Mar 30, 2023

China’s Economy Keeps Up Momentum as Services Activity Surges

, Bloomberg News

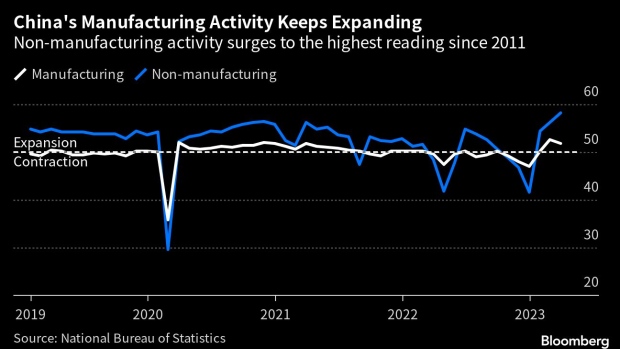

(Bloomberg) -- China’s economic recovery gathered pace in March, with gauges for manufacturing, services and construction activity remaining strong, boosting the outlook for growth this year.

The purchasing managers’ index for the non-manufacturing sector surged to 58.2 in March, the highest level since May 2011, led by a surge in the construction sub-index to a record high.

The manufacturing PMI was above economists’ forecasts, at 51.9 in March, even though it eased slightly from February’s level. A reading above 50 signals expansion from the previous month.

The PMIs are the first official indicators of economic activity for the month, showing the recovery is strengthening after stringent pandemic restrictions were dropped and Covid infection waves eased. Economists expect a rebound in consumer spending and strong government spending on infrastructure to help drive up growth in the world’s second-largest economy to 5.3% this year from just 3% in 2022.

Stocks in China and Hong Kong rose amid broad gains in Asia. A gauge of Chinese shares listed in the financial hub jumped as much as 2.4%, leading the regional advance. The currency edged higher, with the offshore yuan strengthening 0.2% to 6.8603 per dollar as of 11:38 a.m. local time.

“The PMI indicates China’s economic recovery is on track,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management. “The strong momentum will likely continue in the coming months,” he said, with recent government policy actions helping to boost confidence. “We think GDP growth may surpass 6% this year,” he added.

The NBS said services activity picked up “as the effects of local governments measures to promote consumption kicked in” and households showed willingness to spend and travel. Warmer weather also helped to get construction projects going across the country, it said.

What Bloomberg Economics Says...

Another jump in China’s official non-manufacturing PMI further into expansion in March shows spending on services and government investment in infrastructure driving the economy’s recovery. This is a good sign — domestic demand is kicking in. That will be important. A slowdown in manufacturing evident in Friday’s data could deepen as global growth slows.

For the full report, click here

Chang Shu and David Qu

Premier Li Qiang said at this week’s Boao Forum in the southern island province of Hainan that economic growth in March likely strengthened from the first two months of the year. Consumption and investment picked up and employment and prices were “broadly stable,” he said, adding market expectations improved “notably.”

He sought to soothe foreign investor concerns over investing in China as tensions with the US intensify, pledging that the country will be “an anchor for world peace.” He also vowed to roll out new measures to broaden market access and improve the business environment.

Yao Wei, chief economist for Asia-Pacific and China at Societe Generale SA, said China can probably achieve economic growth of around 5.5% or higher this year just with a normalization in services and consumption, and stability in the housing market.

“There’s no need for big stimulus,” she said. “What’s more positive recently are the ever-clearer signs of Beijing being friendly to the private sector.”

Ho Woei Chen, an economist at United Overseas Bank Ltd. in Singapore, said the implications for monetary policy is that interest rates will likely be on pause, although another cut to the reserve requirement ratio is possible.

Although domestic spending and construction is picking up, global demand for Chinese-made goods remains weak, weighing on the growth outlook. A set of early indicators tracked by Bloomberg showed a mixed recovery in March, with car sales still falling and global trade weakening.

Property developers are also still pessimistic about the outlook for the sector despite recent signs of a stabilization in prices and sales. And unemployment remains relatively high, weighing on the consumer rebound.

The PMI surveys showed employment in manufacturing and non-manufacturing sectors likely contracted in March, casting a shadow over the job market.

“The sentiment among manufacturers and non-manufacturing firms to hire weakened,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc. “The government needs to better implement policies that prioritize the support for employment.”

--With assistance from Chester Yung, Shikhar Balwani and Wenjin Lv.

(Updates with additional details.)

©2023 Bloomberg L.P.