Feb 4, 2023

FOMO is Gripping Credit Markets, Making Bond Premiums Vanish

, Bloomberg News

(Bloomberg) -- It’s been some time since companies could raise cash in debt markets and come away feeling like they got the better end of the deal.

For most of 2022, borrowing was a delicate game of dodging rate hikes and negative inflation data and showering bond investors with extra yield in order to ensure they bought your debt.

In 2023, many of those potential land mines remain. Markets in most corners of the world are still navigating rate hikes, even if smaller ones. The risk of a recession later this year is still very real. And inflation, though ebbing, remains a worry.

Yet in some corners of credit markets, companies are starting to see money being thrown around in ways that feel very similar to the easy-money days.

Case in point is Oracle Corp.’s bond offering this past week to refinance a bridge loan that it took out to buy the electronic medical records company Cerner Corp. Oracle initially looked to raise $4 billion. Then bond investors put in orders for a whopping $40 billion of the debt. Not only did the company end up boosting the size of the offering, it did so at what’s known in market parlance as a negative concession, Bloomberg’s Brian Smith wrote this week.

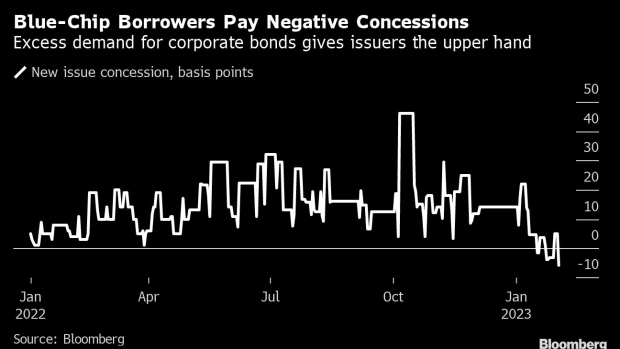

Normally, when companies issue debt, they sprinkle it with a few extra basis points on top of what you’d normally expect to pay. In 2022, those concessions averaged 13 basis points, per Smith. Oracle walked away with $5.2 billion at an average concession of -11 basis points, meaning investors were effectively giving up some of the yield they could have otherwise received by buying Oracle’s debt in the secondary market.

The software giant isn’t alone. Companies issued more than $18 billion of US dollar-denominated bonds this past week at an average concession of -1 basis point. That was on the back of orders that were five times the offering size, meaning that investors basically forfeited their new issue premiums in order to get a piece of the deal.

All of this points to the FOMO gripping markets now as fixed-income money managers, buoyed by signs that interest rates have peaked, rush to snap up yields that are starting to disappear again.

CLO Whale

Corporate bonds aren’t the only market where the big money is returning. In collateralized loan obligations, securities backed by risky buyout loans and other highly leveraged corporate debt, Japan’s Norinchukin Bank is planning to resume purchases, Bloomberg’s Carmen Arroyo and Lisa Lee wrote this past week. Nochu, as the bank is called, was once among the biggest buyers of CLOs globally. But it paused last year when UK pension funds dumped their holdings of the securities, roiling the market.

A representative for Nochu earlier declined to comment to Bloomberg when asked about its CLO plans.

CLOs were a hot market during the easy money era because, thanks to the magic of financial engineering, they can transform junk-rated loans into top-rated securities that pay more than the typical AAA bond.

Nochu, which has been in and out of the market over the past few years, is plotting its return just as issuance of CLOs bounces back from last year’s turmoil. Growing demand has helped US CLO issuance reach $10.5 billion so far this year, according to data compiled by Bloomberg, up from the $7.5 billion priced at this time in 2022.

Elsewhere:

- Chinese issuers’ high-yield dollar bonds continued their record winning streak as the nation’s beaten-down property sector rallies on supportive government policies and improving economic prospects. New-home sales continued to slump in January, though, underscoring the challenge the country faces in salvaging the real estate sector.

- Dalian Wanda Group Co., one of the few Chinese firms that have sold US dollar notes recently, is talking with state-controlled Industrial & Commercial Bank of China Ltd. for an offshore loan to pay off a $350 million dollar bond maturing next month, Bloomberg News reported.

- Yen corporate bond spreads reached a new high, diverging further from global credit and reflecting pressure on the Bank of Japan to normalize its ultra-easy monetary policy.

- Blackstone agreed to acquire American International Group’s $3.6 billion of CLO assets, a deal that would make the investing giant the largest manager of CLOs globally.

- Billionaire Patrick Drahi’s Altice France won some breathing room on its debt load by reaching a deal with creditors to extend maturities on about $6.13 billion of its loans.

- Carl Icahn’s Auto Plus chain filed for bankruptcy in Houston, blaming slowing demand for car parts and supply chain troubles.

--With assistance from Brian Smith, Charles Williams, Wei Zhou, Carmen Arroyo, Lisa Lee, Olivia Raimonde, Alice Huang and James Crombie.

©2023 Bloomberg L.P.