May 25, 2023

BlackRock’s $9 Billion Quant ETF Set to Lean in on Nvidia, Tech

, Bloomberg News

(Bloomberg) -- BlackRock Inc.’s $9 billion momentum exchange-traded fund is expected to ramp up its bets on tech giants as the ETF chases Wall Street’s trendiest stocks in its semiannual makeover.

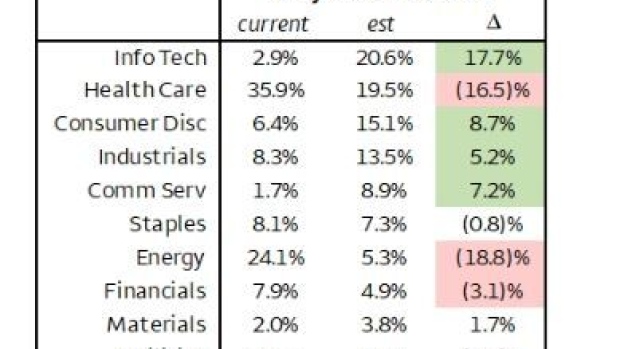

After an equity rally fueled by the largest technology companies, the firm’s iShares MSCI USA Momentum Factor ETF (ticker MTUM) — which tracks the MSCI USA Momentum Index — will have to up its allocation in information technology to 21% from 3% while shedding recession-resistant sectors like health care and energy, according to estimates from Wells Fargo & Co.

The three-day rebalancing, expected to kick off Friday, will slash the fund’s exposure to dividend-paying energy stocks, which had maccounted for nearly one-fourth of the fund prior to the shift.

The shuffle will make MTUM less defensive overall just as Wall Street is trying to gauge the timing and potential depth of the next economic downturn. The fund is also likely to trade at a valuation premium as it pursues those higher growth tech stocks, according to a Wells Fargo analysis.

“It’s going to trade much more with tech, with growth than it has in the past,” Christopher Harvey, head of equity strategy at Wells Fargo, said in a phone interview. “But it’s hard to say if it’s going to enhance performance or hurt performance.”

A BlackRock representative declined to comment.

The fund will likely tack on Microsoft Corp., Meta Platforms Inc., and Nvidia Corp. — all of which are among the S&P’s top 5% of year-to-date gainers, according to data compiled by Bloomberg. Bloomberg Intelligence projects Nvidia — which surged nearly 30% Thursday after a blowout forecast connected to the artificial intelligence frenzy — will reach a 5% weighting, the cap on any individual stock.

The shakeup is the latest in a string of rebalances for the index and fund, underscoring the macro forces that have shaped the market over the past two years amid steepening interest rates and rising inflation.

The underlying index — and thus, MTUM — will lean in on big tech as investors debate what to make of the sector’s frothy valuations. One camp says the price gains signal the need for a downside correction, while others argue that solid quarterly earnings, artificial intelligence excitement, and a softening economy make megacap tech attractive.

But in tracking the MSCI USA Momentum Index, MTUM hardly engages in qualitative posturing. The fund fits into a class of so-called smart-beta ETFs that generally target securities with one specific factor, such as value, quality, or — in the case of MTUM — momentum. Thus, the ETF’s baseline strategy is simple: add outperforming stocks, dump underperforming ones. MSCI Inc. ranks stocks by returns over a six month and one-year time frame.

A projected 80 new stocks will enter MTUM’s portfolio, according to BI, setting the fund up for its third-highest turnover since 2016. The emphasis on big tech will make the fund more expensive and more volatile moving forward, and that could hinder its performance, according to BI’s Christopher Cain.

“From a longer term perspective, I think you’re going the wrong way,” said Cain, who focuses on quant trading and equities.

Investor interest in MTUM has waned in the past 18 months, with assets under management having almost halved from an $18.1 billion high in Nov. 2021, according to data compiled by Bloomberg. According to Harvey, while factor investing generally emphasizes long-term growth, investors don’t always act with that in mind.

“Money chases performance, and performance just hasn’t been as strong, so money is leaving to chase higher returns,” he said.

Year-to-date, MTUM has dipped some 5% through Wednesday’s close trailing the S&P’s roughly 7% gain in that time. Other factor strategies have floundered this year as well. Dow Jones market-neutral indexes tracking five of the most popular factors — value, momentum, quality, size and low volatility — trail the benchmark gauge this year, and most have lost money.

If MTUM’s past makeovers are any indication, stocks removed from the fund might be set for a bounce post-rebalance, per a Wells Fargo note. Harvey expects “some high volume days” as index arbitrageurs try to profit from the anticipated reshuffling.

Other funds that track MSCI indexes will also be affected by the shake-up — including three other ETFs tracking minimum volatility, quality, and value, respectively — according to Wells Fargo.

©2023 Bloomberg L.P.