Jan 17, 2022

Canadian firms see higher inflation with economy hitting limits

, Bloomberg News

BoC business survey shows labour as big of a concern as supply chain issues: Economist

Canadian businesses reported widespread challenges with supply chains, labor shortages and their ability to meet strong demand in a Bank of Canada survey that will stoke worries about inflation and fuel expectations of a rate hike as early as next week.

The central bank’s quarterly survey of executives paints a picture of an economy pressed up against its limits. Over two-thirds of respondents expect annual consumer price gains to surpass 3 per cent over the next two years. Almost 80 per cent say worker shortages are intensifying and their companies would have at least some difficulty meeting unexpected demand.

The capacity constraints are coming up against strong demand. More than two-thirds say indicators of future sales are improving, 62 per cent anticipate they’ll increase investment in machinery and equipment over the next year and 80 per cent plan to grow employment levels and wages.

The report adds to evidence that economic conditions were strong in the final weeks of 2021, before the omicron variant prompted fresh lockdowns.

Rising wage and inflation expectations will only cement investor bets that interest rates are poised to increase very soon. Markets are pricing in six Bank of Canada rate hikes this year, with a 70 per cent chance of an increase Jan. 26, when policy makers led by Governor Tiff Macklem announce their first decision of the year.

A broad gauge of business sentiment reached its highest level on record. The central bank’s composite indicator of business conditions rose to 5.99, up from 4.56 in the third quarter.

The loonie extended gains after the report, rising 0.4 per cent to $1.254 per U.S. dollar at 10:37 a.m. in Toronto trading. Canada’s benchmark 10-year yield rose as high as 1.814 per cent, near its highest intraday level since the start of the pandemic and higher than any closing mark since March 2019.

KEY INDICATORS

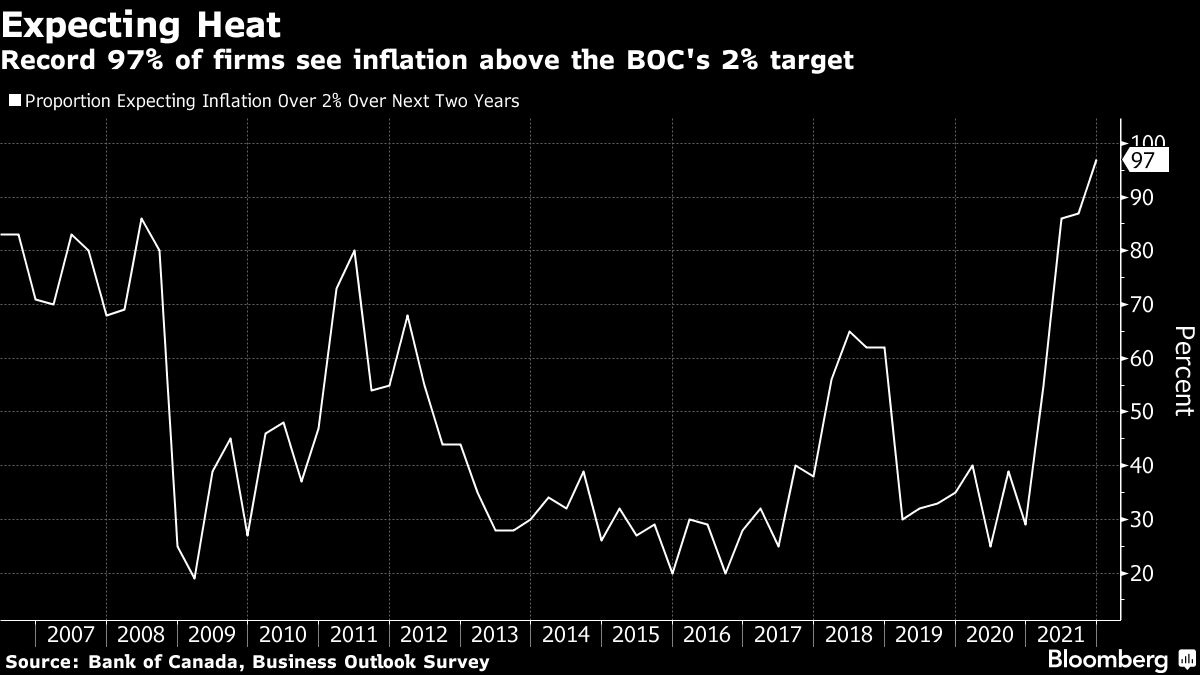

Macklem has said the central bank would be closely monitoring wage and inflation expectations to determine next steps, and the survey indicates they have become extremely elevated: 97 per cent of respondents see inflation above the central bank’s 2 per cent target, also a record.

Officials even noted some firms blamed expansionary monetary policy for higher inflation.

A separate survey of consumer expectations showed Canadian households also expect inflation to stay above 3 per cent over the next couple of years. Asked what they expect the rate of inflation to be in the future, Canadians saw it at 4.89 per cent in the next year, 4.12 per cent in two years and 3.5 per cent in five years.

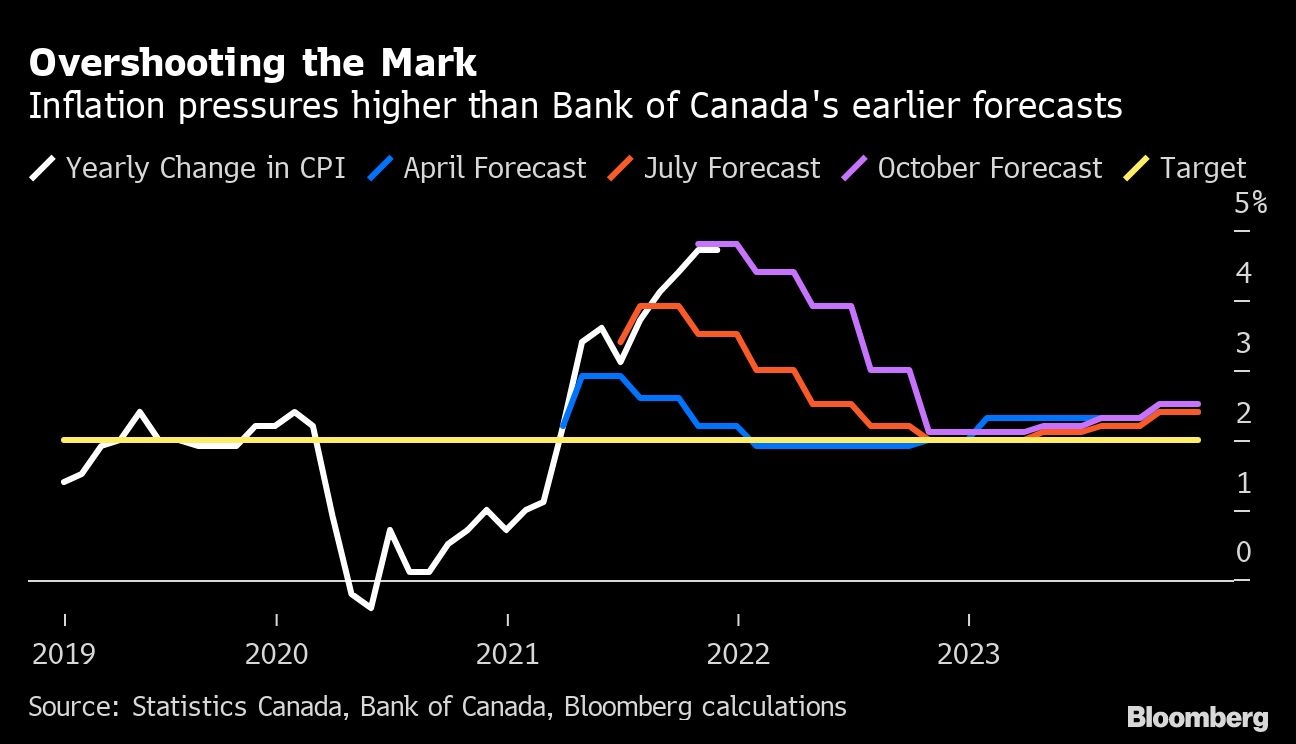

Canada’s annual inflation rate hit 4.7 per cent in November, and is expected to accelerate to a three-decade record when December is published Wednesday.

In the consumer survey, about two-thirds of Canadians said they believe inflation has become more difficult to control. Still, expectations of wage gains for households remain moderate, according to the survey.

Firms also largely expect the high inflation levels to be transitory, the Bank of Canada said, based on a special question it posed in this survey.

Yet, the risks are clearly elevated. The central bank said more intense labor shortages and difficulties attracting and retaining workers are prompting companies to ramp up investments and putting upward pressure on wages.

“A strong majority of firms intend to raise wages at a faster rate in the next 12 months,” according to the Bank of Canada.

There are also potential signs that companies are starting to compensate workers for rising cost of living, the central bank said.