumers, but said the government is doing all it can to ease the burden on families.

“I do not underestimate the economic difficulties and uncertainty of the months to come,” Finance Minister Chrystia Freeland said Thursday in prepared remarks to the Empire Club of Canada in Toronto.

Her speech, which contained no new measures, lays out a five-part plan to tackle inflation, with annual price gains on track to exceed 7 per cent when May data is released next week. She said the challenge is global, singling out China’s strict COVID-19 lockdowns and Russia’s invasion of Ukraine as exacerbating factors.

“We have been through two years of remarkable turbulence,” she said. “Our challenge now is to land the plane. A soft landing is not guaranteed. But, fortunately for us, there is no country in the world better placed than Canada to achieve one.”

The finance minister prioritized the central bank’s role in bringing prices to heel, with officials embarking on an aggressive series of interest rate hikes. She also stressed the need for politicians to avoid “undermining Canada’s fundamental institutions” -- an implicit rebuke of Pierre Poilievre, the front-runner to lead the main opposition Conservative Party who has vowed to fire the Bank of Canada’s governor.

SUPPLY SIDE

Inflation “is a global phenomenon -- one driven by factors that no single country is responsible for, and that no single country can insulate itself from,” Freeland said. But she argued Prime Minister Justin Trudeau’s government has a role to play in delivering policy to “make it easier by tackling the supply constraints which are driving the rise in prices.”

It’s doing so in four ways, she said: investing in skills training, keeping spending in check, creating jobs and targeting aid at lower-income households.

Freeland highlighted programs including an increase to old-age benefits, a one-time $500 (US$387) payment to people struggling with housing costs, and the government’s marquee child-care program that will cut fees by as much as 50 per cent for most families by the end of the year.

She also pointed to her government’s move to index many benefits to inflation, including the Canada Pension Plan and old age security payments.

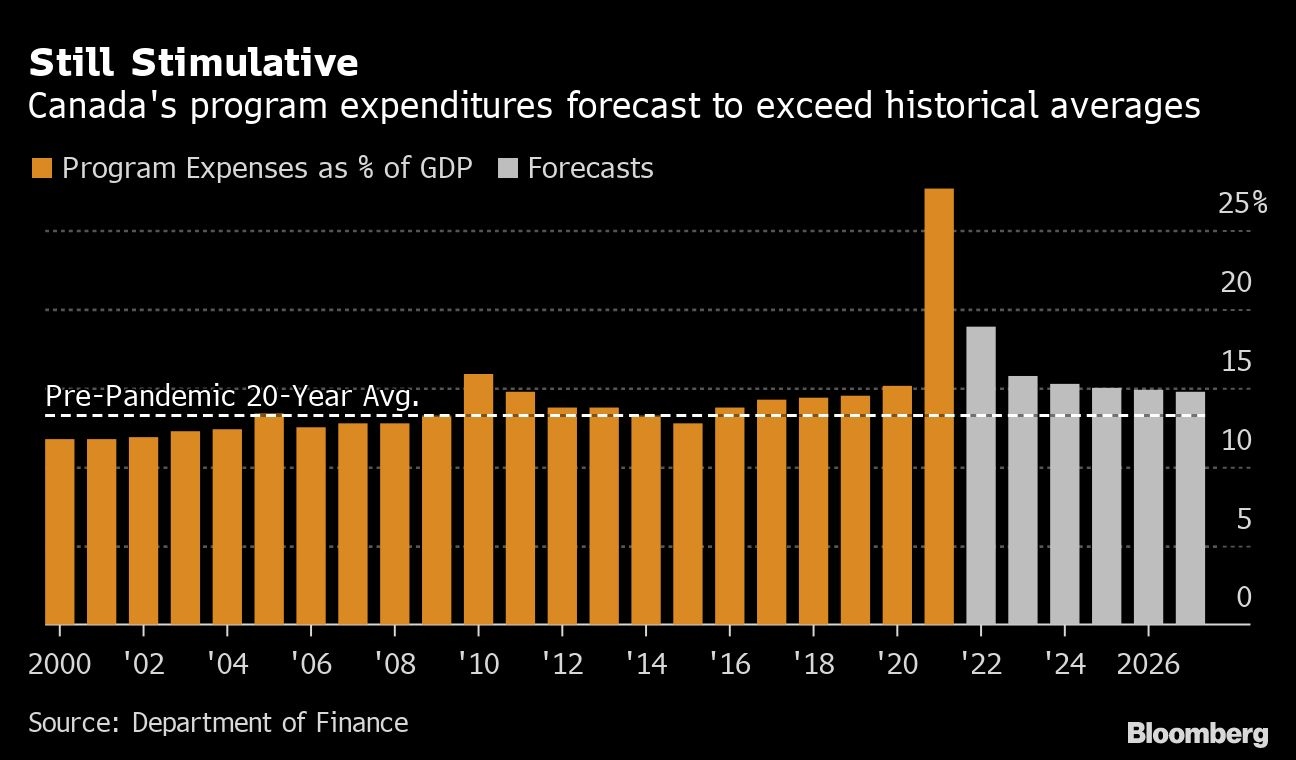

Canada’s fiscal response during the pandemic shot program spending up to almost 30 per cent of gross domestic product. While the government resisted adding new expenditures in its April budget, Freeland’s department forecast expenses that remain elevated near 16 per cent over the next year, higher than the 13 per cent average in the two decades prior to the pandemic.

Freeland emphasized that programs meant to ease the inflationary burden have already been budgeted and said the government is focused on fiscal restraint. “I am determined to see our debt-to-GDP ratio continue to decline and our deficits continue to be reduced. Our pandemic debt must -- and will -- be paid down.”

Speaking to a room filled with Toronto’s business class, Freeland made reference to the fact many economists had projected much higher spending in the budget.

“I know that my fiscal prudence surprised many in this room,” she said. “Yes, I do read your predictions. This fiscal restraint was very intentional. At a time when inflation was elevated, we knew we needed to be careful not to increase aggregate demand.”

'ACHILLES HEEL'

Freeland also delivered an implicit response to criticism from her predecessor, Bill Morneau, who told a similar audience two weeks ago that Trudeau’s government isn’t sufficiently focused on long-term growth challenges.

“We are serious about tackling the productivity challenge that is Canada’s Achilles heel,” she said, acknowledging “a lot of skepticism about whether we can get it done.”

To quell those concerns, she cited her government’s success in getting other big things done including imposing a national carbon tax, fostering a thriving technology sector and getting provincial buy-in for the daycare plan.

Freeland also said that, like other industrialized economies, Canada faces a labor shortage. She hailed the government’s commitment to increasing immigration levels as one potential remedy.

Some economists, however, have called for policy makers and businesses to retain older workers who are on the cusp of leaving the workforce and to attract those that have already left.

Increasing the participation rate of workers in their 50s and 60s would quickly ease a glut of job vacancies that’s grown to 1 million, according to a report Wednesday by Bank of Nova Scotia Chief Economist Jean-Francois Perrault and Robert Asselin, senior vice president at the Business Council of Canada.

Asselin, who was director of policy under Morneau at the finance ministry, offered a tepid assessment of Freeland’s speech.

“There is not much to see here other than political rhetoric, frankly. The reality is that the federal government fiscal policy is still expansionary,” he said by email. “This is all on the central bank now: They will be the ones in charge of cleaning up this inflation mess.”