Jan 24, 2023

Cathie Wood’s ARKK Is Well on Way to One of Its Best Months Ever

, Bloomberg News

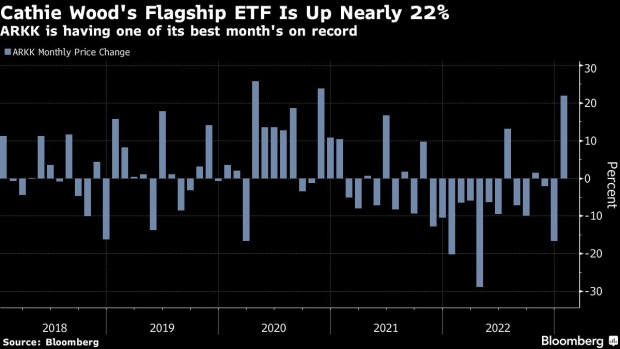

(Bloomberg) -- Cathie Wood’s flagship strategy is on course for one of its best months on record, joining assets across Wall Street that are so far defying gloomy expectations for the year ahead in emphatic style.

The ARK Innovation ETF (ticker ARKK) has returned almost 22% since the start of January, currently set for its third-strongest month ever. With a week of trading still to go, the fund could yet eclipse the 26% and 24% monthly returns it delivered in 2020, the year it burst onto the global investing scene.

The product is benefiting from a buoyant mood in global markets, as investors wager that high inflation is behind us and policy makers will be able to slow their monetary tightening. Relentless rate hikes, pushing up the cost of money, had slammed the likes of ARKK and the type of speculative tech shares it targets.

The tech-heavy Nasdaq 100 index has led US equity benchmarks higher in 2023 on bets the worst is now behind the cohort. Exact Sciences Corp., ARKK’s largest holding, is up about 37%. Beleaguered Tesla Inc., now the third biggest weight in the portfolio, has jumped about 17%.

ARKK’s surge comes off a low base, and the ETF remains more than 75% from its record high notched in early 2021. About 9.5% of outstanding shares are currently on loan to short sellers, according to IHS Markit Ltd. data.

Read more: Cathie Wood’s Grim 2022 Is Over. Next Year Also Looks Bad

Despite its poor performance over the past two years, Wood’s vision of targeting the innovative disruptors of tomorrow continues to attract fans. ARKK has lured a net $1.5 billion in inflows over the past year, according to data compiled by Bloomberg.

Every one of her eight US-listed ETFs is sitting on gains in 2023, the data show.

©2023 Bloomberg L.P.