Feb 1, 2023

DeSantis Seeks Tax Cuts, State Pay Hikes in $115 Billion Budget

, Bloomberg News

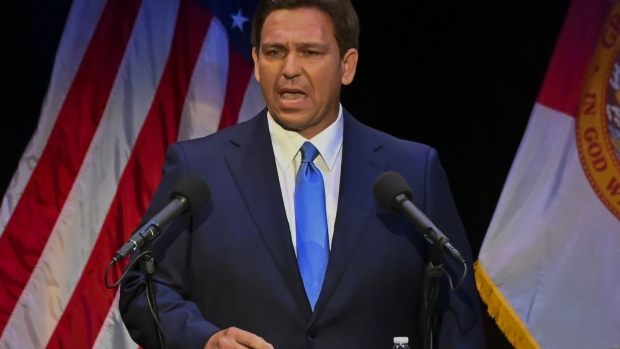

(Bloomberg) -- Florida Governor Ron DeSantis is pushing for tax cuts and pay increases for state employees in the coming year’s budget as revenue surpasses forecasts.

DeSantis, a Republican who’s widely considered a potential contender for the 2024 presidential nomination, unveiled his $114.8 billion spending proposal dubbed “Framework for Freedom” for the fiscal year that starts July 1.

“Florida is stronger than ever,” he said, pointing to the state’s 2.5% unemployment rate, high levels of in-migration, low taxes and rapid clip of new business creation. The governor proposed $15.7 billion of total reserves. “That shows you that the state is going in the right direction.”

The “freedom” branding of this year’s proposal is a direct callback to DeSantis’ outline for the past year, which was dubbed the “Freedom First Budget” and was deeply steeped in conservative rhetoric. The outline released Wednesday speaks to a similar Republican base.

For example, DeSantis proposed adding another $12 million to his controversial migrant relocation program that drew intense criticism and legal challenges after he sent a plane of immigrants to Martha’s Vineyard last fall. Florida’s CFO Jimmy Patronis lauded the line-item saying that it is “money-well-spent,” in a Monday statement.

DeSantis’ outline is just a proposal. Lawmakers in the Florida House and Senate, both of which are led by Republican majorities, will craft an appropriations bill factoring in his recommendations during the legislative session that begins next month. DeSantis ultimately has line-item veto authority over the spending after the legislature passes the bill.

He said Florida is on sound fiscal footing as the state has been “blowing past” revenue estimates even after forecasters upped projections in 2022.

The budget would expand sales-tax exemptions and create more than 10 temporary tax-free holidays, according to a release outlining the proposal on Wednesday. The exemptions would apply to baby and toddler necessities, cribs and strollers, over-the-counter pet medicine and gas stoves. The temporary holidays would provide a window of tax-free purchases on items including children’s books, certain household items and disaster preparedness items.

DeSantis also advocated for a 5% pay raise across all state employees with an additional 10% increase for “hard-to-hire” positions. Correctional officers specifically would receive a $23 hourly wage under his plan.

The governor’s proposal called for a $200 million spending increase to fund pay raises for teachers and budgeted $451 million for the state’s free pre-k initiative, which serves about 155,000 children, according to budget documents.

DeSantis has been rolling out investment priorities recently and announced a $7 billion infrastructure plan on Monday that would accelerate projects designed to strengthen the state’s roadways.

“When you’re in a situation where you have really persistent inflation, where you have a growing state with infrastructure needs, you don’t want to have all this money just sitting there,” he said.

Below are some of the Governor’s spending priorities:

- Over $2.7 billion for Florida’s agricultural industry, including $29.4 citrus research and for consumer awareness marketing efforts

- $30 million to fund recruitment bonus payments for law enforcement officers who are new to the profession in the state, including those relocating from other states

- $614 million for Everglades restoration projects and $370 million for targeted water quality improvements

- $65 million to combat the effects and impacts of harmful algal blooms, including blue-green algae and red tide

- $1.5 billion in state operating funding for the Florida College System and $3.1 billion in state operating funding for the State University System

- $807.4 million investment in rail and transit projects, with $100 million to support broadband initiatives to expand high-speed internet deployment

(Updates with context on budget process and priorities in fifth and sixth paragraphs.)

©2023 Bloomberg L.P.