Jun 29, 2022

China’s Easier Travel Rules Are Still the World’s Toughest

, Bloomberg News

(Bloomberg) -- Travelers wanting to get into China will still need to contend with the intricate web of testing and bureaucratic requirements that underpin Covid Zero, tempering optimism that its decision to halve quarantine time signals the country is ready to emerge from an extended isolation.

While inbound flight schedule data show a marked uptick in planned services each month from July through the end of the year, airlines are yet to lock in arrangements as they lack clarity on whether other travel rules will be eased. Currently, China limits companies to just one international flight a week to any country, caps the number of passengers allowed on aircraft and can suspend flights with little notice under a circuit-breaker rule.

Without more frequent flights, the costs for individuals entering from overseas remain substantial. In August, a one-way ticket in business class on China Eastern Airlines Corp. non-stop from New York to Shanghai cost $13,200, while a premium economy seat on a United Airlines Holdings Inc. flight in October is going for $9,700. Travelers then need to spend a week in quarantine on their own dime, though that’s down from 14 days and as long as three weeks previously.

Even as the shortening of quarantine was welcomed by investors, with the report sending travel shares surging on Tuesday, Chinese officials cautioned the move isn’t a sign of reopening and President Xi Jinping indicated Covid Zero is here to stay. The approach will help China achieve the goal of stamping out infection, and the country would rather take an economic hit than risk the health of its 1.4 billion people, Xi said during a trip to Wuhan this week.

Read more: Why China Is Sticking With Its Covid Zero Strategy: QuickTake

Adding more international flights offsets the impact of the circuit breaker canceling existing ones, while easing testing rules for people coming to China also sent positive signals, said Qi Qi, a professor at Guangzhou Civil Aviation College. But they don’t really mean a reopening, he said.

Here’s a look at the hurdles that remain to easier travel to China.

Get Tested

Chinese embassies require anyone wanting to enter China to get two PCR tests within 48 hours of departure, with the second one done within 12 hours of the flight taking off. Only people with negative results can apply for a health code that grants permission to cross the border. Anyone with a previous infection needs to get pre-approval at least six weeks before their scheduled travel.

For people departing from places like the UK, the journey to the Chinese mainland is made more difficult by the lack of direct flights. Travelers transiting through a European country need an additional PCR test during their stopover, and need a green health code from the local Chinese embassy to board their flight to China. Anyone with a positive test result at this point won’t be allowed on the plane and must wait until they recover to then go through the pre-approval process.

Read more: China Quarantine Cut Just First Step in Ending Global Isolation

Hong Kong has emerged as a popular entry point as there are more flights into the mainland each day than anywhere else. But that route also requires a strict pre- and post-flight testing regimen to get to the financial hub, plus a week of hotel quarantine, before someone can cross the border to the mainland where they’ll undergo further isolation.

On top of the testing requirements, foreigners heading to China for business still need to navigate extensive bureaucracy to get the relevant invitation letter and paperwork to apply for a visa.

Flight Caps

Any increase in demand for travel will be stymied by China’s ‘Five One’ policy, which allows Chinese airlines just one international flight a week to any country with a cap on passenger capacity, and permits foreign carriers to operate one flight a week into the mainland. Airlines have also frequently been banned or had services cut back to prevent imported cases.

After reducing quarantine, the next step needs to be to increase flight capacity, said Jonathan Kao, managing director for Greater China at corporate travel management firm BCD Travel. The “limiting factor is how many flights come into China,” he said.

While there has been a nearly 50% increase in the number of flights landing in major aviation hubs on the mainland since June 2020, they are subject to a circuit-breaker mechanism instituted by the Civil Aviation Administration of China to suspend flights that bring in infected passengers.

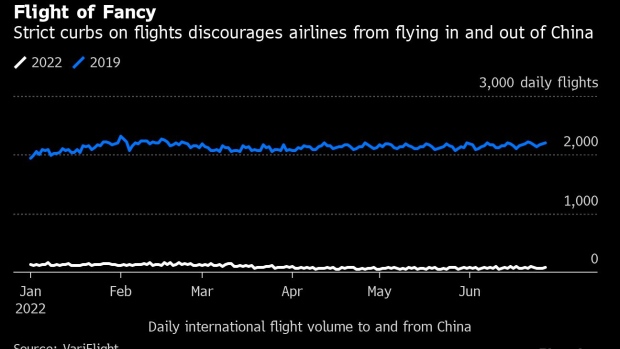

As of late May, the authority had canceled 768 inbound flights, though it is in talks with some countries to gradually increase the number of international flights. The volume of international flights is 96% lower compared to 2019 levels, according to VariFlight.

Up in the Air

Travel and tourism related stocks surged on Tuesday with the announcement of China’s new requirements, though gains petered out on Wednesday along with Xi’s affirmation of Covid Zero. Market watchers were split as to the impact of the quarantine shift.

Morgan Stanley warned that while it was increasingly optimistic China would exit Covid Zero by the start of 2023, lingering virus restrictions mean “a V-shape bounce in travel is less likely.” Citigroup Inc. analyst Lydia Ling said the quarantine adjustments would drive a further rebound in domestic travel and likely demand for international travel.

For airlines, the task to get more planes in the sky remains an uphill struggle, and VariFlight data show international flight activity to and from China remains near record lows.

Korean Air Lines Co. said that while a reduction in quarantine time is a positive sign, it’s difficult to immediately restore services due to flight limitations. “There needs to be a discussion between the South Korean and Chinese aviation authorities to restore flights. Should flights to Beijing, Shanghai and other major Chinese cities become available, Korean Air plans to increase services,” it said in a statement.

Cathay Pacific Airways Ltd. said it will continue to look for opportunities to add back passenger capacity and rebuild its hub and network.

It’s not just inbound travel that’s affected, Chinese looking to head overseas can also face difficulties. In May, the National Immigration Administration vowed to tighten its border control by “strictly limiting Chinese nationals’ unnecessary outbound travel and the review and approval of travel documents”.

More is needed to stimulate a recovery in international travel to and from the world’s second-largest economy, according to Xie Xingquan, the International Air Transport Association’s regional vice president for North Asia.

“As long as there is still a quarantine, it will be a disincentive for people considering travel to China, especially when many parts of Asia are already allowing quarantine free travel,” he said.

©2022 Bloomberg L.P.