Jan 26, 2023

Deutsche Bank Fund Unit Doubles Down on ETF Target Amid Outflows

, Bloomberg News

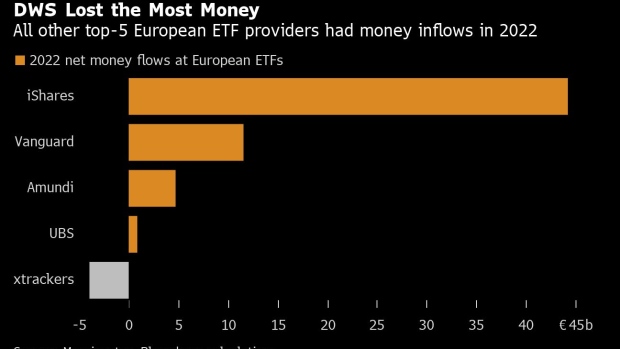

(Bloomberg) -- Deutsche Bank AG’s investment arm said it won’t walk away from a goal of becoming Europe’s second-biggest ETF provider, after an analysis showed it was among the few in the industry to lose client cash in 2022.

DWS Group, which remains the subject of US and German investigations into alleged greenwashing, saw a decline in its European market share to 10% in 2022 from 10.9% the previous year, according to Jose Garcia-Zarate, an analyst at Morningstar Inc. He links the development to questions around DWS’s handling of its environmental, social and governance investing strategy.

“DWS being in the headlines for the wrong reasons, as was the case last year, is unlikely to have helped them,” Garcia-Zarate said by email. “Investors are always wary of reputational risk that affects asset managers irrespective of the origin, and this can have a negative effect on all business units.”

Morningstar’s analysis shows that DWS’s Xtrackers business saw €3.9 billion ($4.2 billion) in net outflows last year, making it the only ETF provider among the five biggest in Europe to lose client cash. Of the 20 ETF managers Morningstar analyzed, none had bigger outflows than the Frankfurt-based firm last year.

DWS, which is due to publish full-year results on Feb. 2, has set a target of 12% annual ETF growth, as part of a plan to overtake Amundi SA as Europe’s No. 2 provider of such products.

“The Xtrackers ETF business is one of the growth drivers for DWS,” a spokesperson for the firm said by email. Last year, DWS “laid the groundwork for above-average asset growth for Xtrackers,” with examples of this work including its “strengthened” digital distribution through online brokers, so-called neobanks and robo advisers, the person said.

According to DWS, “clients started to reduce the equity allocation in their portfolios to lower risks” in the second half of last year, “driven by the well-known global issues financial markets are facing. This risk-off-movement became a topic for the ETF industry as a whole later on.”

The asset manager said its passive ETF offering focused on environmental, social and governance strategies attracted “positive net inflow” in the third and fourth quarters “and we continue to evolve our product offering in this space.”

DWS has been through a turbulent period following allegations of greenwashing brought against it by its former head of sustainability, Desiree Fixler. Investigations by the US Securities and Exchange Commission and German regulator BaFin are ongoing, with a related police raid last year expediting the departure of then CEO Asoka Woehrmann.

Stefan Hoops, who took over from Woehrmann as chief executive officer last year, said in December he’s carefully reviewed how DWS arrived at previous ESG disclosures, including those made in the firm’s 2020 and 2021 annual reports, which were singled out by Fixler for criticism. That review gave him “confidence” that the information contained in them was accurate at the time, though he said evolving regulation meant DWS subsequently changed how it handles ESG disclosures.

DWS saw €2.62 billion in outflows in the third quarter followed by €140 million in inflows in the fourth, according to Morningstar data looking at European flows.

As part of its ESG offering, DWS recently launched a range of ETFs that are aligned with the United Nations’ Sustainable Development Goals. The products are registered as Article 8, which is the less stringent of the European Union’s two ESG fund designations. DWS was among asset managers that last year downgraded a number of funds from the EU’s stricter ESG class, known as Article 9.

The Morningstar report includes €132 billion of Xtrackers assets under management. DWS manages a total of about €220 billion in client assets, according to its latest public statements.

The ETF growth strategy laid out by Hoops isn’t surprising, Garcia-Zarate said. The growth outlook for the ETF industry is “positive overall,” he said. And Germany, where DWS has a strong foothold, is “a key target market for the expansion of ETF usage amongst retail investors” because of the growing popularity of savings plans that make automatic and recurring investments in ETFs, he said.

(Adds reference to new ETF launches in third-to-last paragraph)

©2023 Bloomberg L.P.