Jun 24, 2022

CIBC's Dodig pushes his strategy as recession fear hits bank sector

, Bloomberg News

Rocky road for bank stocks

In his eight years as chief executive officer of Canadian Imperial Bank of Commerce, Victor Dodig has turned the lender into one of the country’s fastest-growing banks. His next task is convincing investors the change will stick.

Under Dodig, CIBC charged into the US with the purchase of wealth manager and commercial lender PrivateBancorp Inc. Its Canadian retail-banking unit has produced strong growth, helped by huge investments in technology. More recently, the company opened a new headquarters in downtown Toronto and refreshed its branding with a more modern look.

The result is that CIBC has posted the second-best revenue and profit increases among Canada’s six largest banks during Dodig’s tenure. But the shares are in fifth place, dogged by a reputation for expensive mishaps during past downturns that’s led to a lower stock multiple.

Dodig, in an interview that followed a five-hour presentation to sell investors on his strategy, said he remains confident that he’s changing perceptions.

“Whenever you go through a transformation agenda where you’re investing, sometimes the market likes to observe before they lean in,” said Dodig, 57. “Our top-line growth, our market-share growth is at the upper end of the market. So some people like to take a pause on that, but I’m increasingly seeing more and more investors leaning in and investing in our company.”

At the moment, the market is worried. Since Feb. 8, the day the S&P/TSX Commercial Banks Index closed at a record, CIBC has dropped nearly 25 per cent. No large Canadian bank has been hit harder in the selloff.

Dodig first worked for CIBC as a teller while attending the University of Toronto. He later worked at McKinsey & Co., Merrill Lynch and UBS AG before returning to the Canadian bank in 2005 in its wealth-management division. He ascended the ranks in that unit before he was tapped to become CEO in 2014.

His predecessor, Gerald McCaughey, had spent much of his term trying to reduce risk at the bank, which had been caught up in several famous corporate blowups, including Enron Corp.’s bankruptcy. During the financial crisis, CIBC took large writedowns on securities tied to US subprime mortgages, reinforcing its reputation as the “bank most likely to walk into a sharp object,” as a joke on Bay Street goes.

As part of McCaughey’s retrenchment, CIBC sold most of its US investment-banking business, largely relegating the firm to its domestic market at a time when larger rivals including Royal Bank of Canada, Toronto-Dominion Bank and Bank of Montreal were expanding south.

“The bank was in disarray” when Dodig took over, said John Aiken, an analyst at Barclays Plc. “Operationally, strategically, CIBC was definitely falling behind the peer group. It was the bank with the most volatile earnings and no real discernible strategy as to where the growth was going to come from.”

The early work of improving CIBC’s customer service included speeding up responses to complaints, and recording and then sharing feedback from clients, Dodig said. The bank also invested heavily in technology, including cloud and customer-relationship software.

Dodig brought the bank back into the US in 2017, buying Chicago-based PrivateBancorp for US$5 billion -- his biggest deal -- giving CIBC access to American middle-market companies, business owners and wealthy families. Last year, CIBC added a minority stake in Chicago-based Loop Capital for an undisclosed price.

'WINNING PROPOSITION'

Dodig argues that CIBC has carved out a niche in what it calls the private economy in the US, where its commercial-banking, capital markets and wealth-management units work together to serve the “entrepreneurial class where wealth gets created,” he said.

Dodig pointed to an example: CIBC recently advised the owner of a closely-held food company on the sale of half of its business to a private equity firm, helped finance the deal and now has its wealth division managing the proceeds for the seller’s family.

“This doesn’t require us to compete with Wall Street,” Dodig said. “This requires us to take the best of our capabilities and bring them to the United States with a winning proposition.” Last year, about a fifth of CIBC’s profit was generated in the US, compared with around 2 per cent before the PrivateBancorp deal.

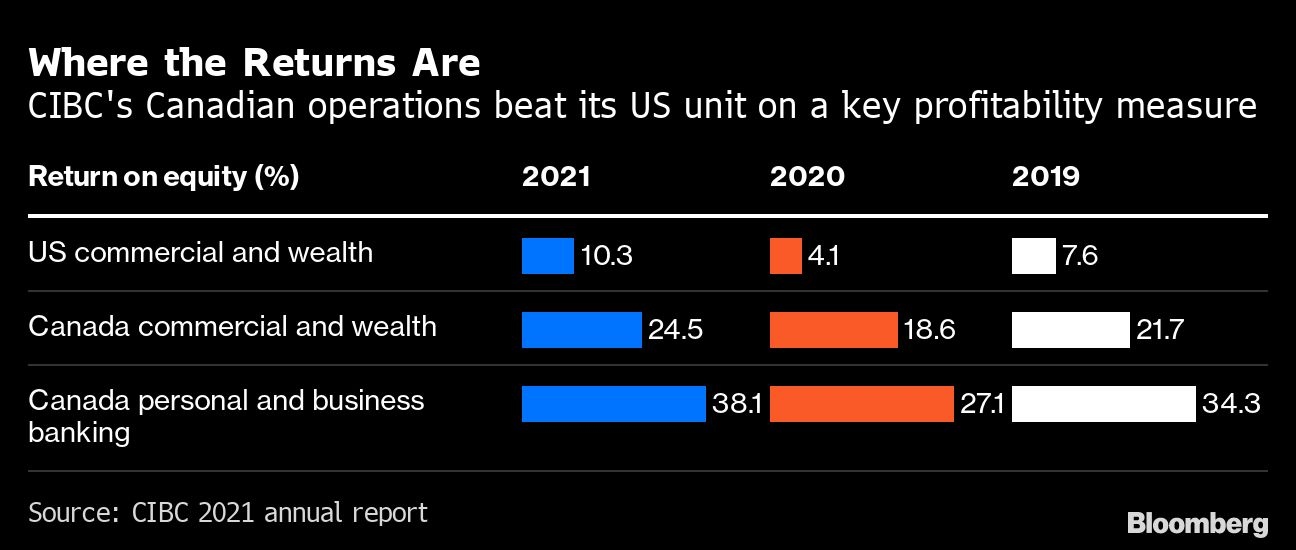

By other measures, the US strategy looks less impressive. It’s decidedly less lucrative than most of what CIBC does in Canada: Return on equity for the US commercial and wealth unit was 10.3 per cent in fiscal 2021, and before the pandemic it was between 7 per cent and 8 per cent.

“So the question for Victor is, why grow the US business aggressively by 10 per cent if it’s not as profitable as Canada?” RBC Capital Markets analyst Darko Mihelic asked the CEO at last week’s investor day.

Dodig replied that CIBC would be “unrelenting” in its focus on organic growth and that any US acquisitions would focus on wealth management, where returns tend to be higher.

In Canada, the bank is working on funneling customers through its Imperial Service financial-planning channels to cross-sell them other products. And it bought Capital One Financial Corp.’s Costco credit card business in Canada, which added more than 2 million cardholders, 75 per cent of whom are new to CIBC.

Still, the shares lag behind those of competitors. Concerns about CIBC’s performance during past credit cycles are now amplified by rising interest rates, which threaten to curtail its faster-than-market loan growth, said Aiken, who rates the shares equal-weight, the equivalent of a hold.

The bank’s expenses are rising at a faster rate than rivals’ as it spends on technology and employees to fuel sales gains. Non-interest expenses rose 13 per cent from a year earlier in the quarter ended in April, contributing to an overall profit figure that trailed analysts’ projections.

Even as Dodig righted the ship, the bank has struggled somewhat to show investors where its next leg of growth is going to come from, Aiken said.

That was a weakness that CIBC attempted to rectify at its investor day last week. The bank lifted its targeted range for adjusted earnings per share growth 7 per cent to 10 per cent a year, up from 5 per cent to 10 per cent previously. The lender also raised its return on equity target to 16 per cent or more, from at least 15 per cent.

On its current trajectory, CIBC doesn’t “need a big deal” to grow and is instead focused on executing on its plans, Dodig said.

“You can’t obsess about a stock price day to day,” Dodig said. “You have to have a strategy where everyone is aligned. You have to find investors who believe in your long-term strategy. And there are investors who believe in that.”