Apr 7, 2022

Feds to establish industry panel for legal cannabis sector

Canada's pot market expected to double to $8.8B by 2027: Brightfield report

Canada’s cannabis industry is finally getting an audience with Ottawa.

More than three years after Canada legalized cannabis, the government plans to form a strategic panel led by the Department of Innovation, Science and Economic Development aimed at engaging with industry participants and other stakeholders to help grow the country’s domestic legal marijuana industry.

The measures will likely be welcomed by industry executives and advocates who have complained about a lack of interest from Ottawa in fixing regulations that have weighed on Canada’s licensed cannabis producers, many of whom have struggled to make a profit.

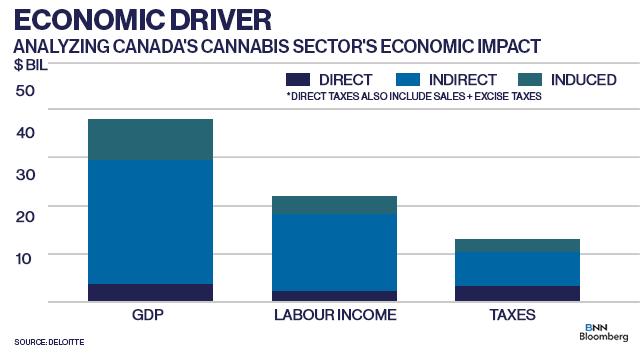

“Today's budget recognizes the scale and impact of Canada's cannabis sector,” said George Smitherman, chief executive officer of the Cannabis Council of Canada and a former Ontario health minister.

“The amendments to the cannabis excise duty framework are both technical and consequential for many license holders and the promised launch of a cannabis industry strategy table at ISED is a means for our sector to contribute more to the public health, social and economic goals for Canada.”

Health Canada is tasked with coordinated a mandated review of the Cannabis Act, the legislation that legalized recreational cannabis sales in Canada, but has yet to formally begin that process. Industry participants have stated their need to address several regulations in the legislation, namely potency levels on cannabis products such as edibles, excise tax amendments and clarifying inconsistent lab testing standards which would all help drive away illicit operators from selling to consumers. The review of the Cannabis Act is slated to be completed a year from now.

In addition to establishing the industry group, the Finance Ministry plans to amend several cannabis-related excise tax regulations that include allowing duty payments to be made on a quarterly basis, transferring excise stamps between licensed producers, and penalty provisions on lost excise stamps. Ottawa also plans to continue working with Indigenous groups to create a potential fuel, alcohol, cannabis, and tobacco sales tax framework for those communities.