Dec 1, 2021

Central banks told not to panic in face of inflation spike

, Bloomberg News

'Transitory' Is Out

Central bankers should hold their nerve as they watch the global economic recovery slowing, imbalances persisting, and a stronger and longer-than-expected inflation surge cast a shadow over the outlook, the OECD said.

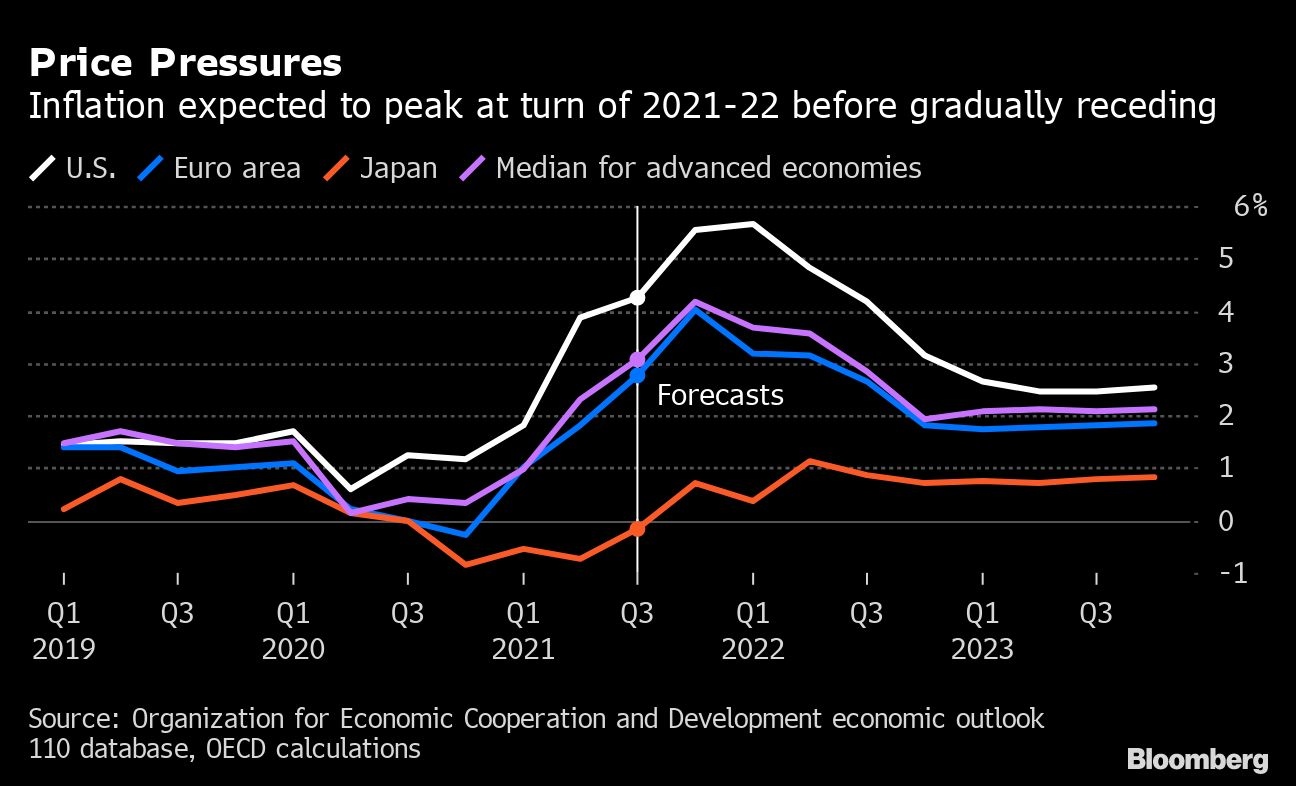

In its report on the world economy, the Paris-based organization said price gains will peak at the turn of the year as demand stabilizes, supply bottlenecks fade and people return to the labor force. The situation presents “considerable policy challenges” for monetary officials who should stand ready to intervene, but not move precipitously to rein in inflation.

“In current circumstances, the best thing central banks can do is to wait for supply tensions to diminish and signal they will act if necessary,” OECD Chief Economist Laurence Boone said in commentary to forecasts mainly compiled before news emerged of the omicron coronavirus variant.

Recent inflation reports in major economies are challenging central bankers. In the U.S., inflation rose at the fastest pace since 1990 in October, while the euro area in November recorded the highest rate in the history of the single currency. The Bank of England, meanwhile, has laid the groundwork to raise rates in the months ahead to avoid overheating.

The emergence of the new virus strain is adding to difficulties in gaging policy support, with Federal Reserve Chair Jerome Powell warning of “increased uncertainty for inflation” and saying Tuesday that the word “transitory” should be retired when speaking of price growth.

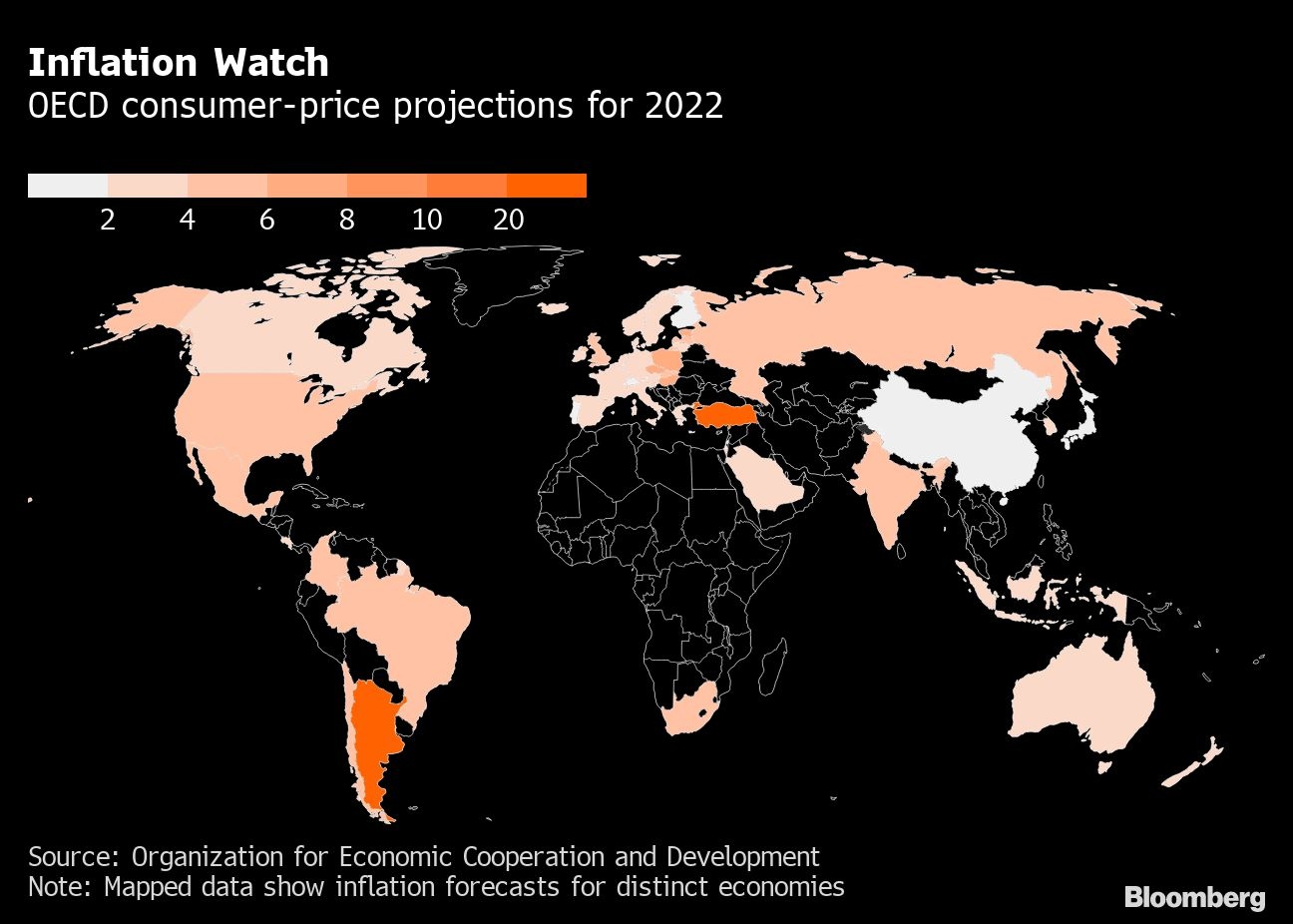

Despite the forecasts being largely prepared before omicron rocked global markets and investor confidence, the OECD still put new variants at the top of its list of “significant risks” surrounding projections. Those threats also include a possible disappointment in China’s economy if problems in the real-estate sector persist, and continued upside surprises from inflation.

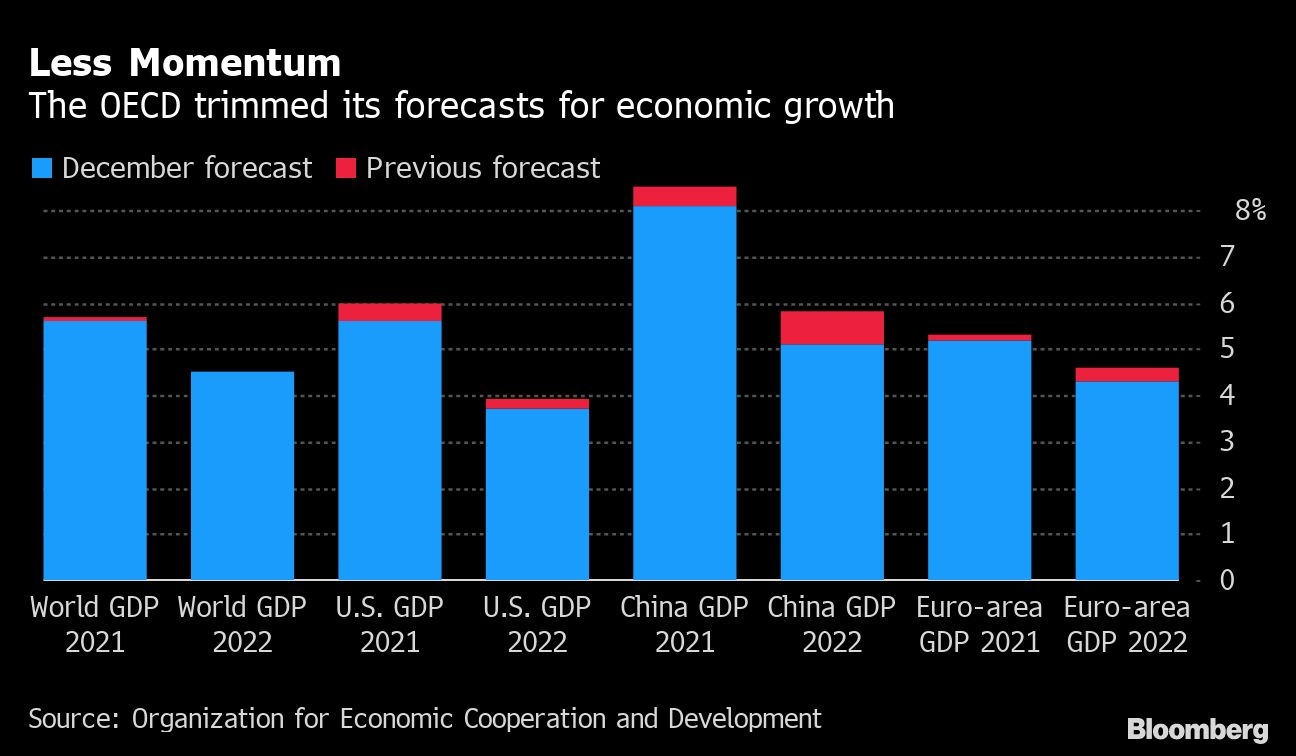

The OECD revised its global growth projection for this year down 0.1 percentage points to 5.6 per cent while keeping its 2022 forecast at 4.5 per cent. It also reduced its outlooks for U.S., Chinese and euro-area output for both years.

Boone said that outlook is “cautiously optimistic,” but also observed that there are more downside than upside risks in an imbalanced revival. To combat that, the chief economist said vaccination efforts should be stepped up to avoid breeding grounds for deadlier strains of the virus.

“The recovery is real, but the task for policy makers is a tough one,” Boone said. “They must balance prudence, patience, and persistence while developing new and improved plans to transform economies.”