Mar 20, 2023

Freeland defends banks, promises prudent spending

, Bloomberg News

Freeland has tough decisions to make with big spending needs in 2023 budget: Former finance minister

Finance Minister Chrystia Freeland said Canada’s banks remain on solid ground despite global turmoil in the financial sector, and pledged to “exercise fiscal restraint” when she delivers the federal budget next week.

Freeland said the spending plan due Mar. 28 will include “significant” investments in health care and green technology incentives. It will also contain “narrowly focused” affordability measures to help Canadians deal with soaring consumer prices, which are increasing at an annual rate of 5.9 per cent.

Overall, she promised “a responsible fiscal plan” that won’t impede the Bank of Canada’s mission to bring inflation back to its 2 per cent target.

“What Canadians want right now is for inflation to come down and for interest rates to fall,” Freeland told unionized electrical workers the Toronto suburb of Oshawa. “That is one of our primary goals in this year’s budget: to not pour fuel on the fire of inflation.”

She conceded, however, that Prime Minister Justin Trudeau’s government is laying out its spending priorities at “a turbulent time in the world economy.” The collapse of Silicon Valley Bank and distress at other U.S. regional lenders this month has roiled financial markets, along with this weekend’s government-brokered takeover of European giant Credit Suisse Group AG.

But Canada has “a financial system that has proven its strength time and again,” Freeland said, in her first public appearance since the crisis began.

“Our financial institutions have the capital they need to weather periods of turbulence,” she said. “A hallmark of Canadian banks is prudent risk management — and this is also a core principle for those of us who regulate the financial system.”

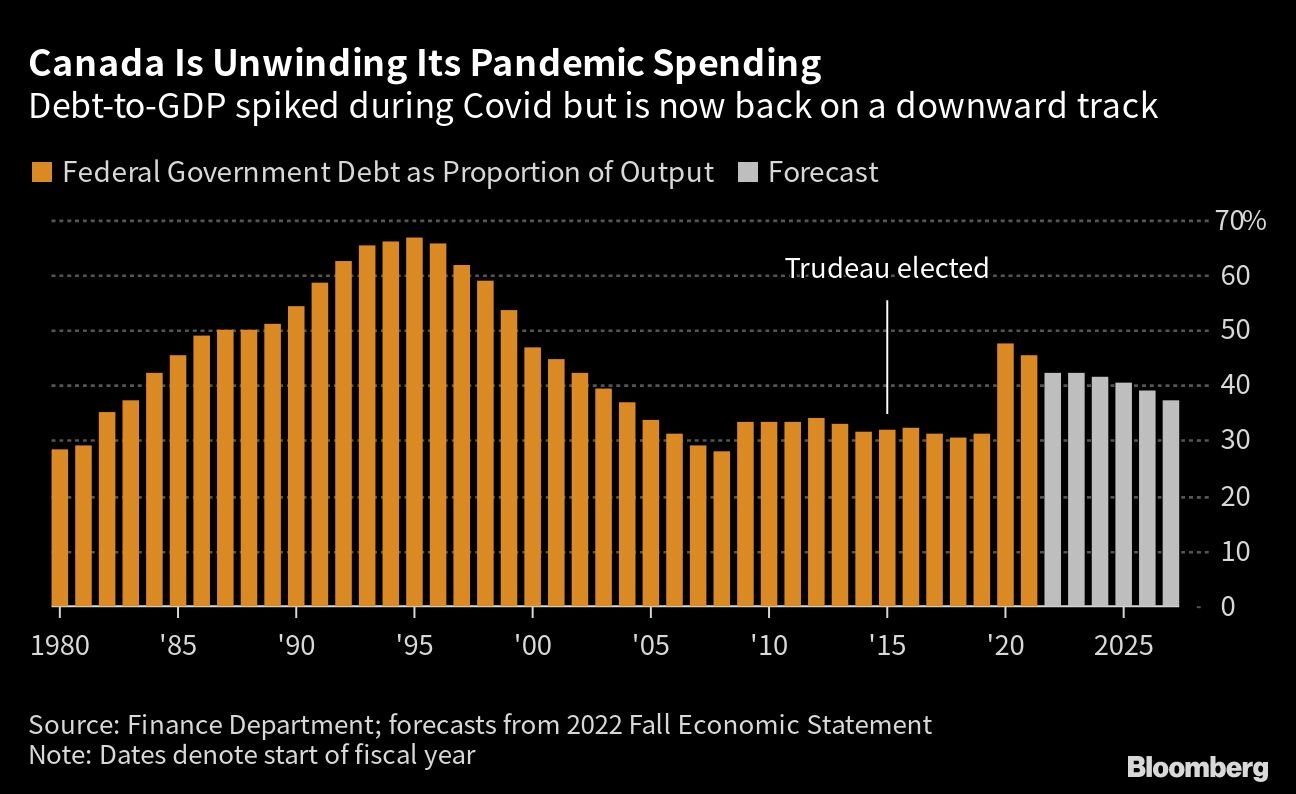

The government’s last budget update painted a picture of surging revenues but significant uncertainty over the economic outlook due to a pending slowdown and perhaps even a recession in 2023.

For the fiscal year that began April 1, the projected deficit was revised down to $36.4 billion (US$26.6 billion) from the $52.8 billion shortfall forecast in the previous budget. The November update also projected the shortfall would be eliminated by 2027, though many observers deemed that unrealistically optimistic given the expected downturn.

Since then, the inflation and interest rate environment has worsened but Canada’s economy has proven resilient, helped by a surprisingly strong labor market.

That means the overall fiscal picture is “fairly similar” to where it was in the fall, according to Rebekah Young, an economist at Bank of Nova Scotia. But the turmoil in the financial sector means there is “less conviction around the outlook,” and the downside risks are likely higher now.

The government is also facing a much tougher economic environment that will make it harder to spend, Young said by phone from Toronto. “Heading into this budget, they don’t have these big fiscal windfalls that are going to enable really big spending packages without materially changing the bottom line.”

Much of the health-care spending was outlined last month, with Trudeau pledging $46.2 billion in new funding over the next decade — a sizable figure, but much less than what provincial leaders had been calling for.

On green incentives, Freeland said Canada must keep up with allies — chiefly the U.S. — that are “investing heavily to build clean economies and the net-zero industries of tomorrow.”

The finance minister called the situation “the most significant economic transformation since the Industrial Revolution.” But she gave no details on what that spending would look like, aside from highlighting clean energy, electric-vehicle manufacturing and critical minerals as areas of priority.