Feb 6, 2023

China’s Local Entities Splurge on Land Shunned by Developers

, Bloomberg News

(Bloomberg) -- As China’s cash-strapped private developers avoid buying land to build homes during the industry’s unprecedented slump, one group has emerged to prop up the ailing market.

Local government financing vehicles, or LGFVs, snapped up more than half of residential land sales last year, spending 2.2 trillion yuan ($324 billion), according to a tally by Guangfa Securities Co. last week.

“LGFVs and national state-owned developers have dominated the land market,” said Liu Shui, research director at China Index Holdings. “National private players have almost vanished from land buying under liquidity pressure.”

The trend has helped to shore up the finances of local governments that rely on land sales for much of their revenue. But it has also stoked concerns that municipalities are using LGFVs to support land values, while adding to debts of the entities and raising questions over prospects for developing the sites as housing demand plummets.

Antan Credit Rating Co., a firm based in Hubei province, said in a note last month that 79% of the land LGFVs bought at auctions was at the reserve price, suggesting that the transactions were mainly intended to prevent the market from collapsing.

And there was no sign that LGFVs were letting up on their purchases even after the government unveiled steps to support financing for property developers late in the year. The entities made up 65% of land sales in the final quarter, up from 43% in the first.

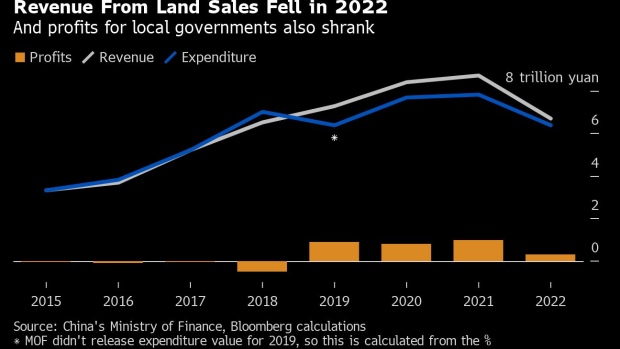

Despite LGFVs’ buying, local government income from land sales slumped 23% to 6.69 trillion yuan last year, the lowest annual take since 2018, according to official data. Once the cost of selling the land was subtracted, local governments only made 312 billion yuan from the transactions last year, two-thirds less than in 2021. Revenue from deed taxes also slid 22% from 2021.

Weakening land sales helped push China’s overall budget deficit to a record 8.96 trillion yuan last year, putting local governments in an increasingly poor fiscal position, according to Bloomberg calculations based on Ministry of Finance data. The deficit was larger than the previous record of 8.72 trillion yuan in 2020, when the economy was battered by the initial Covid outbreak, the calculations showed.

--With assistance from Fran Wang and James Mayger.

©2023 Bloomberg L.P.