Nov 27, 2022

Discounts Return on UK Homes In Latest Sign of Market Turbulence

, Bloomberg News

(Bloomberg) -- UK homebuyers are starting to get discounts on properties in the latest sign of turbulence in the country’s housing market.

Agreed prices fell below asking prices last month for the first time in 18 months, according to a report from property portal Zoopla. The average discount has increased to 2.4% in the week ending Nov. 19, the most since January 2021.

Zoopla expects discounts to widen further as buyers gain an advantage over sellers dealing with the threat of a house price plunge. More than one in 10 homes for sale since September have cut more than 5% off their asking price, with reductions most prominent in southern England where sales activity has dipped the most, according to Zoopla.

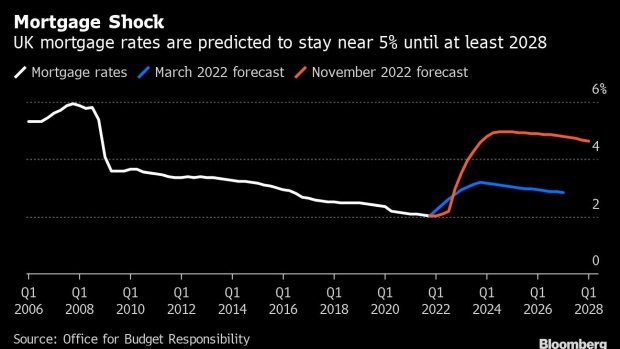

Since transaction volumes currently include offers that were agreed before then-Prime Minister Liz Truss’s mini-budget on Sept. 23 roiled markets and triggered a surge in mortgage rates, sales may drop and discounts widen further. It’s taking an average of 129 days this year from having an offer accepted on a home to completion, according to broker Hamptons International.

“It’s very likely that most of the completions showing up in data sources like HMRC and Land Registry at the moment are from buyers who locked in lower mortgage rates a while back,” said Aneisha Beveridge, head of research at broker Hamptons International.

Most mortgage offers made this summer would have been for six months, meaning many issued before the mini-budget are still working their way through the system. Once this lag tails off, downward pressure on house prices will increase, according to broker Knight Frank.

“We don’t expect the sort of cliff-edge moment we saw during the global financial crisis,” said Tom Bill, head of residential research at Knight Frank. “But as a new lending landscape emerges after 13 years of ultra-low rates, we believe prices will fall by around 10% over the next two years.”

The positive for sellers is that strong house price growth since the pandemic should give them more wiggle room when it comes to negotiating on a price. The prospects for 2023 depend on how willing sellers are to adjust values in line with what buyers are willing to pay, Zoopla said in its report.

“The housing market is adjusting to a reset in the level of mortgage rates,” said Richard Donnell, executive director at Zoopla. “While the outlook for house prices is weak, we see a shift to more needs driven motivations to move in 2023 and beyond which will support sales volumes.”

©2022 Bloomberg L.P.