Nov 25, 2022

Eric Nuttall's Top Picks: November 25, 2022

BNN Bloomberg

Eric Nuttall's Top Picks

Eric Nuttall, partner and senior portfolio manager, Ninepoint Partners

FOCUS: Energy stocks

MARKET OUTLOOK:

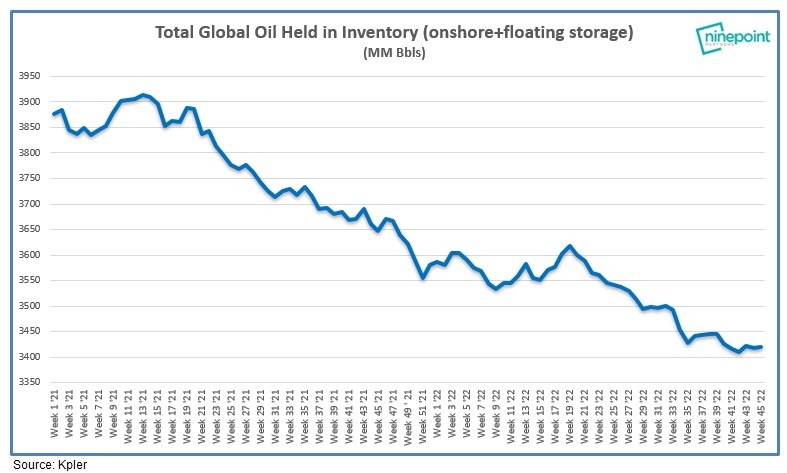

Christmas has come early for energy investors with a Chinese COVID-zero policy-induced sell-off combined with lingering fears of an impending recession leading to a $10+/bbl selloff in oil. Fundamentals remain strong! Despite the largest release in history from strategic political reserves and Chinese demand being suppressed by about 1MM Bbl/d, global oil inventories have continued to fall throughout 2022. What happens in 2023 when the SPR release ends, China eventually emerges from lockdown, Russia production is finally impacted by the EU import embargo, and fuel switching occurs in Europe due to forecasts of a cold winter? We remain bullish.

Canadian energy stocks are reaching their ultimate debt targets in real-time and are in the coming months and quarters about to meaningfully increase the amount of free cash flow to be returned to investors in the form of share buybacks and variable dividends. This action in our opinion will act as a catalyst to re-rate valuations multiples from still depressed levels (less than half of historical). Despite two very strong years for energy investors, we remain bullish heading into 2023 believing that patience will continue to be rewarded given the strong macro for oil, record profitability for the sector, rock-solid balance sheets, and the enshrined commitment to return the majority of free cash flow back to shareholders.

- Sign up for the Market Call Top Picks newsletter at bnnbloomberg.ca/subscribe

- Listen to the Market Call podcast on iHeart, or wherever you get your podcasts

TOP PICKS:

Tamarack was busy in 2022 consolidating acreage in Clearwater, North America’s most economic oil play with wells that payout in under two months. While this set the company up well for the future, it acted as an overhang on the stock throughout much of this year. As the company continues to pay down debt it will be set up to return 50 percent of free cash flow back to investors by mid-2023. Trading at a free cash flow yield of 32 per cent and 2.5x EV/CF at $100WTI we think fair value is a 13 per cent free cash flow yield = $11 target price = 121 per cent potential upside.

Baytex has drilled 15 of the top 15 wells in the most economic play in North America, yet still trades at a discount to the average trading multiple in North America. With the company trading at 2X EV/CF at $100WTI and a 36 per cent free cash flow yield, we see the company being able to continue to delineate its Clearwater acreage while returning 18 per cent back to investors in 2023. We think fair value is a 12 per cent free cash flow yield =$18 target price = 168 per cent potential upside.

MEG energy continues to aggressively pay down debt while returning 50 per cent of free cash flow back to investors. With production running ahead of consensus and WCS differentials expected to meaningfully improve in 2023 we see the company hitting its final debt target in the third to fourth-quarter of 2023, at which point they could pay a 27 per cent dividend for the next 33 years. We think fair value is a 12 per cent free cash flow yield = $40 target price = 110 per cent potential upside.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| TVE TSX | Y | N | Y |

| BTE TSX | Y | N | Y |

| MEG TSX | Y | N | Y |

PAST PICKS: November 5, 2021

Cenovus Energy (CVE TSX)

- Then: $15.59

- Now: $27.16

- Return: 74%

- Total Return: 77%

Athabasca Oil (ATH TSX)

- Then: $1.24

- Now: $2.68

- Return: 116%

- Total Return: 116%

Arc Resources (ARX TSX)

- Then: $12.87

- Now: $18.88

- Return: 47%

- Total Return: 51%

Total Return Average: 81%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| CVE TSX | N | N | Y |

| ATH TSX | Y | N | Y |

| ARX TSX | N | N | N |