Feb 8, 2023

End May Be Near for Eastern Europe’s Rate Hikers

, Bloomberg News

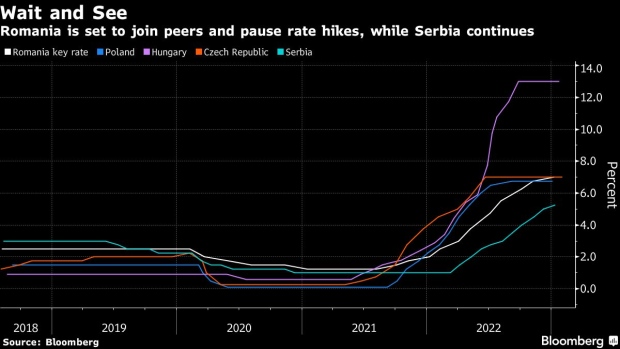

(Bloomberg) -- Romania may join Poland and other regional peers this week in holding interest rates steady as policy makers shift attention to risks posed by an economic slowdown even as inflation persists.

Poland is expected to extend a four-month pause, keeping the benchmark rate at 6.75% on Wednesday, while Romania is slated to join the trend a day later, holding the key rate 7%, Bloomberg surveys show. Serbia, which began raising rates later than peers, may deliver a 25 basis-point hike on Thursday, according to a survey.

After a campaign to fight soaring inflation with a raft of hikes, economic risks raised by Russia’s invasion of Ukraine have prompted eastern European central bankers to take a more cautious monetary approach. While data signal an easing in the second half of 2023, lingering inflation may keep policy makers on alert, much like the European Central Bank.

“The first months of the year will be a moment of truth for central and eastern Europe — and confirmation that the region has its own inflation story, more persistent than the global narrative,” London-based ING Strategist Frantisek Taborsky told Bloomberg. “The region’s economic picture is generally better than expected, but this also means stronger inflationary pressures and a problem for central banks to cut rates soon.”

Romania

The Banca Nationala a Romaniei sees promising signs in the nation’s inflation outlook, expecting it to drop toward 7% at the end of this year after capped energy prices brought relief to households and companies.

Still, the bank is not ready yet to call the end of its tightening cycle given high uncertainty and underlying inflationary pressures on food.

Poland

Policy makers are battling the biggest inflation surge in a quarter century, but have held off from further increases amid concerns a deeper economic slowdown would trigger job cuts.

Consumer prices decelerated in December to 16.6% from a year earlier, but are expected to pick up in the first quarter on an increase in regulated prices.

Still, inflation is expected to slow thereafter, potentially paving the way to a rate cut later this year, Premier Mateusz Morawiecki said last week. Money markets expect Poland’s key rate to be a percentage point lower a year from now.

Serbia

Serbia may increase its benchmark for a tenth month even as annual inflation may have peaked in December. Once it brings the key rate to 5.5% this week, the monetary authority may end the cycle at that level, according to UniCredit SpA senior economist Mauro Giorgio Marrano’s February 3 note.

Still, he cited a “risk of further hikes, especially if inflation surprises to the upside and global growth remains more resilient than we currently forecast, or if there is pressure on the currency.”

What’s Next

In the end, the scale of inflation and the scope of a possible economic slowdown will determine rate paths for central banks from Warsaw to Belgrade.

“Will inflation fall as economic activity slows?” Erste Group Research asked on January 31. “If so, central banks will stop raising rates, and recessions, if they occur, will be brief and modest.”

--With assistance from Irina Vilcu, Maciej Onoszko, Misha Savic and Barbara Sladkowska.

©2023 Bloomberg L.P.