Oct 6, 2022

Fed Officials Keep Hammering Hawkish Message on Rates Heading Up

, Bloomberg News

(Bloomberg) -- Federal Reserve officials kept up the drumbeat of support for extending their run of interest-rate hikes, stressing the need to quash inflation that’s proved unexpectedly stubborn.

Five officials, in separate remarks during the course of Thursday, delivered a resolutely hawkish message that inflation is too high and they won’t be deterred from raising rates by volatility in financial markets.

“The focus of monetary policy needs to be fighting inflation,” Governor Christopher Waller told an audience at the University of Kentucky in Lexington. “We have tools in place to address any financial stability concerns and should not be looking to monetary policy for this purpose.”

Fed officials are delivering the most aggressive tightening campaign since the 1980s to tackle inflation near four-decade highs. Starting near zero in March, they’ve increased their benchmark rate to a target range of 3% to 3.25%, including with back-to-back 75 basis-point hikes at their last three meetings.

“We have to bring interest rates up to a level that will get inflation on that 2% path, and I have not seen the compelling evidence that I need to see that would suggest that we could start reducing the pace at which we’re going,” Cleveland Fed President Loretta Mester told the Council for Economic Education.

The median of the 19 policymakers’ latest projections sees another 1.25 percentage points of increases over their two remaining meetings of the year, with investors pricing a 75 basis-point move when they gather Nov. 1-2. Fed forecasts show an additional 25 basis-point increase next year, with policy staying at restrictive levels until at least 2024.

Earlier in the day, Governor Lisa Cook gave her first speech since joining the central bank in May and dashed any hopes that she would be a dovish voice at the Fed. She echoed her colleagues’ resolve in continuing tightening policy and then holding rates at restrictive levels until inflation comes down.

“With inflation running well above our 2% longer-run goal, restoring price stability likely will require ongoing rate hikes and then keeping policy restrictive for some time until we are confident that inflation is firmly on the path toward our 2% goal,” Cook told the Peterson Institute for International Economics in Washington.

“In the current situation, with risks to inflation forecasts skewed to the upside, I believe policy judgments must be based on whether and when we see inflation actually falling in the data, rather than just in forecasts,” Cook said.

Her message was echoed in separate comments from Chicago Fed President Charles Evans and Minneapolis’s Neel Kashkari, pushing back against bets by investors that policymakers will cut rates next year.

“We look to me, according to our reports, headed for 4.5% to 4.75% by sometime next year -- which, given how fast we’ve been raising interest rates, is likely to be the springtime,” Evans told a meeting of the Illinois Chamber of Commerce.

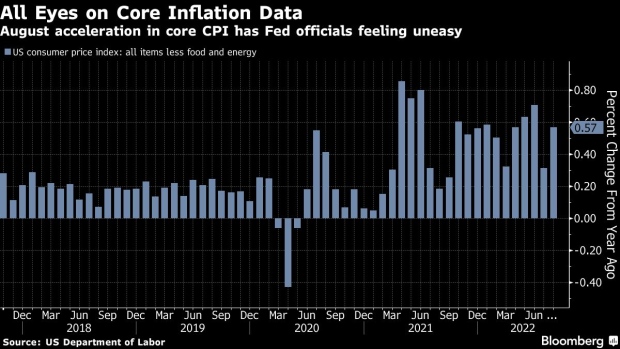

Policymakers expressed concern over core inflation. Prices minus food and energy, typically the most volatile categories, rose in August even in the face of historic Fed tightening this year.

“Commodity prices move up and down, but underlying inflation -- like wages and services -- tend to be stickier,” Kashkari said during a talk hosted by Bremer Financial Corp. “We’re not seeing any evidence yet that those things are moving in the right direction.”

Core consumer prices rose 6.3% in the 12 months through August, marking an acceleration from 5.9% in the 12 months through July. September’s data will be released Oct. 13. It will be preceded by the closely-watched monthly employment report Friday.

“The big question everybody is asking is: Can we achieve a soft landing?” Kashkari said. “My answer is: I hope so -- we’re going to try -- but we have to bring inflation down.”

(Updates with comments from Waller and Mester from third paragraph.)

©2022 Bloomberg L.P.