Jun 22, 2022

Forgotten ETFs That Hedge Currency Risk Are Making a Comeback

, Bloomberg News

(Bloomberg) -- The wild swings racing through foreign-currency markets are turning an obscure group of exchange-traded funds into a bulwark against the full brunt of the stock losses piling up worldwide.

The currency-hedged ETFs sat relatively unnoticed in recent months, seeing little cash flow in to those run by the likes of BlackRock Inc., even as the widening gap between interest rates worldwide has touched off one of the biggest surges in foreign-exchange rate volatility of recent decades.

Yet the unpredictable moves are delivering a run of outsize performance to funds that use hedging strategies to guard against currency swings, a type of ETF that proliferated last decade only to see interest fade during the period of relative calm that followed. The tactic has softened the blow of the dollar’s rise, which is cutting the value of investments overseas.

Nearly every currency-hedged ETF has outperformed its unhedged counterparts as the dollar climbed about 10% over the past year, according to data compiled by Bloomberg Intelligence. Yet the flows into the funds have been mere ripples, drawing about $150 million this year compared with the roughly $44 billion that’s flowed into international stock funds overall.

Among the hedged funds is BlackRock’s iShares Currency Hedged MSCI Japan ETF (ticker HEWJ), which has lost about 7% this year and seen about $183 million in outflows. By comparison, investors have withdrawn just $44 million from its unhedged counterpart, even though it has lost three times as much while the yen tumbled to the weakest against the US dollar since 1998.

“A lot of people were thinking the dollar was going to weaken,” said Jeremy Schwartz, global chief investment officer at WisdomTree Asset Management, the first issuer to launch currency hedged ETFs. “Because of how strong our interest rate move has been, it just caught people on the wrong side of the trade.”

The divergent returns between the ETFs reflects the volatility in foreign exchange markets this year as central banks pull back on the flood of stimulus pumped into the financial system during the depths of the pandemic.

With the Fed moving more aggressively than its counterparts in the UK, the European Union and Japan, an index of the dollar’s strength has gained more than 7% this year, the most since 2015, even after pulling back from its highs last week. It has risen even more against the British pound and yen.

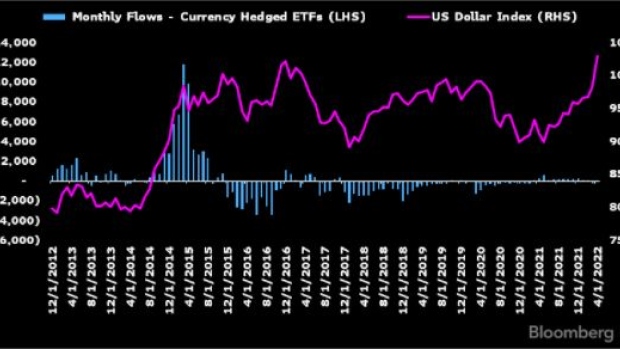

The movements are reminiscent of 2014, when the dollar rallied as the Fed began pulling back on its bond purchases and traders braced for interest rates to rise. At the time, issuers raced to launch new ETFs that would protect investors from the risk that the rising dollar would erase gains on overseas stocks. In the first six months of 2015, investors piled roughly $40 billion into US-based currency hedged equity ETFs, according to data compiled by Bloomberg Intelligence.

But the biggest inflows came after the dollar had already risen significantly, contributing to lackluster performance that dampened investors’ interest. After 2015, returns -- and flows -- stalled.

“As long as people view it as a trade and they did it and got burned, they’re probably just not going to come back,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence.

One other potential reason for the tepid demand: Currencies don’t always go in the same direction. Investors may be betting that foreign-exchange fluctuations will shift in their favor, or may calculate that currency oscillations tend to neutralize each other in the long run.

The lack of flows has lead issuers to put many strategies to rest, with over 47 currency-hedged ETFs shuttering over the past five years, according to Bloomberg Intelligence.

As the funds shutter, popularity wanes for the remaining funds, making them less attractive investment options, and potentially less liquid, explained Henry Ma, chief investment officer at Julex Capital Management. He invested in the iShares Currency Hedged MSCI EAFE ETF (ticker HEFA) in 2015, but exited the position shortly after. Now, he’s concerned about liquidity, but he also doesn’t have a strong view on the direction of the dollar any more.

“Normally when we pick an ETF we’re looking at liquidity, expense ratio, maybe the size of the ETF,” said Ma. “If there’s a really small size, there’s not much liquidity. We tend to ignore them.”

But one investor hoping to be on the right side of the trade is Spenser Lerner, head of the multi-asset solutions team at Harbor Capital. Last month, he added the WisdomTree’s hedged Japanese ETF (DXJ) to one of his firm’s model portfolios.

“Our view of a strengthening US dollar is favorable for Japanese equities,” he said. “And it’s most favorable for Japanese equities if they’re hedged.”

©2022 Bloomberg L.P.