Nov 28, 2022

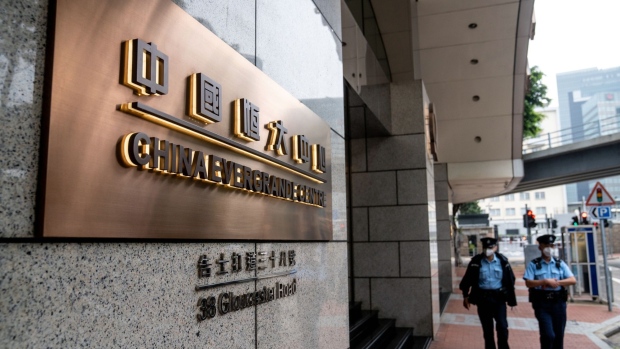

China Evergrande Winding-Up Lawsuit Is Adjourned in Hong Kong

, Bloomberg News

(Bloomberg) -- China Evergrande Group said it expects to receive restructuring support from offshore creditors by as early as February, helping its plea to adjourn a winding-up hearing again.

The world’s most indebted developer wants to offer restructuring terms for its dollar debt and get backing from major creditors by the end of February or early March, Evegrande’s legal representative said during a hearing in Hong Kong on Monday. The Hong Kong High Court adjourned the winding-up case against Evergrande to March 20.

Evergrande is racing against a self-imposed deadline to present restructuring proposals by year-end, as creditors lose patience. With 1.97 trillion yuan ($274 billion) of liabilities, the company’s debt overhaul will be China’s biggest and has broader implications for the country’s $58 trillion financial system.

Evergrande has told offshore creditors it expects to present a plan as soon as the first week of December, according to people familiar with the matter. That would meet a self-imposed deadline, after it failed to deliver a preliminary blueprint it promised by the end of July.

The winding-up petition against Evergrande was filed in June by Top Shine Global Limited of Intershore Consult (Samoa) Ltd. The company was a strategic investor in Evergrande’s online home and car sales platform. The lawsuit involves a HK$862.5 million financial obligation.

The judge, Linda Chan, urged Evergrande on Monday to present “something more concrete” during the next hearing.

The case is among a flurry of petitions against Chinese builders that could result in asset liquidation. Evergrande’s dollar bond defaulted last December.

Hong Kong’s court tends to give some leeway to companies, but debtors shouldn’t assume multiple deferrals of a winding-up petition will be granted, according to James Warboys, a restructuring partner at Linklaters LLP. Firms need to show that restructuring discussions are occurring in good faith and collaboratively with creditors, he said in a recent interview.

Developers were given a fresh reminder of liquidation risks when a Hong Kong court issued a winding-up order to Yango Group Co.’s unit in October, the first such instance against a major builder.

The Top Shine vs Evergrande case number is HCCW 220 / 2022.

©2022 Bloomberg L.P.