Jun 9, 2023

U.S. tech trim gains as S&P 500 pushes into bull market

, Bloomberg News

BNN Bloomberg's closing bell update: June 9, 2023

Technology shares pared gains Friday, though the S&P 500 remained cemented in bull-market territory amid bets the Federal Reserve is nearing the end of its hiking cycle.

The Nasdaq 100 trimmed an advance of as much 1.3 per cent, while the S&P 500 was little changed in midday trading. Tesla Inc. added 5.3 per cent after General Motors Co. announced it’s joining the company’s charging network. Netflix Inc. rose 2.0 per cent after a report the streaming service provider added U.S. subscribers after cracking down on password sharing. And Adobe Inc. gained another 4.4 per cent amid the frenzy in stocks linked to artificial intelligence.

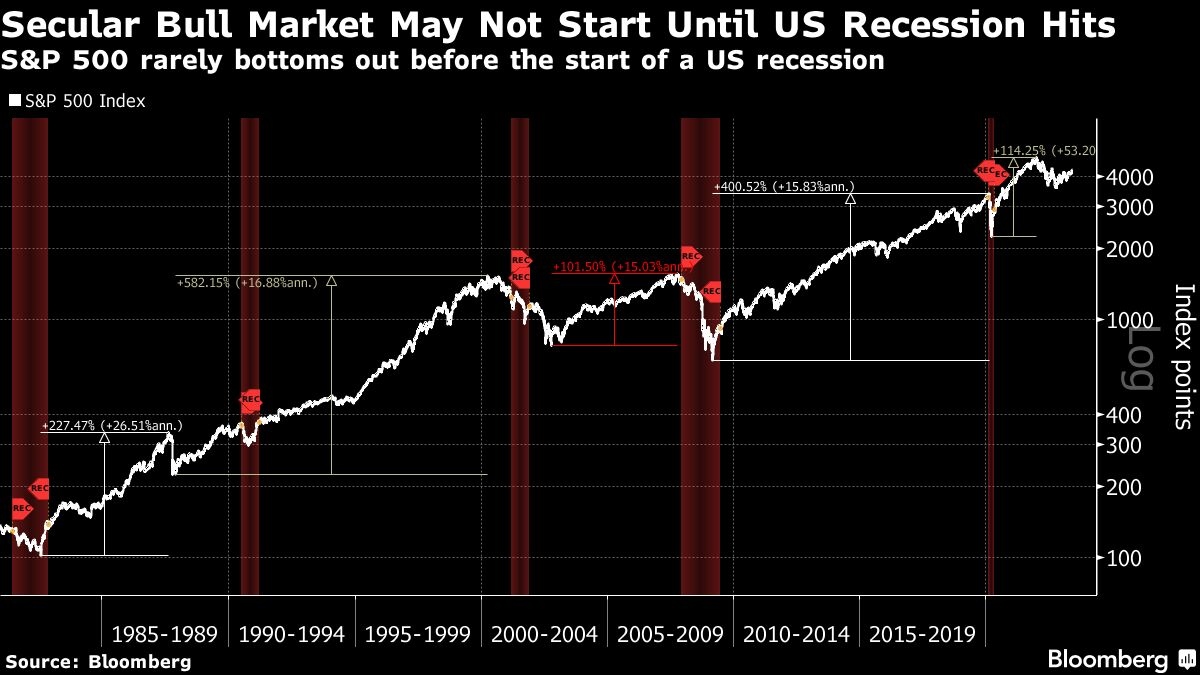

The S&P 500 has now surpassed a 20 per cent gain from an October low, a common marker of a bull market, after recent gains in technology stocks. However, analysts have warned the rally could stall ahead of next week’s interest-rate decisions from the Fed and the European Central Bank. Unexpected hikes from two central banks this week have raised speculation that policymakers may have to keep rates higher for longer. Meanwhile, U.S. data pointing to a cooling labor market has supported the consensus view that the Fed is likely to pause.

“We’ve become a little uncomfortable with the tech trade,” Stuart Kaiser, head of U.S. equity trading strategy at Citigroup, told Bloomberg TV. “There’s a scarcity of growth in the market, and the market is willing to pay a premium for that scarcity of growth.” But the debate for investors is what can get the market rally to turn “into something that is maybe a little more durable and sustainable to the upside.”

Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management, also cautioned against assuming the recent upswing in equities can gain momentum.

“While many investors believe that passing this milestone puts markets in bull territory, it remains possible that we are seeing a bear market rally— a period of strong gains that occurs in the middle of a bear market,” she said. “Until markets reach a new all-time high, it’s impossible to know whether the bear market trough —the ultimate low of the market cycle — is behind us.”

Elsewhere, Treasury yields rose after disappointing employment data from Canada and ahead of U.S. coupon sales. Canada’s economy ended its eight-month run of employment gains with minor job losses in May, signaling weakness in the labor market.

Currently, swaps traders are pricing in roughly a one-third chance of a Fed hike next week, and almost 90 per cent odds of one in July, after an unexpected rate hike by the central banks of Canada and Australia this week.

In Europe, stocks edged lower after a downbeat outlook from Croda International Plc weighed on chemical shares.

Japan’s Nikkei 225 capped a ninth week of gains, up 2.4 per cent, for its longest streak in more than five years.

And in currencies, the Turkish lira extended its decline to an all-time low against the dollar, taking its weekly drop to 10 per cent. President Recep Tayyip Erdogan completed key appointments of the economy team, which is expected to turn to more conventional policies.

Stocks

- The S&P 500 was little changed as of 11:33 a.m. New York time

- The Nasdaq 100 rose 0.3 per cent

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 fell 0.2 per cent

- The MSCI World index rose 0.5 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3 per cent to US$1.0751

- The British pound rose 0.1 per cent to US$1.2578

- The Japanese yen fell 0.3 per cent to 139.30 per dollar

Cryptocurrencies

- Bitcoin fell 0.2 per cent to US$26,587.71

- Ether fell 0.3 per cent to US$1,847.5

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.75 per cent

- Germany’s 10-year yield declined three basis points to 2.38 per cent

- Britain’s 10-year yield was little changed at 4.24 per cent

Commodities

- West Texas Intermediate crude fell 0.1 per cent to US$71.21 a barrel

- Gold futures were little changed