May 18, 2022

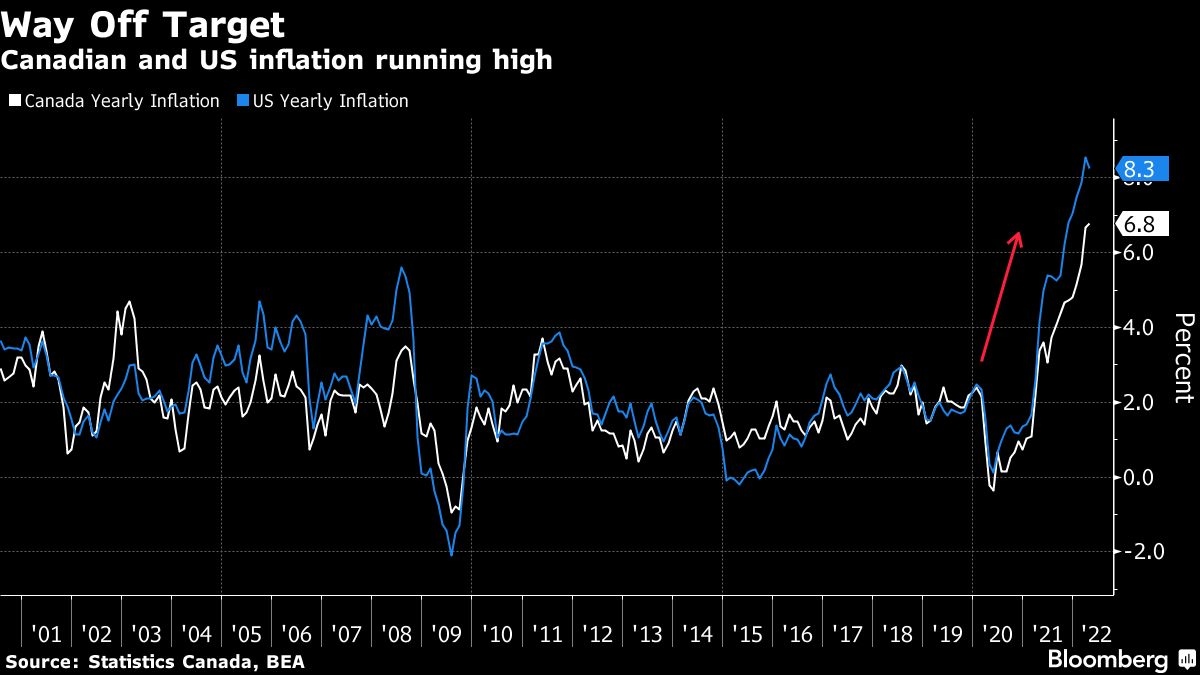

Canadian inflation hits new three-decade high of 6.8% on housing

, Bloomberg News

9.7% rise in grocery costs looks scary but it's our reality: Sylvain Charlebois

Canadian consumer price inflation accelerated to a fresh three-decade high, adding pressure on the nation’s central bank to continue with aggressive interest rate hikes in coming weeks.

Annual inflation rose to 6.8 per cent last month, up from 6.7 per cent in February, Statistics Canada reported Wednesday in Ottawa. That’s the highest since January 1991 and exceeds the median estimate of 6.7 per cent in a Bloomberg survey of economists.

The average of core measures -- often seen as a better indicator of underlying price pressures -- rose to 4.23 per cent, the highest since 1990.

The report shows inflation pressures continue to be stronger than policymakers had been anticipating, raising the urgency for Governor Tiff Macklem to quickly withdraw stimulus from an overheating economy. Investors see a second half-percentage point increase at the Bank of Canada’s next meeting on June 1, after officials delivered a jumbo hike last month.

“What went up still isn’t coming down in Canadian inflation, and might not anytime soon,” Royce Mendes, head of macro strategy at Desjardins Securities Inc., said in a report to investors.

The market’s reaction was muted, with the benchmark two-year bond yield briefly rising as high as 2.825 per cent before falling back to 2.81 per cent. The loonie was trading at $1.2820 per U.S. dollar as of 9:12 a.m. Ottawa time, little changed from Tuesday’s close.

Markets are fully pricing in a 50 basis point rate hike by the Bank of Canada next month, bringing its policy rate to 1.5 per cent. That rate is expected to reach as high as 3 per cent by the end of this year. Prime lending rates offered by commercial banks are typically a little more than 2 percentage points above the policy rate.

Shelter costs were a leading driver for price gains in April, while prices for gasoline declined slightly. Food costs also continue to rise quickly, gaining 8.8 per cent on an annual basis as the war in Ukraine drives up the price of critical foodstuffs like wheat and farming inputs like fertilizer. Prices for food purchased from stores are up 9.7 per cent from a year ago, the statistics agency said, the fastest gain since 1981.

There were some signs of easing pressure on a month-over-month basis, even as gains continue to be historically high. In April, prices rose 0.6 per cent, versus expectations for a 0.5 per cent gain, after a 1.4 per cent gain in March.

The 6.8 per cent annual reading, though, may not represent the peak of annual price gains, given that gasoline prices have picked up since last month, with some economists speculating inflation could top 7 per cent.

“This is the relative calm before another downpour in next month’s report, as gasoline prices are tracking a double-digit increase for May alone,” Doug Porter, chief economist at Bank of Montreal, said in a report to investors. Statistics Canada will also introduce a new pricing index for used cars that could lift inflation further, Porter said.

POLITICAL CRITICISM

There are also signs that imported inflation continues to spill over into domestic price gains, with the cost of services rising 4.6 per cent from a year earlier, the fastest pace since 1991.

“The key takeaway from April’s CPI release is that inflation is spreading much more broadly, and at clear risk of getting firmly entrenched,” Porter said.

The inflation surge has made the Bank of Canada a target of criticism, with some politicians accusing Macklem of moving too slowly. Immediately after the inflation data was published, Conservative leadership candidate Pierre Poilievre released a statement reiterating he plans to fire Macklem should he ever win power.

The central bank has consistently failed to anticipate the growing inflationary pressures, putting it well behind the curve on interest rates. In its quarterly forecasts last month, the central bank forecast inflation would average 5.7 per cent in the first half of 2022.

Higher-than-expected inflation this year may also mean that any easing of price pressures will be more prolonged than initially believed.

The cost of living is increasing at more than twice average wage gains in the country, adding a major headwind to the economy.