Sep 29, 2022

Dip-Buyers Schooled Again After $7 Billion Dive Into Risk Assets

, Bloomberg News

(Bloomberg) -- Traders who jumped headfirst into the biggest cross-asset rally since April 2020 on Wednesday are being dealt a quick lesson in market-timing.

A combined $6.7 billion flooded into the biggest exchange-traded funds tracking US stocks, investment-grade bonds and high-yield credit on Wednesday after the Bank of England’s intervention in bond markets stoked a fierce relief rally.

The tone abruptly shifted on Thursday. Sell-everything mode descended on global markets after UK Prime Minister Liz Truss doubled down on a robust package of tax cuts, while inflation data added to anxiety. That zapped animal spirits in US equity markets and sent bond yields soaring, piling more pain on beaten-down bulls.

“Buying the dip is something that has worked for years - if not decades - but this market is unlike one that we’ve seen since the late 1970s and 1980s,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “What has changed is the Fed is the problem as opposed to the solution to economic shocks. Until investors adjust to this new normal, they will continue to get whipsawed.”

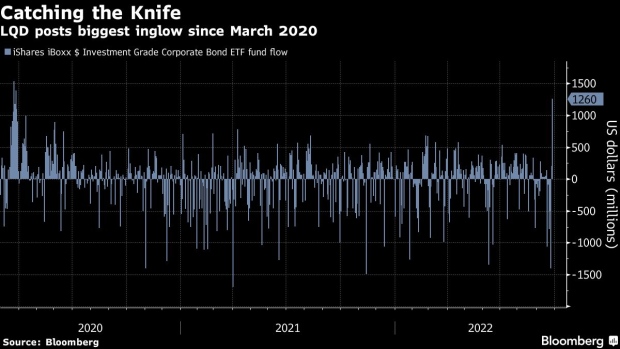

In equities, the $340 billion SPDR S&P 500 ETF Trust (ticker SPY) and the $156 billion Invesco QQQ Trust Series 1 (QQQ) took in $2.2 billion and $2.5 billion, respectively. In credit, the $11.8 billion iShares iBoxx High Yield Corporate Bond ETF (HYG) absorbed about $739 million, while the $30 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) attracted $1.3 billion -- the fund’s biggest single-day inflow since March 2020.

Although dip-buyers are hurting today, it’s not surprising to see bargain hunters flood the market after such a brutal drawdown, said Miller Tabak & Co.’s Chief Market Strategist, Matt Maley. However, it’s the next two days leading into quarter-end that will be critical in shaping risk appetite into year-end, he said.

“If the market rolls-over immediately over the last two days of the quarter,” Maley said, “people are going to be extremely reluctant to ‘buy the dips’ in the fourth quarter.”

©2022 Bloomberg L.P.