May 17, 2022

Consumers getting 'hit where it hurts' by gas prices: BMO economist

, BNN Bloomberg

Gasoline records will keep on breaking in Canada: Roger McKnight

Canadian consumers’ disposable income will come under pressure as gasoline prices extend their climb above $2 per litre for the first time, said BMO Capital Markets Senior Economist Jennifer Lee.

“This situation is not unique to Canada, everyone around the world is dealing with higher taxes, food prices and gasoline — so most people are getting hit where it hurts right now,” Lee said in a phone interview.

“We are going to see the start of slower consumer spending if we haven’t seen that already, but this is just the beginning of pressure on Canadians’ pocketbooks.”

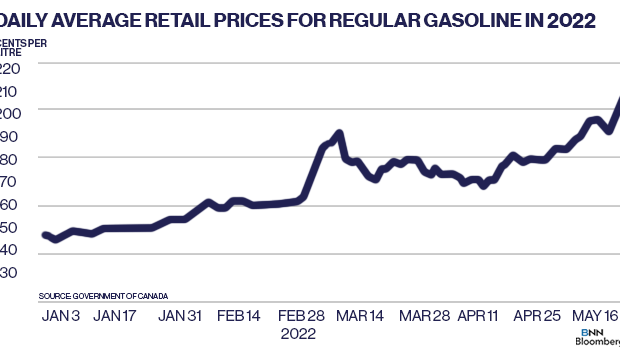

Gasoline prices have jumped 41 per cent since the beginning of the year, with consumers paying 60 cents more per litre than they did on January 1, 2022.

The average price for regular gasoline hit an all-time high of $2.06 per litre on Monday, with Vancouver residents paying the most at $2.34 a litre.

Experts are warning that as prices continue to rise, it could spell trouble for many household budgets.

BMO has estimated that fuels for transportation accounted for 3.65 per cent of nominal consumer spending in last year’s fourth quarter, and now Canadians are spending 1.5 per cent more of their budget on higher gasoline prices.

Personal finance expert Melissa Leong said drivers should be taking stock of their expenses to see if they can redirect spending to cover higher gas costs.

“These record-high prices aren’t forever but you are going to have to change your behaviours and put up with some pain in the short-term in order to make sure you are still maintaining your financial goals,” said Leong, author of Happy Go Money, in an interview.

To cut down spending on gas, Leong recommended Canadians use apps to find stations with lower prices, choose alternative transit methods like biking or taking the bus, and adopt money-saving driving habits such as accelerating gently and using air conditioning sparingly.